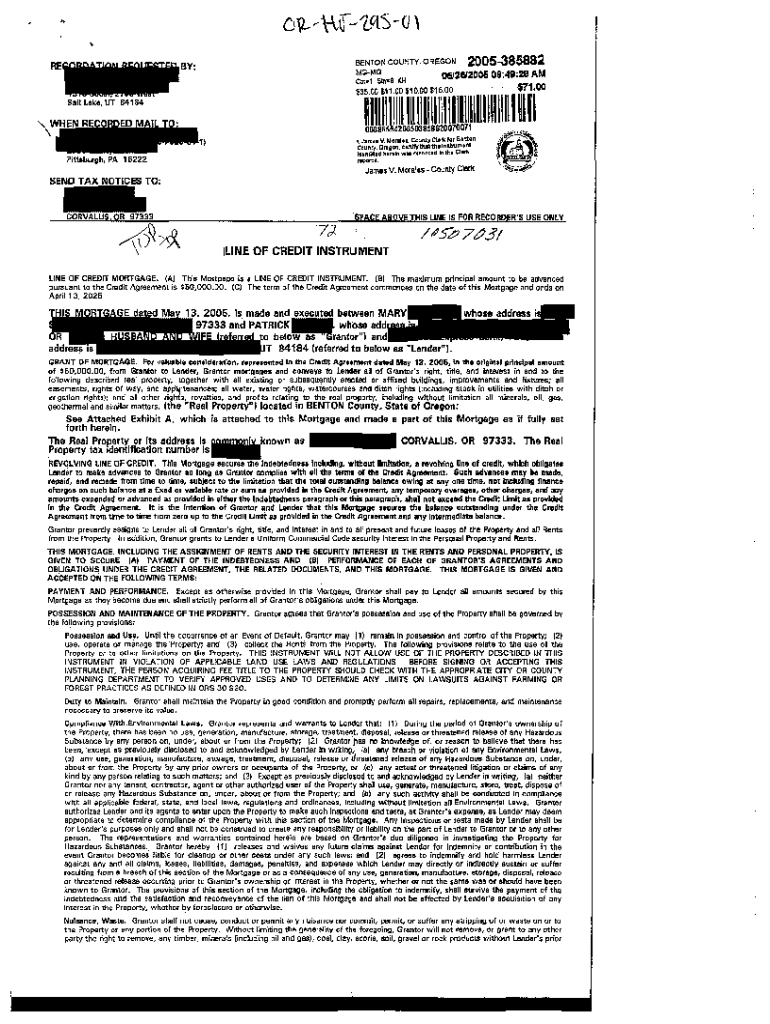

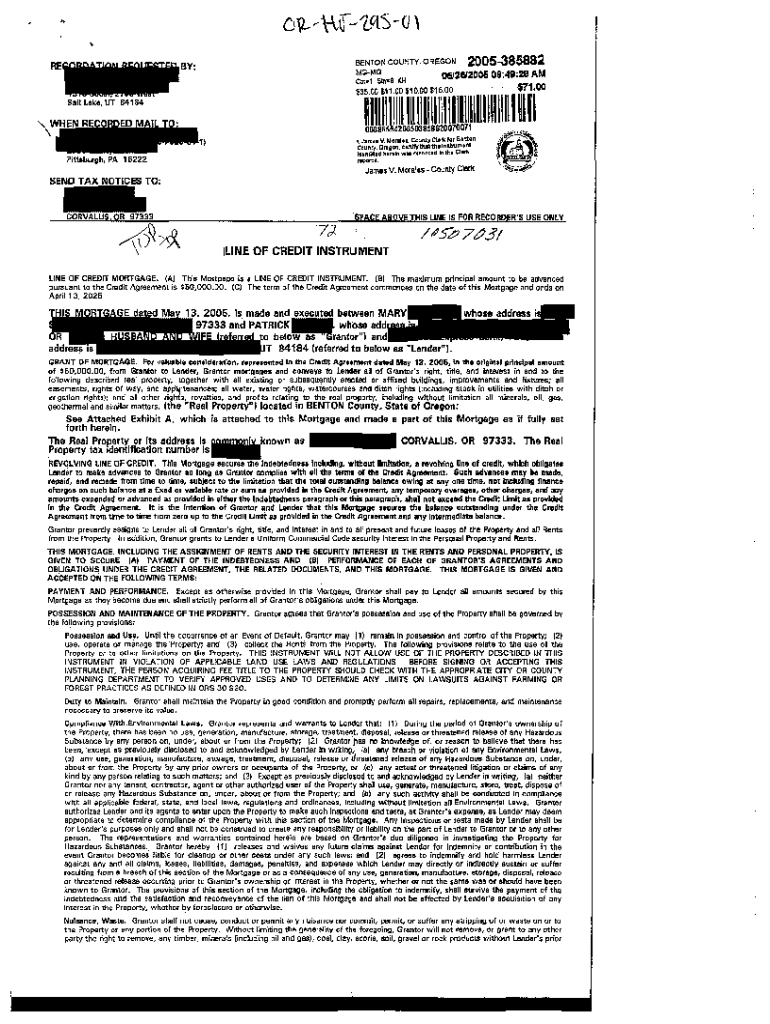

Get the free Line of Credit Instrument

Show details

Line of Credit Instrument

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is line of credit instrument

A line of credit instrument is a flexible loan agreement allowing borrowers to access funds as needed up to a predetermined limit.

pdfFiller scores top ratings on review platforms

I am doing my own 1099's for my business!

