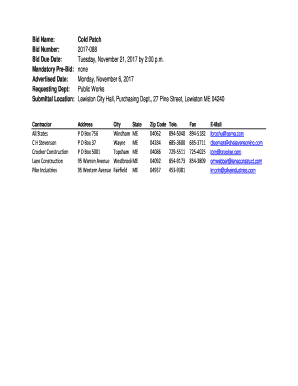

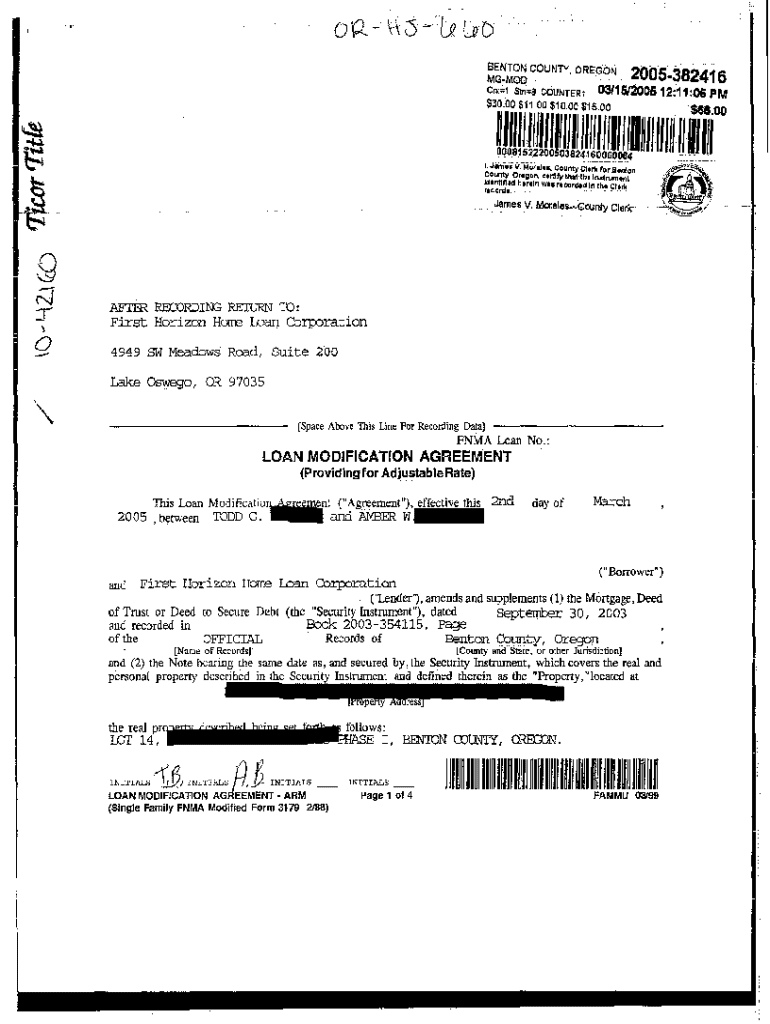

Get the free Loan Modification Agreement providing for Adjustable Rate

Show details

Loan Modification Agreement providing for Adjustable Rate

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is loan modification agreement providing

A loan modification agreement providing outlines the terms under which a lender agrees to modify the original loan agreement to benefit the borrower, typically aimed at making payments more manageable.

pdfFiller scores top ratings on review platforms

I appreciated the ease and speed, just a few little glitches here and there when entering data and printing. Dealing with IRS docs, so need to do it correctly and quickly. Thanks!

easy to naviagate, but I still need instruction On how to allow my employees to use the fillable PDF on their devices

It's extremely efficient and very helpful

It provides a nice interface for customers to answer questions and for central office to get reports.

So far easy to use. would like more of a guided tour to learn how to use.

eally like the program and it easy to use .

Who needs loan modification agreement providing?

Explore how professionals across industries use pdfFiller.

How to fill out a loan modification agreement providing form

Overview of loan modification agreements

A loan modification agreement provides a formal means to alter an existing loan's terms. This process typically aims to make payments more manageable for borrowers facing financial difficulties. Reasons for modification can include changing interest rates, extending payment periods, or adjusting monthly payments.

-

Loan modification alters original loan terms to help borrowers better afford their payments.

-

Borrowers may seek modifications due to job loss, reduced income, or other financial strains.

-

Modifying a loan can provide lower monthly payments, prevent foreclosure, and improve financial stability.

Understanding the loan modification process

Navigating the loan modification process can be complicated without clear guidance. It is crucial to understand the steps involved and the necessary documentation required for submission.

-

Start by assessing your financial situation, then contact your lender to discuss possible options.

-

Prepare income verification, bank statements, and a hardship letter as part of your application.

-

Loan modifications typically take 30 to 90 days to process, depending on the lender's workload.

Completing the loan modification agreement form

Accurately filling out the loan modification agreement form is critical. Ensuring that each section is completed correctly can significantly impact the approval process.

-

Follow the provided guidelines for each part of the form, detailing your financial situation clearly.

-

Double-check calculations and ensure all required fields are filled to avoid delays.

-

Having a trusted advisor or professional view your form before submission can help catch any errors.

How to edit and eSign your agreement using pdfFiller

pdfFiller offers a streamlined approach to editing and signing your loan modification agreement. This cloud-based service makes handling documents easier and ensures a secure submission process.

-

Use pdfFiller to modify any part of your document quickly, ensuring all your information is up-to-date.

-

eSign your document securely online, saving time and avoiding delays associated with printing and mailing.

-

Invite team members to review or approve the document, enhancing collaboration during the process.

Post-submission: What to expect

Once you submit your loan modification agreement, it's essential to know what comes next. Understanding the lender’s process can help you stay informed and proactive.

-

Your lender will evaluate your document against their criteria to determine eligibility.

-

Regularly check in with your lender for updates on your modification status to prevent unnecessary delays.

-

You can expect approved modifications, counteroffers, or denials based on your application specifics.

Ensuring compliance and legal considerations

Legal compliance is critical during the loan modification process. Different regions may have specific laws governing modifications, so it's vital to stay informed.

-

Research your state laws regarding loan modifications, which may impose additional requirements.

-

Be aware of fraud warnings and ensure all your documentation is legitimate and accurate.

-

Consult with legal professionals specializing in loan modifications for guidance tailored to your situation.

Advantages of using pdfFiller for loan modifications

Utilizing pdfFiller for your loan modification forms enhances the efficiency of the entire process. The platform's accessibility and functionality make it an ideal choice for individuals and teams alike.

-

Access your documents from anywhere, ensuring you can manage your loan modification details remotely.

-

Collaborating on documents with team members is smoother, reducing the need for physical meetings.

-

Creating and handling loan modification agreements becomes more straightforward, allowing you to focus on other aspects of your financial situation.

How to fill out the loan modification agreement providing

-

1.Start by opening the loan modification agreement on pdfFiller.

-

2.Read the document thoroughly to understand all the terms and conditions.

-

3.Fill in your name and contact information in the designated fields.

-

4.Enter the loan number and property details as requested.

-

5.Specify the reasons for your modification request based on your financial situation.

-

6.Provide any supporting documents that may be required, such as income statements or proof of hardship.

-

7.Review all the information you've entered to ensure accuracy.

-

8.Sign the document electronically, and date it in the appropriate area.

-

9.Save your completed document and download or print for your records.

-

10.Submit the agreement to your lender as instructed, and keep a copy for your records.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.