Get the free Intercreditor and SubordinationAgreement template

Show details

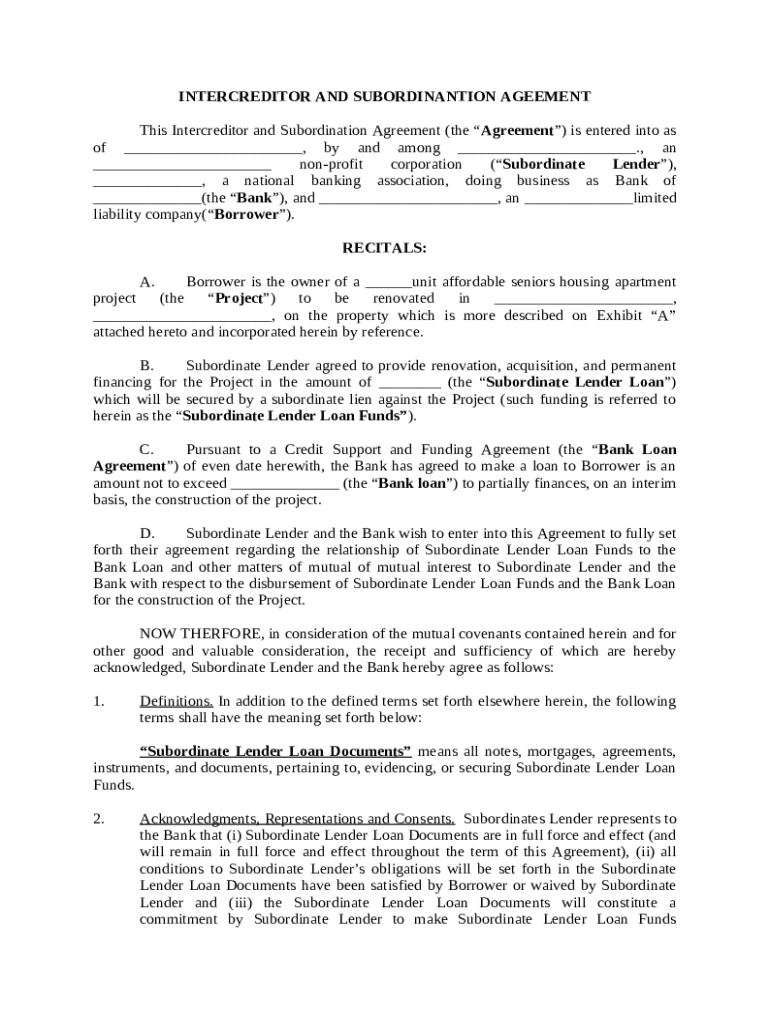

An Intercreditor Agreement (or inter-creditor deed) is a contract between two more creditors. Such an agreement comes into effect when the borrower has two (or more) lenders. The lenders sign a contract

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is intercreditor and subordinationagreement

An intercreditor and subordination agreement is a legal document that outlines the priorities and rights of lenders in relation to a debtor's collateral and obligations.

pdfFiller scores top ratings on review platforms

I like the ease of filling out the documents and being able to go back and retrieve them...love it

On a learning curve,so it has been slow but I really like the ease of putting in my own form and filling in my data. Helps with creating readable Dues Notices

I used pdffiller to complete some important documents for the County. It was easy and gave the form a professional look.

I tried another service first and was extremely disappointed. Your controls are easy to use and I was very satisfied!

Accurate, Easy to navigate, sign, and fill forms

Minor delays in saving and processing forms once complete

This has been a great experience using this PDF filler.

Who needs intercreditor and subordinationagreement template?

Explore how professionals across industries use pdfFiller.

Comprehensive Guide to Intercreditor and Subordination Agreement Forms on pdfFiller

How to fill out an intercreditor and subordination agreement form

Filling out an intercreditor and subordination agreement form involves following specific steps to ensure accuracy and compliance with legal standards. Begin by gathering necessary information such as the details of the parties involved and the terms of the loan. Use the suitable templates available on pdfFiller to streamline your process and ensure clarity in your document.

Understanding the intercreditor and subordination agreement

An intercreditor and subordination agreement is a crucial legal document used primarily in finance for hierarchical structuring of rights among different lenders. Its main purpose is to clarify the rights and priorities among a subordinate lender, borrower, and bank, especially in the context of construction financing. Proper structuring is vital to mitigate risks associated with multiple lenders.

What are the key components of the agreement?

The agreement includes defining terms essential for clarity, such as 'subordinate lender' and 'borrower.' Understanding the section breakdown, which includes parties involved, recitals, and agreements is critical. Each component serves to provide detailed insights into rights, responsibilities, and liabilities.

-

Each party's role must be clearly defined, ensuring everyone understands their standing in the agreement.

-

This section outlines the background of the agreement and the intent behind it.

-

Detailing the terms of the loan and subordination levels among lenders.

How to fill out the intercreditor and subordination agreement form

Completing the intercreditor and subordination agreement form on pdfFiller is straightforward with its interactive tools. Start with a step-by-step guide that outlines each required field, ensuring you provide typical information needed to enforce the agreement. Utilize pdfFiller's capabilities to seamlessly edit and sign the forms.

Editing and managing your agreement with pdfFiller

pdfFiller offers robust features for editing PDF documents that enable users to collaborate efficiently. These tools assist teams in managing agreements effectively, from creating to finalizing the documents. Cloud-based storage eases document management, allowing access anytime and anywhere.

What are the legal considerations and compliance?

Legal implications in intercreditor agreements are significant. Understanding common compliance requirements across various regions is crucial for maintaining validity. Adhering to state-specific rules can further enhance the enforceability of your agreement, making it essential to research local laws.

How to navigate financial relationships in agreements

Financial relationships between lenders can significantly influence funding disbursement. Subordination affects how funds are released, requiring careful consideration in drafting agreements. Real-world case studies can shed light on typical scenarios that highlight these dynamics and assist in making informed decisions.

What are the best practices for drafting and finalizing your agreement?

To ensure clarity and enforceability of terms, it's crucial to follow best practices while drafting your intercreditor and subordination agreement. Using templates from pdfFiller can save time, and a final review checklist is essential to catch any missing elements before signing.

-

Use straightforward language to avoid ambiguity in your terms.

-

Go through the agreement thoroughly to elude future disputes.

-

Leverage pdfFiller’s tools to manage and edit your document easily.

How to fill out the intercreditor and subordinationagreement template

-

1.Start by accessing the intercreditor and subordination agreement template on pdfFiller.

-

2.Enter the date at the top of the document to specify when the agreement is created.

-

3.Identify the parties involved in the agreement; this typically includes all lenders and the borrower.

-

4.Clearly outline the terms of subordination, detailing which loans are subordinate and which have priority.

-

5.Specify the rights and obligations of each creditor, ensuring all parties understand their roles.

-

6.If applicable, include any conditions for default and remedies available to creditors.

-

7.Review the document for accuracy and completeness, ensuring all necessary details are filled out.

-

8.Once satisfied, utilize pdfFiller’s tools to electronically sign the agreement or send it for signatures.

-

9.Save the final document in your preferred format for record-keeping.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.