Get the free A04 Final Order of Establishing Paternity, Custody, Parenting Time, and Child Support

Show details

A04 Final Order of Establishing Paternity, Custody, Parenting Time, and Child Support

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is a04 final order of

An A04 final order of is a legal document issued by a court that provides a final ruling on a case or matter.

pdfFiller scores top ratings on review platforms

I did not get notification that the fax was received... I contacted the company and was told that it was received

Having a little problem with printing but think I just need to read instructions. Trying to get something done quickly and it is done.

So far PDF filler has worked just great for me in filling out forms for hospitals/doctors/etc

Quick, excellent answer to my question from chat support

once you get the hang of it, goes smoothly

I wish I would have known that I had to pay to print or save my forms when I first filled out 10 pages of work.

Who needs a04 final order of?

Explore how professionals across industries use pdfFiller.

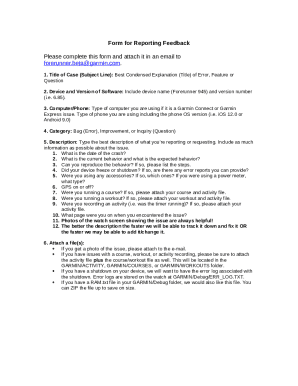

How to fill out a A04 final order of form

What is the A04 final order of form?

The A04 final order form is a crucial document used for reporting tax obligations. Its primary purpose is to summarize income, deductions, and tax withholdings for individuals and entities, ensuring compliance with tax regulations. Accurate completion of this form is essential to avoid penalties and ensure proper tax assessment.

Why is accuracy important when filling out the A04 form?

Accurate completion of the A04 final order form directly impacts your tax obligations. Errors or omissions can lead to penalties, delayed processing, or tax audits. Maintaining transparency with accurate data helps streamline the assessment process and fosters trust with tax authorities.

What are the common uses and scenarios for the A04 form?

-

Individuals and businesses use the A04 form to accurately report their taxable income from various sources.

-

Used to communicate withholding amounts to tax authorities, the form helps individuals track their tax contributions.

-

The A04 form supports taxpayers in claiming eligible deductions and credits, optimizing their tax liabilities.

How is the A04 final order form structured?

The A04 final order form comprises several sections, each with specific instructions for completion. Understanding these sections is key to ensuring accurate submissions.

-

This section includes fields for the taxpayer's name, address, and identification numbers.

-

Required entry fields detail the sources and amounts of income earned during the tax year.

-

Optional fields for claiming deductions and credits that can reduce tax liabilities must be completed carefully.

-

This final section requires signatures to confirm the accuracy of the information provided.

How do fill out the A04 final order form step-by-step?

Filling out the A04 form can be straightforward if you follow the right steps.

-

Collect all necessary documents such as income statements, previous tax returns, and identification numbers.

-

Use the features in pdfFiller to easily input your data, ensuring accuracy and efficiency.

-

Double-check all entries for completeness and accuracy, as mistakes can lead to complications.

What are the key deadlines for submitting the A04 form?

There are specific deadlines associated with the A04 form that must be adhered to avoid penalties. Key deadlines include submission dates correlated with the tax year and dates for providing additional documentation.

-

Typically due by a specified date in the following tax year; check current regulations for accuracy.

-

Any necessary corrections after submission should be made as soon as possible to avoid complications.

-

Late submission can result in fines and additional interest charges on owed taxes.

-

Utilizing pdfFiller allows for streamlined submissions and reminders for deadlines.

How can understand payment and compensation information on the A04 form?

The A04 form outlines details regarding income, deductions, and tax withholdings crucial for accurate reporting.

-

Understanding the details regarding what constitutes taxable income and applicable deductions is essential.

-

Clearly outline all sources of income including wages, freelance earnings, and investments.

-

pdfFiller can assist in organizing this financial data and performing necessary calculations.

Why is compiling an annual summary of incomes and deductions important?

An annual summary compiled for the A04 form is vital for a clear picture of your financial status throughout the year. It promotes easier reporting and aids in complying with tax regulations.

-

pdfFiller offers templates that simplify the data collation process, making it user-friendly.

-

Ensuring all incomes and deductions are accurately captured minimizes the risk of audits.

-

A thorough summary ensures adherence to local tax regulations and guidelines.

Where can find resources for assistance with the A04 form?

Various resources exist to help individuals navigate the completion of the A04 form. Seeking assistance can provide clarity and reduce errors.

-

Consider discussing with a tax professional or contacting local tax authorities for support.

-

pdfFiller provides tools that guide users through the form filling process effectively.

-

Having the contact information for tax advisors ensures you have options for expert advice when needed.

What role does the Norwegian Tax Administration play regarding the A04 form?

The Norwegian Tax Administration helps ensure compliance with local tax regulations and provides guidance concerning the A04 form.

-

The Tax Administration outlines specific requirements that must be followed to ensure valid submissions.

-

Following best practices suggested by the Tax Administration minimizes the chances of errors during submission.

-

Regular updates from the administration help keep taxpayers informed about any changes in tax legislation.

How does pdfFiller streamline document management?

pdfFiller's cloud-based features enhance document management by allowing users to organize, edit, and collaborate on PDFs efficiently.

-

Users can access and edit their documents from anywhere, facilitating a flexible work environment.

-

Built-in tracking features help streamline collaboration and ensure that all changes are documented accurately.

-

Electronic signatures help speed up the signing process while reducing the chance of errors associated with handwritten signatures.

How to fill out the a04 final order of

-

1.Open pdfFiller and log into your account.

-

2.Locate the A04 final order of form using the search bar or browse through available forms.

-

3.Select the form and click on 'Fill' to open it.

-

4.Begin filling out the required fields, providing relevant case details, parties' names, and dates as necessary.

-

5.Make sure to review the form for accuracy, ensuring all required fields are completed.

-

6.Add any necessary case-specific information as dictated by the court's requirements.

-

7.Once all information is filled in, save your progress frequently to avoid data loss.

-

8.After completing the form, click on 'Done' to finalize your A04 final order of.

-

9.Download the completed document as a PDF or export it according to your needs, ensuring it meets the submission guidelines.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.