Nice experience but somewhat difficult to navigate from one form to the next.

Its been great! I filled out an extensive document easily and quickly. Easy to navigate and use.

Seems to slow down more than expected and the file size is too big

I've only used it for a few contracts but it has been great so fa

Awesomeness that is all one of the best pdf editing programs I have worked with.

Who needs line of credit instrument?

Explore how professionals across industries use pdfFiller.

How to fill out a line of credit instrument form

What is a line of credit instrument?

A line of credit instrument is a financial tool that allows individuals or businesses to borrow money up to a specified limit, providing flexibility for ongoing funding needs. It functions similarly to a credit card, with borrowers responsible for paying interest only on the amount drawn. The key benefits of using such instruments include access to funds for emergencies, managing cash flow, and avoiding high-interest loans.

-

You can withdraw funds as needed and only pay interest on the amount used.

-

As you repay the borrowed amount, your available credit replenishes, ready for future use.

-

Compared to traditional loans, lines of credit often have lower interest rates, making them cost-effective for many.

Common use cases include funding construction projects, covering unexpected expenses, or providing operational cash flow. A line of credit can be a valuable asset for managing both personal and business financial needs.

What are the key components of a line of credit instrument form?

A line of credit instrument form outlines the agreement between the lender and borrower, detailing essential terms. It involves understanding the parties involved, specifying loan amounts, interest rates, and establishing repayment conditions.

-

The form should clearly identify all parties, typically the lender and borrower.

-

Specify the credit limit available to the borrower and the associated interest rate charged on the drawn amount.

-

Outline the timeline and method for repayment, including any fees associated with late payments.

How do you complete the line of credit instrument form?

Completing the line of credit instrument form requires careful attention to detail and accurate documentation. Begin by gathering necessary documents such as proof of income and credit history to ensure you meet lender requirements.

-

Collect relevant financial documents, such as bank statements and identification.

-

Carefully complete sections with your and the lender’s personal information.

-

This section includes your income details and any existing debts.

-

Before submitting, ensure all terms and conditions are understood and accurately reflected.

Following these steps helps prevent common errors and ensure a smooth application process.

How can you edit and customize your line of credit instrument form?

Using pdfFiller, users can effortlessly edit their line of credit instrument forms. This tool provides various functionalities that allow for document personalization, which is essential when adapting forms to specific needs.

-

pdfFiller allows users to modify text, images, and even layout directly within PDF documents.

-

Easily add electronic signatures and approvals to streamline the document validation process.

-

Share documents with stakeholders to enable real-time feedback and collaboration.

What are common mistakes to avoid when completing a line of credit instrument form?

Completing the form incorrectly can result in delays or even denials. Being aware of common pitfalls can save applicants from future complications.

-

Ensure all financial information is complete to prevent your application from being dismissed.

-

Read all terms and conditions carefully to fully understand your obligations.

-

Review your completed form thoroughly to catch any errors before submission.

Why are compliance and legal requirements important?

Compliance with legal standards is essential when dealing with financial instruments. Regulations vary by region, and understanding these helps prevent penalties.

-

Review rules specific to your locale to ensure compliance with local financial laws.

-

Adhere to standards set by banks and other lending institutions to maintain credibility.

-

Ignoring legal requirements can lead to severe penalties, including fines or loss of lending eligibility.

How can you manage your line of credit instruments effectively?

Effective management of a line of credit involves monitoring usage and ensuring timely payments. By keeping track of your credit limits and available amounts, you can avoid overspending.

-

Regularly check your credit balance to understand how much credit is available.

-

Consistency in payments helps maintain a good relationship with lenders and improves your credit score.

-

Understand the procedures needed for renewing or modifying your credit line as your financial needs change.

What challenges may arise with line of credit instruments?

Navigating challenges related to credit applications or disputes with lenders is vital. Be proactive in addressing potential issues to ensure seamless access to your credit.

-

Understand reasons for denial, such as poor credit history or insufficient income.

-

Have strategies ready for resolution to avoid negative impacts on your finances.

-

Regularly review your credit reports and work on areas that may need improvement.

How to fill out the line of credit instrument

-

1.Access the line of credit instrument template on pdfFiller.

-

2.Review the document to familiarize yourself with the sections required.

-

3.Begin by filling in your personal information, including your name and contact details.

-

4.Input the details of the lender, including their name and address.

-

5.Specify the credit limit you are requesting in the designated section.

-

6.Provide relevant financial information, such as income and existing debts, to support your application.

-

7.Review all entered information for accuracy.

-

8.Sign and date the document where indicated, ensuring that you comply with any specific signing requirements.

-

9.Save your completed document and choose the option to either print it or submit it electronically, depending on your preference.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.