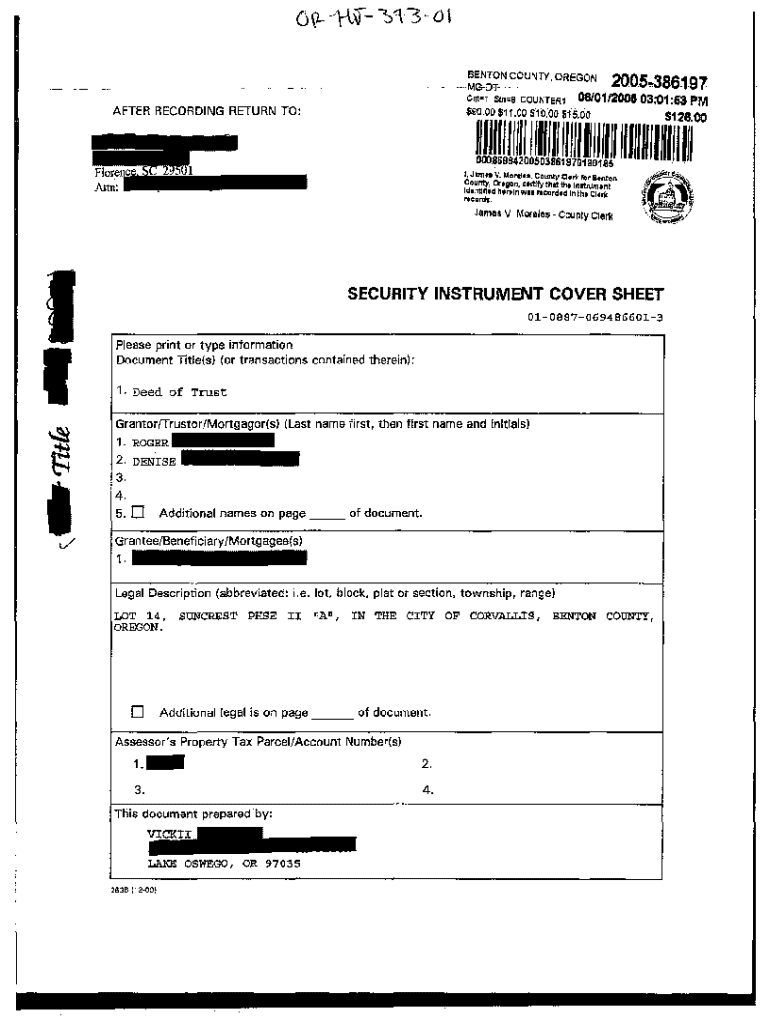

Get the free Sample Deed of Trust

Show details

Sample Deed of Trust

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is sample deed of trust

A sample deed of trust is a legal document that secures a loan by transferring the title of a property to a trustee until the borrower repays the loan to the lender.

pdfFiller scores top ratings on review platforms

THANKDSFKJASLDKJFALK;JDF;LAK FJKDFJ;A FJDSKFJ;AL K

Love that I can send 1099 directly to IRS

Trying to finish what I'm working on despite interuptions like these surveys

Fairly easy to use. Wish there were more font selections. Thank you for making a free program that really works! I love this program!!!

great experience in using it just too costly for what I use sparingly

It really helps me do counselings for my guys en masse, I love it

Who needs sample deed of trust?

Explore how professionals across industries use pdfFiller.

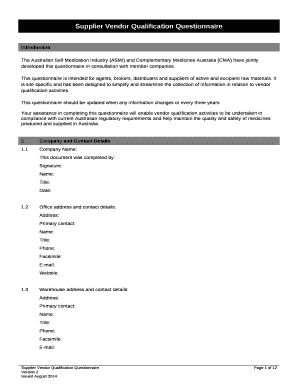

How to fill out a sample deed of trust form

Understanding the deed of trust: an essential guide

A deed of trust is a legal document that secures a loan by transferring the property title to a third party, known as the trustee, until the borrower, or trustor, repays the lender, referred to as the beneficiary. This mechanism ensures security for the loan, differentiating itself from a traditional mortgage by involving a trustee as the neutral party.

-

A deed of trust transfers property title to a trustee to protect the lender's interests.

-

The trustor is the borrower, the trustee is the neutral third party, and the beneficiary is the lender.

-

In a deed of trust, a trustee holds the title, whereas a mortgage involves direct agreements between borrower and lender.

