Get the free A05 Original Promissory Note and Guaranty of Defendant

Show details

A05 Original Promissory Note and Guaranty of Defendant

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

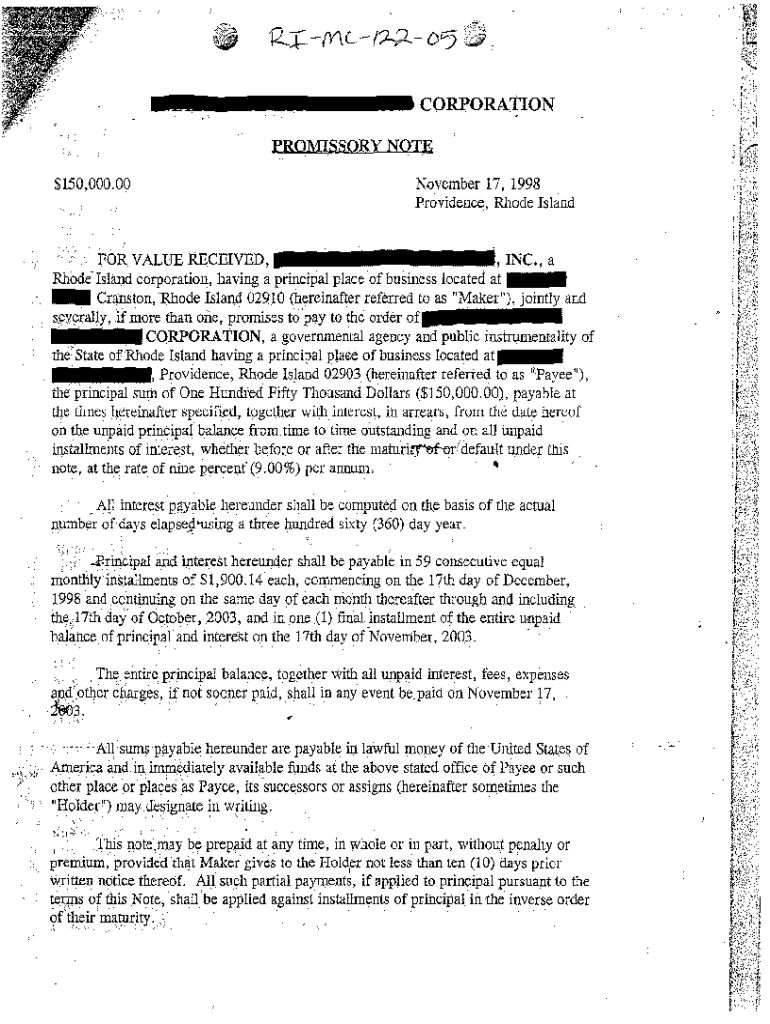

What is a05 original promissory note

An A05 original promissory note is a legal document that outlines a borrower's promise to repay a loan under specified terms.

pdfFiller scores top ratings on review platforms

Very easy to use

Very easy to use, the layout is easy to navigate.

Takes some getting use to

Takes some getting use to. Not as User friendly as I had hoped.

quick and easy to use

quick and easy to use. has a ton of features that really help me get my job done faster!

Great tool!

Great tool works like a charm and easy to navigate!

With help I was able to access the…

With help I was able to access the forms I needed! Thanks!

easy to use

Does everything I need it to do and very easy to use

Who needs a05 original promissory note?

Explore how professionals across industries use pdfFiller.

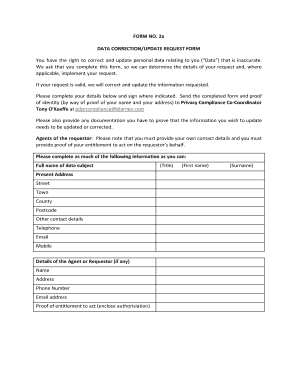

How to fill out a05 original promissory note form form

Understanding the A05 original promissory note form

The A05 original promissory note form is a key document in financial transactions where one party (the borrower) agrees to pay another party (the lender) a specified sum of money. This document serves as a legal record of the loan agreement and outlines the terms both parties have agreed upon. Utilizing a promissory note is crucial as it not only formalizes the loan arrangement but also provides evidence that can be presented in court if disputes arise.

