Get the free Federal Estate Tax Affidavit template

Show details

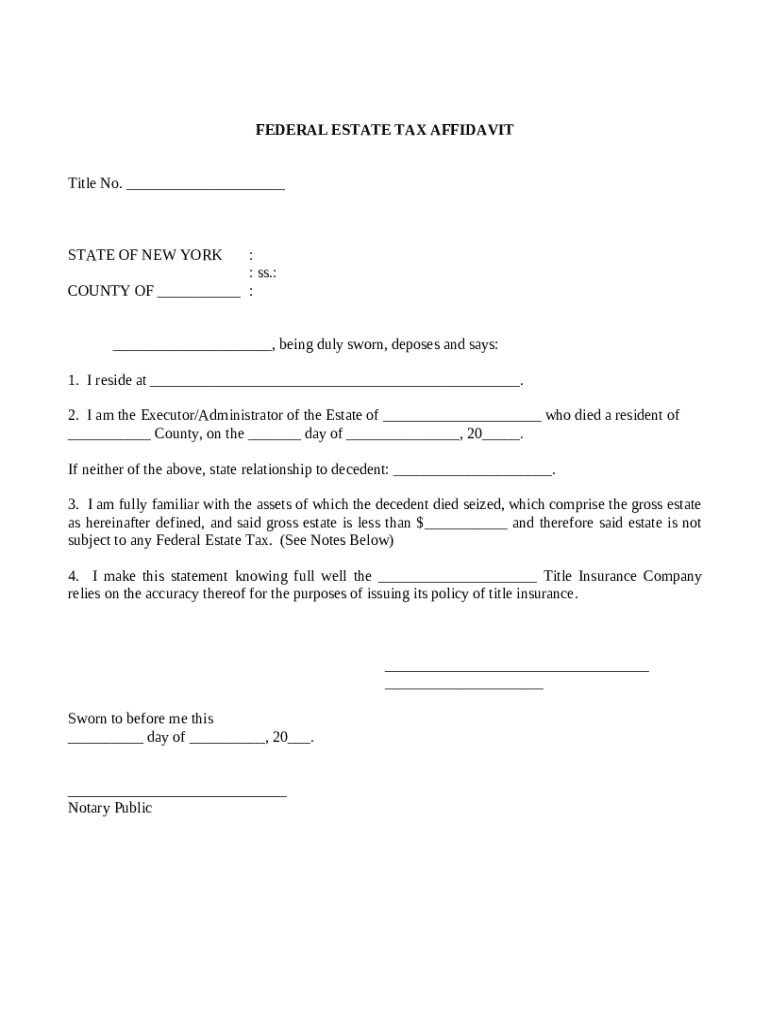

This affidavit is signed by the executor or administrator of an estate to affirm the gross value of the estate and it being insufficient to be subject to federal estate tax.

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is federal estate tax affidavit

A federal estate tax affidavit is a legal document used to report the value of a deceased person's estate for tax purposes to the federal government.

pdfFiller scores top ratings on review platforms

easy

good

Excellent software. Very easy to use.

great tool

great tool, easy to use !

first time went ok

Not Now

I do not wish to share anything at this point

Who needs federal estate tax affidavit?

Explore how professionals across industries use pdfFiller.

Federal Estate Tax Affidavit Guide

TL;DR: How to fill out a federal estate tax affidavit form

To fill out a federal estate tax affidavit form, begin by collecting personal information of the executor and details about the decedent. Ensure you understand the exemption eligibility criteria, fill in each required section accurately, and finally, have the affidavit notarized before submitting it to the appropriate tax authority.

What is the federal estate tax affidavit?

The Federal Estate Tax Affidavit is a legal document that provides a sworn statement regarding the assets and value of a decedent's estate. Its primary purpose is to facilitate the transfer of ownership of real property when the estate does not owe federal estate taxes. This affidavit is particularly important in ensuring that heirs can claim their inheritance without delay.

-

A document to declare estate information necessary for tax exemption.

-

Individuals acting as the executor or administrator are required to file this affidavit.

-

It helps in clearing title in real estate transactions and confirming no tax liability.

Who is eligible for estate tax exemption?

Eligibility for estate tax exemption is determined primarily by the value of the estate and its composition. Estates falling below a specified value may qualify for exemption and avoid federal estate taxes, enabling beneficiaries to inherit without additional financial burden.

-

Only estates under a certain value set by federal guidelines qualify for exemption.

-

The total value of assets must be below the threshold to avoid taxes.

-

This includes real estate, financial accounts, and personal property.

What are the key fields in the form?

Understanding the fields in the Federal Estate Tax Affidavit is crucial for proper completion. Each section requires specific information to ensure the form meets legal requirements and accurately reflects estate details.

-

Details on the individual responsible for managing the estate.

-

Including the name and county of the decedent's residence.

-

A declaration of total estate worth and its components.

-

Context on how the executor is related to the deceased.

How do you fill out the federal estate tax affidavit?

Filling out the Federal Estate Tax Affidavit involves several key steps that ensure compliance with legal standards. Following a structured approach can help prevent errors commonly encountered during the process.

-

Carefully follow each section for accurate completion and clarity.

-

Double-check information to prevent delays from inaccuracies.

-

Leverage pdfFiller for easier editing, signing, and management of your forms.

What is the notarization and submission process?

Once the affidavit is completed, notarization is typically required to affirm its authenticity. Understanding the submission process, including where to send the document and expected processing times, ensures timely filings.

-

Confirm that the affidavit is signed in the presence of a notary public.

-

Identify the appropriate tax office for submission of the affidavit.

-

Anticipate a timeframe for how long the affidavit processing will take.

How do state-specific requirements vary?

Filing requirements can vary significantly across states, impacting how residents should prepare their affidavits. Being aware of state-specific nuances improve compliance and facilitates smoother transactions.

-

New York has unique requirements that differ from federal guidelines.

-

Each state may have different forms, thresholds, or procedures.

-

Utilize resources to assist in understanding local rules for filings.

What features does pdfFiller provide?

pdfFiller offers a robust platform for managing document needs, enhancing the ease of filling out forms like the Federal Estate Tax Affidavit. With its collaborative tools and cloud-based features, users can edit, sign, and share their documents effortlessly.

-

Modify and eSign documents easily with online tools.

-

Store, access, and manage your documents from anywhere.

-

Work with teams to enhance the affidavit preparation process.

How to fill out the federal estate tax affidavit

-

1.Access the federal estate tax affidavit template on pdfFiller.

-

2.Gather necessary documents including details about the deceased's estate, assets, and liabilities.

-

3.Begin filling out the form by entering the decedent's full name, date of death, and Social Security number.

-

4.List all assets of the estate, including real estate, bank accounts, investments, and personal property.

-

5.Provide the estimated value for each asset as of the date of death.

-

6.Include any debts owed by the deceased such as loans or credit card balances.

-

7.Calculate the total gross estate value by summing all assets and subtracting total debts.

-

8.Review the affidavit for accuracy, ensuring all information is complete and correct.

-

9.Sign and date the affidavit where indicated, and have it notarized if required.

-

10.Once completed, file the affidavit with the appropriate tax authority and provide copies to relevant parties.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.