Last updated on Feb 17, 2026

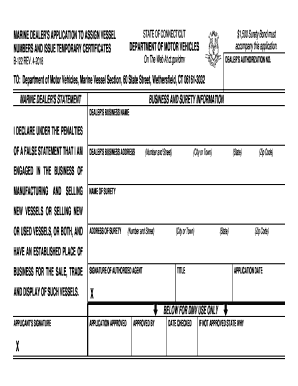

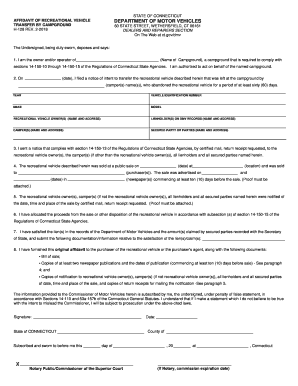

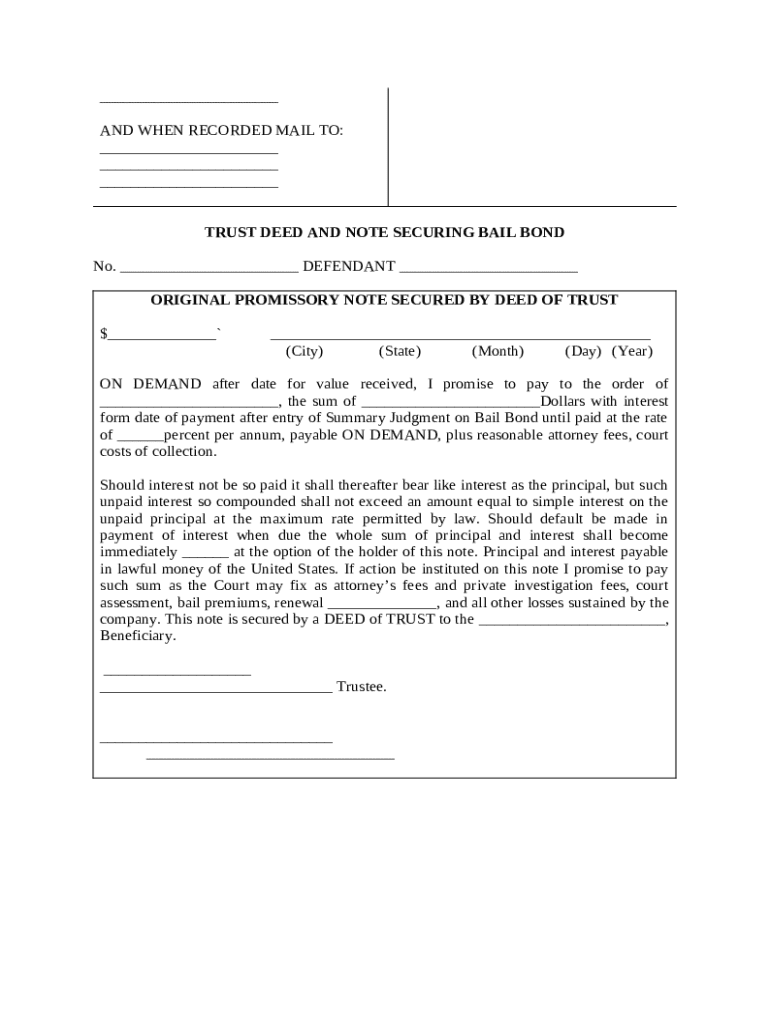

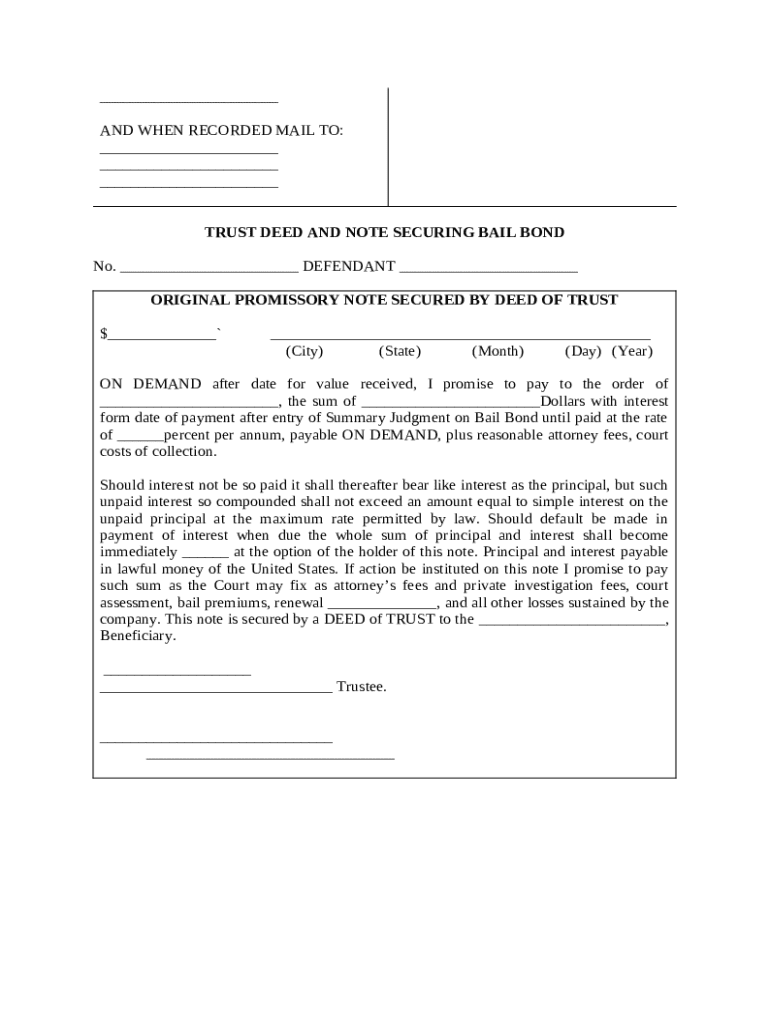

Get the free Trust Deed and Note Securing Bail Bond template

Show details

A bail bond is designed to ensure the appearance of the defendant in court at the scheduled time. This Deed of Trust secures payment of all indebtedness, fees and expenses incurred by way of a Bail

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is trust deed and note

A trust deed and note is a legal document that secures a loan by transferring an interest in property to a trustee until the loan is repaid.

pdfFiller scores top ratings on review platforms

What do you like best?

being able to manipulate pdfs that are set up already

What do you dislike?

There is nothing that I dislike about pdf filler.

What problems is the product solving and how is that benefiting you?

It solves the problem of updated materials without needing to go back and redo the item.

Great Experience

I didn't know about this program until it was introduced to fill out an application but it was seamless

Easy and convenient to fill out forms…

Easy and convenient to fill out forms and sign. Saves information accurately

Review

All good with the document that was attached

happy

PDFiller is easy to use.

Works great

Easy download, so far I like it

Who needs trust deed and note?

Explore how professionals across industries use pdfFiller.

Comprehensive Guide to Trust Deed and Note Forms

What are trust deeds and promissory notes?

Understanding how to fill out a trust deed and note form is crucial for anyone involved in securing loans. A trust deed is a legal document that secures a loan by transferring the title of a property to a trustee, while a promissory note serves as a written promise to pay back the borrowed amount. Together, these documents form a security agreement between the borrower and the lender.

What are the key components of trust deeds and notes?

-

Key parties include the trustor (borrower), trustee (the entity holding the title), and the beneficiary (lender) who will receive payments.

-

Important terms often include the loan amount, interest rate, and payment terms, which need to be clearly defined to avoid disputes.

-

Notarization is necessary to validate the documents legally and protect all parties’ rights.

How do you complete the trust deed and promissory note form?

-

Include accurate information on the property being used as collateral, as well as the involved parties' details.

-

Clearly state the amount borrowed, the interest rate, repayment schedule, and any fees associated, ensuring clarity.

-

