Get the free Notice of Tax Lien template

Show details

A tax lien is a lien imposed by law upon a property to secure the payment of taxes. A tax lien may be imposed for delinquent taxes owed on real property or personal property,

or because of failure

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

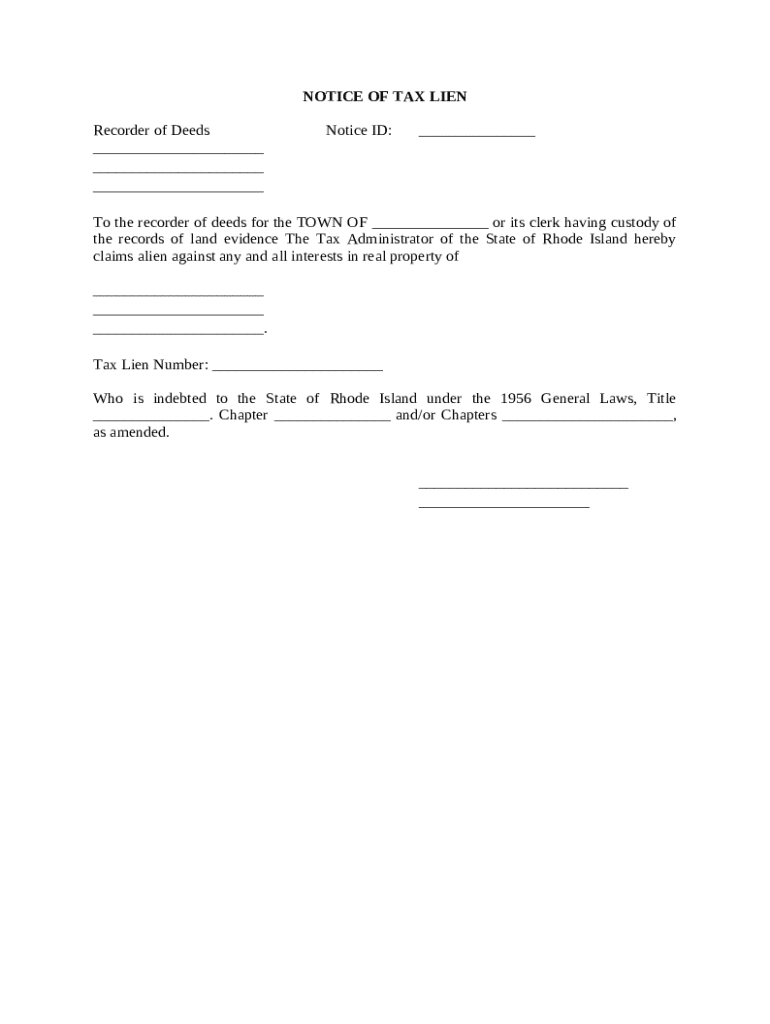

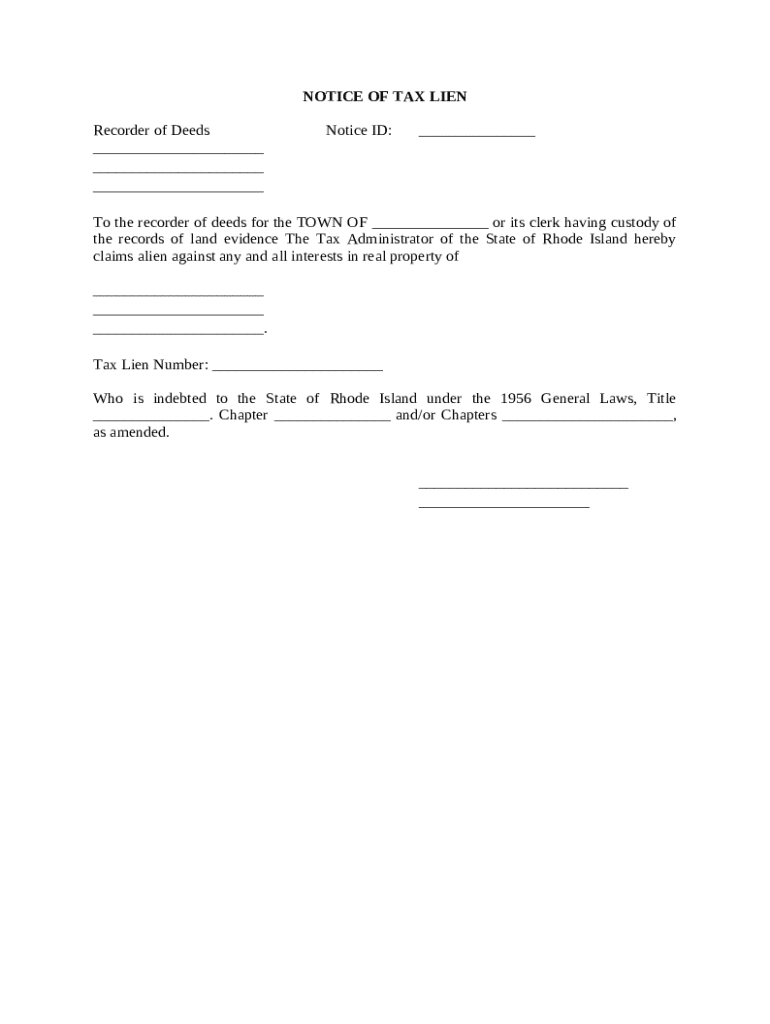

What is notice of tax lien

A notice of tax lien is a legal document that establishes the government's claim against a taxpayer's property due to unpaid taxes.

pdfFiller scores top ratings on review platforms

Great product, but price is too steep

fanatstic

Good

the site is good

It is amazing and it is of a less…

It is amazing and it is of a less struggle

good

good and satisfy

Who needs notice of tax lien?

Explore how professionals across industries use pdfFiller.

How to complete and manage the notice of tax lien form on pdfFiller

How can you understand the tax lien concept?

A tax lien is a legal claim imposed by the government on your property when you fail to pay taxes owed. This obligation can result in serious implications for property owners, including restricted access to credit and potential foreclosure. Understanding the importance of filing a Notice of Tax Lien is crucial; it formally notifies involved parties of the lien, reflecting the government’s claim on the property.

-

A tax lien secures the government's interest in your property, allowing them to seize it if taxes remain unpaid.

-

It can hinder your ability to sell the property or obtain financing, as potential buyers and lenders see tax liens as red flags.

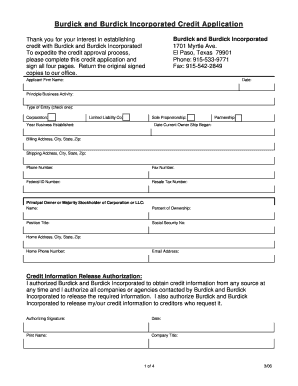

What fields are included in the notice of tax lien form?

When filling out the Notice of Tax Lien form, being meticulous about each section is essential. The fields often include the Notice ID, Tax Lien Number, and details pertaining to the Tax Administrator. Failing to enter accurate information can lead to processing delays or rejections.

-

A unique identifier assigned to each tax lien, critical for tracking the lien's status.

-