-

The A05 original promissory note form is a standardized template used to document loan agreements, detailing the borrower's promise to repay the lender.

-

By using this form, parties have a clear understanding of their obligations, which helps to prevent misunderstandings and potential legal issues.

-

Typical scenarios include personal loans, business financing, and rental agreements where a financial obligation is recorded.

What are the key components of the A05 original promissory note form?

A complete A05 original promissory note contains essential information that defines the legal framework of the loan. Each component must be clearly articulated to ensure both parties understand their rights and responsibilities under the agreement.

-

This section includes the names and addresses of the borrower and lender, ensuring that both parties are identifiable and accountable.

-

Key details like the loan amount, interest rate, and payment schedule are outlined to ensure clarity on the financial obligations.

-

It outlines what constitutes a default and what remedies are available, protecting the lender's interests and providing guidance for the borrower.

How do you fill out the A05 form?

Filling out the A05 original promissory note form is a straightforward process thanks to platforms like pdfFiller, which provide intuitive interfaces for document completion.

-

Begin by locating the A05 form on pdfFiller's platform, where you can easily download or fill it out online.

-

Input essential information such as names, addresses, and loan amounts into the designated fields provided in the form.

-

It’s crucial to carefully review all terms and conditions to ensure correctness before proceeding to sign the document.

How can you edit and customize the A05 promissory note?

Customization allows the A05 original promissory note to meet specific needs, which can be efficiently done using pdfFiller’s editing features.

-

pdfFiller offers a variety of editing tools that let users modify text, add signatures, and insert clauses.

-

Users can tailor the agreement by adding customized clauses or removing unnecessary ones based on their unique circumstances.

-

Ensure that any changes comply with local laws to maintain the document's legal validity.

What management features does pdfFiller offer for the A05 form?

Managing your documents online can streamline your workflow. pdfFiller provides various management features that are ideal for collaborating on the A05 promissory note.

-

Keep track of edits made to the A05 form, allowing users to revert to previous versions if necessary.

-

Team members can easily review and approve documents, enhancing teamwork efficiency.

-

Access your documents from anywhere using cloud storage, ensuring convenience and flexibility.

How do you sign the A05 original promissory note form?

Signing the A05 form can be done electronically through pdfFiller, providing a convenient solution that maintains legality.

-

This platform offers secure electronic signature options that comply with legal standards.

-

Follow intuitive instructions on pdfFiller to complete the signing process without hassle.

-

Ensure your signature is valid by following all security measures provided within the platform.

What are the common issues and considerations?

Despite being a straightforward document, the A05 original promissory note can present challenges if not filled out correctly.

-

Inaccuracies in filling out details can lead to disputes; verifying information is essential.

-

Consider resources or professional advice to ensure your promissory note template is valid and compliant.

What legal considerations should you keep in mind?

Understanding the legal implications of a promissory note is crucial, as it is a binding contract.

-

A promissory note is legally enforceable, meaning both parties must adhere to the terms outlined.

-

Different jurisdictions have unique laws regarding promissory notes; ensure your document meets local requirements.

-

It is recommended to consult with a legal expert before finalizing the agreement to avoid potential pitfalls.

How to fill out the a05 original promissory note

-

1.Open the A05 original promissory note template in pdfFiller.

-

2.Begin by entering the date at the top of the document.

-

3.Fill in the borrower's name and address clearly.

-

4.Next, provide the lender's name and address.

-

5.Enter the principal amount being borrowed as a numerical value, followed by the written dollar amount.

-

6.Specify the interest rate applicable to the loan.

-

7.Indicate the repayment schedule, including due dates and payment amounts.

-

8.Include information about any collateral, if applicable.

-

9.Make sure to detail the consequences of late payments or defaulting on the loan.

-

10.Lastly, both the borrower and lender should sign and date the document to make it legally binding.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.