Fields related to interest rates and payment options can have a significant impact on the loan's overall terms.

How do you get your trust deed and note signed and notarized?

-

Most notaries will require identification and in-person signatures to validate the documents.

-

Coordinate signing appointments efficiently with all parties involved, ensuring availability and convenience.

-

Create a checklist to ensure that all necessary signatures are obtained before notarization.

What are the steps to record your trust deed and note?

-

Visit your local County Recorder’s Office and submit your documents along with any required fees.

-

Fees can vary by jurisdiction, so check with your local recorder for current rates.

-

Recording your documents ensures they are legally enforceable and protects the lender’s rights.

What happens after recording your documents?

-

You will receive confirmation of recording, and your documents will be recorded in public records.

-

You can obtain copies of your documents from the County Recorder upon request.

-

Default can lead to the trustee initiating foreclosure proceedings to satisfy the debt.

What are additional notes on legal compliance and variations?

-

Different states have varying laws affecting trust deeds, which can impact how forms are filled out.

-

Always consider local regulations, as they can influence specific requirements or terms.

-

Maintain thorough records and seek legal guidance to navigate complexities.

How can pdfFiller help you manage your trust deed and note forms?

-

Easily upload your trust deed and note forms onto pdfFiller for streamlined editing.

-

Utilize robust tools for text edits, signatures, and form fields to tailor your documents.

-

Leverage integrated signing capabilities to facilitate cooperation among parties, enhancing the process.

How to fill out the trust deed and note

-

1.Open the trust deed and note template on pdfFiller.

-

2.Begin by entering the names of the borrower and lender. Make sure to double-check spelling and accuracy.

-

3.Next, fill in the property description, including the address and legal description if available.

-

4.Specify the loan amount clearly, ensuring it matches the amount agreed upon by both parties.

-

5.Describe the terms of the loan including the interest rate and payment schedule. Be precise with repayment dates.

-

6.Include details about any contingencies or conditions that may apply to the deed.

-

7.Once all sections are completed, review the information for any errors or omissions.

-

8.Sign and date the document where indicated, ensuring both parties complete this step.

-

9.Download the finalized document or share it directly with relevant parties through pdfFiller's sharing options.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.