This number uniquely identifies the lien itself and should be entered precisely to avoid errors.

-

Include information such as the taxpayer's name, property address, and details about the original tax obligation.

How do you fill out the notice of tax lien form on pdfFiller?

Using pdfFiller to manage your Notice of Tax Lien form is straightforward. Start by accessing the form through the platform's user-friendly interface. You can easily edit fields, electronically sign, and share your completed document with relevant parties, like legal advisors or government agencies.

-

Navigate to the tax lien template on pdfFiller and make a copy to start editing.

-

Use pdfFiller’s eSignature tools to sign the document, making it legally binding.

-

You can invite others to review or edit the form simultaneously, enhancing teamwork and efficiency.

What are best practices for managing your tax lien documents effectively?

To maintain a clear record of your tax lien documents, implementing efficient organizational strategies is vital. Store completed forms in a designated folder within pdfFiller's platform to ensure easy access. Regularly track submissions and responses to maintain compliance and address any issues promptly.

-

Create a systematic approach in pdfFiller to categorize your documents by date or relevance.

-

Use pdfFiller's tracking features to stay updated on the status of your filings.

-

Familiarize yourself with local regulations, especially in states like Rhode Island, to ensure adherence.

Where can you find resources for further information?

To stay informed about tax lien regulations, several resources can provide valuable insights. State government websites often have the latest updates and guidance on tax liens, whereas pdfFiller's help center offers FAQs and additional assistance. Engaging in community forums can also be beneficial for shared experiences and advice.

-

Check these for official updates on tax lien regulations pertinent to your region.

-

Access FAQs and tutorials for navigating tax lien forms and related queries.

-

Participate in discussions to learn from others' experiences regarding tax liens.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.