Components of a sample deed of trust form

-

The form requires legal descriptions and the property address to ensure correctly identifying the asset involved in the transaction.

-

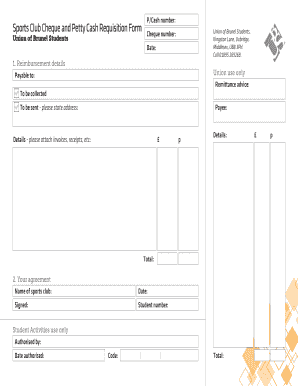

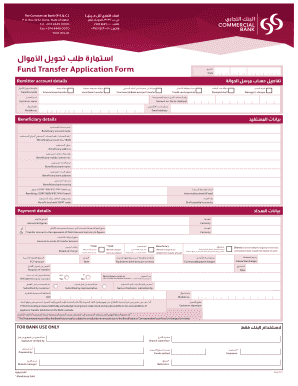

Personal information such as names and addresses of both the borrower and lender must be clearly stated.

-

This includes not only the loan amount but also the interest rate and specific payment terms.

-

Clarifying the procedures that follow if the borrower fails to meet repayment terms is essential for protecting the lender's interest.

Step-by-step instructions for filling out the form

Filling out a deed of trust form properly is crucial for legal compliance and ensuring that both parties are protected. Here’s how to go about it:

-

Collect identification, financial statements, and any previous relevant documents.

-

Begin with the borrower's name and address, ensuring accuracy.

-

Clearly state the lender's full name and address.

-

Input all legal descriptions of the property and specify the terms of the loan, including amount and interest rate.

-

Double-check all entered details for any discrepancies or missing information.

-

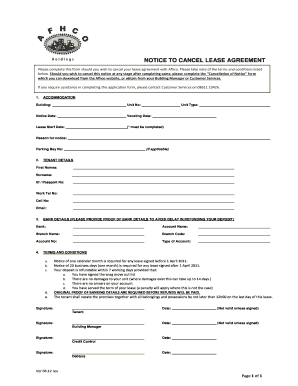

Both parties must sign the document and have it notarized to ensure its validity.

How pdfFiller can simplify the process

-

pdfFiller provides a user-friendly interface to easily fill out and edit the deed of trust form.

-

Users can electronically sign documents directly within the platform for added security.

-

Share forms easily for input or review, enhancing the overall efficiency of the process.

-

Manage and retrieve your documents easily from the cloud, ensuring accessibility anywhere.

Common mistakes to avoid when completing a deed of trust

-

This can lead to legal issues, so ensure that every section is correctly filled out.

-

Different states have different laws about how a deed of trust must be notarized.

-

Before signing, review all terms to avoid future misunderstandings.

-

Always ensure you are using the most current form to stay compliant with legal requirements.

Legal considerations and compliance

-

Each state has its own rules governing deeds of trust; understanding these is crucial for compliance.

-

Legal advice can help navigate complex regulations to avoid legal pitfalls.

-

Failing to adhere to the regulations regarding deeds of trust can lead to severe penalties or loss of property rights.

Finalizing and managing your deed of trust

-

After signing, the deed of trust must be recorded with the local authorities to be legally effective.

-

Keep the original documentation safe and ensure that all records are updated with any changes.

-

In case of a change in terms, it is necessary to officially amend the deed of trust through proper channels.

Additional resources for understanding deeds of trust

-

Access up-to-date legal resources and guidelines specific to your state.

-

Participate in online sessions to deepen your knowledge of real estate documentation.

-

Consult additional resources to clarify common queries related to deeds of trust.

How to fill out the sample deed of trust

-

1.Open the PDF file of the sample deed of trust in pdfFiller.

-

2.Begin by entering the date of the transaction at the top of the document.

-

3.Fill in the names of the borrower(s) and lender, ensuring correct spelling and complete names.

-

4.Provide the address and legal description of the property being secured by the deed of trust.

-

5.Enter the loan amount that the borrower is securing through the deed.

-

6.Specify the terms of the loan, including interest rate and payment schedule.

-

7.If applicable, include any additional terms or conditions that both parties have agreed upon.

-

8.Designate the trustee who will hold the title of the property until the loan is repaid.

-

9.Review all entered information for accuracy before finalizing the document.

-

10.Once verified, save the completed deed of trust and share it with all parties involved for signature.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.