Get the free Promissory Note - Horse Equine s template

Show details

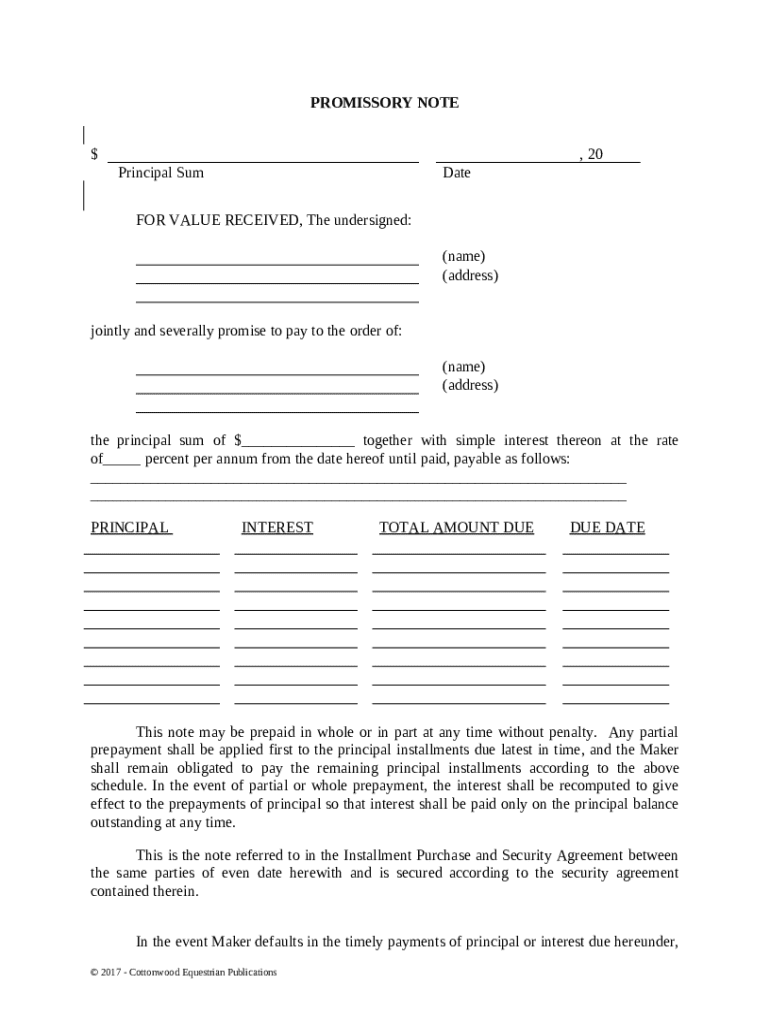

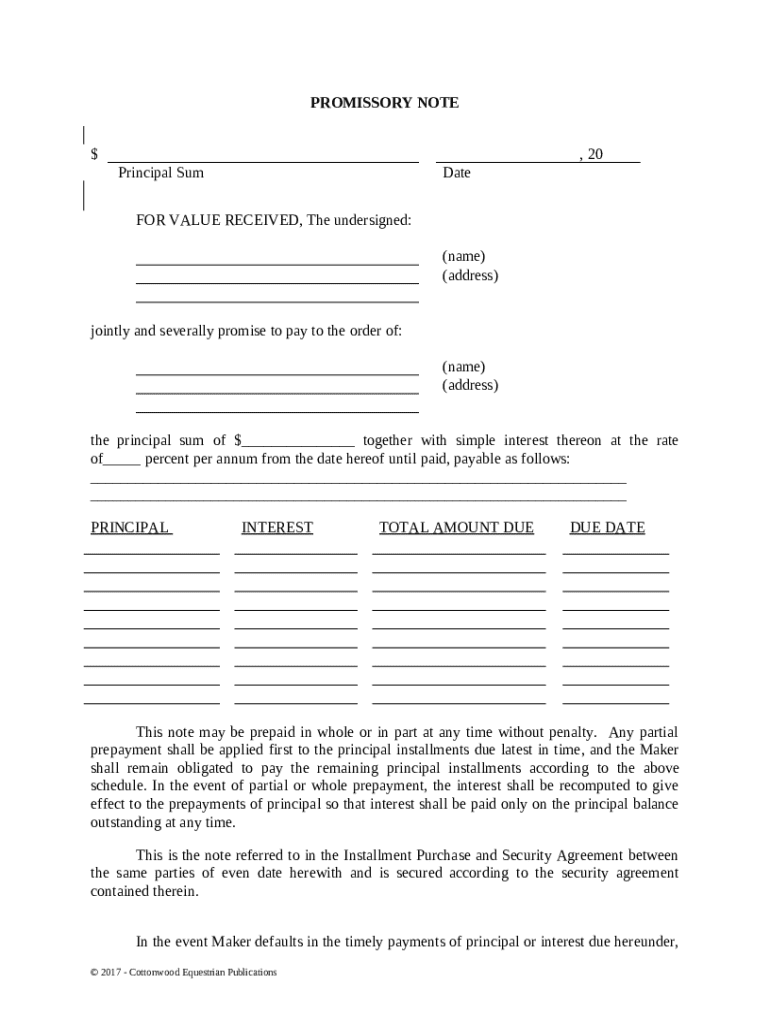

This is a promissory note for use in connection with the sale and purchase of a horse where financing is involved. It is a simple interest note that may be used in conjunction with an Installment

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is promissory note - horse

A promissory note for a horse is a legal document in which one party agrees to pay another a specified amount for the purchase or financing of a horse.

pdfFiller scores top ratings on review platforms

Best PDF site

Easy to use site.

Appreciate their support and trustworthy

I used their services and subscribed annually by mistake but when I asked to cancel the order and refund amount, they immediately processed the refund. I really appreciate.

I used this for school for a month and…

I used this for school for a month and it was great. Only reason I unsubscribed was because I didn’t need it anymore. Customer service is also 10/10

I give you 5 stars

I give you 5 stars. I had no issues at all. It took me a second to grasp the system, but I figured it all out.

It is easily portable

It is easily portable, saves previous works for editing. It is the one stop app for all your document needs!!!

none

Who needs promissory note - horse?

Explore how professionals across industries use pdfFiller.

How to Fill Out a Promissory Note - Horse Form

Filling out a promissory note specific to horse transactions can be straightforward if you understand the key components and steps involved. This guide will provide you with all the necessary information on how to properly complete a promissory note - horse form.

What is a promissory note?

A promissory note is a legal document in which one party promises to pay another a specified sum of money at a designated time or on-demand. This instrument serves as an important financial agreement and must include certain details to be enforceable in a court of law.

-

They formalize the terms of a loan, detailing how much is borrowed, when it is due, and any interest involved.

-

Proper documentation safeguards both parties' interests and ensures legality during potential disputes.

-

In horse transactions, specific conditions such as breeding rights or care requirements may need to be included.

What are the key components of a promissory note?

-

This is the amount being borrowed. It's crucial to be clear and precise to prevent future disputes.

-

Filling in the date of the agreement is essential as it marks when the terms enter effect.

-

Accurate identification of all parties involved avoids confusion and legal complications.

-

This includes details about the interest rate and the payment schedule, establishing how and when payments will be made.

-

Clarifying the rights around early payments can prevent misunderstandings later.

How do fill out the horse form?

-

Collect all relevant documents, including personal identification and any agreements pertaining to the horse.

-

Clearly state the amount being loaned and the date to ensure clarity.

-

Ensure all names and addresses are accurate for both the borrower and lender.

-

Detail the interest to avoid confusion about payment expectations.

-

Ensure terms regarding prepayment are clearly stated to protect both parties.

How can manage my promissory note with pdfFiller?

-

pdfFiller allows users to customize their documents easily to meet specific needs.

-

Signing electronically through pdfFiller enhances security and expedites the process.

-

Use cloud features to share documents and track changes with stakeholders.

-

pdfFiller's tracking function helps in managing different versions of your document.

What common mistakes should avoid?

-

Neglecting the Principal Sum or Date can render the document void.

-

Ensure you comprehend how interest is calculated to avoid later disputes.

-

Different states have unique laws regarding promissory notes; failing to comply can invalidate your document.

-

If terms change after signing, ensure they are also formally documented to avoid confusion.

What legal considerations are important?

-

Understand that promissory notes might be subject to different regulations based on where you live.

-

Know the legal implications of defaulting on the promissory note and what recourse options exist.

-

For complex situations, involving a lawyer can help navigate potential pitfalls.

-

Delinquency on the note could lead to legal action or loss of the horse or assets.

What are the next steps after completing your promissory note?

-

Use pdfFiller's storage options to keep your document safe and easily accessible.

-

Communicate to all parties that the note has been completed to maintain transparency.

-

Implement reminders for payment schedules to ensure timely payments and keep all parties informed.

-

Familiarize yourself with your rights and possible actions if the borrower defaults on the loan.

How to fill out the promissory note - horse

-

1.Open pdfFiller and upload the promissory note template for horse.

-

2.Begin by filling in the date at the top of the document.

-

3.Enter the name and address of the borrower (the individual agreeing to pay for the horse).

-

4.Next, fill in the name and address of the lender (the individual or organization providing financing).

-

5.Specify the total amount being financed for the horse, accurately reflecting the purchase price or loan amount.

-

6.Indicate the interest rate, if applicable, and any repayment terms, such as the payment schedule and due dates.

-

7.Clearly outline any terms and conditions relevant to the sale or loan of the horse, including collateral if required.

-

8.Sign the document by both the borrower and lender to make it legally binding, and add the date of signatures.

-

9.Review the filled-out document for accuracy, ensure all necessary fields are completed, and then save the document.

-

10.If required, print copies for both the borrower and lender to retain a signed physical copy.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.