Get the free Supplemental Promissory Note for College Loan Program template

Show details

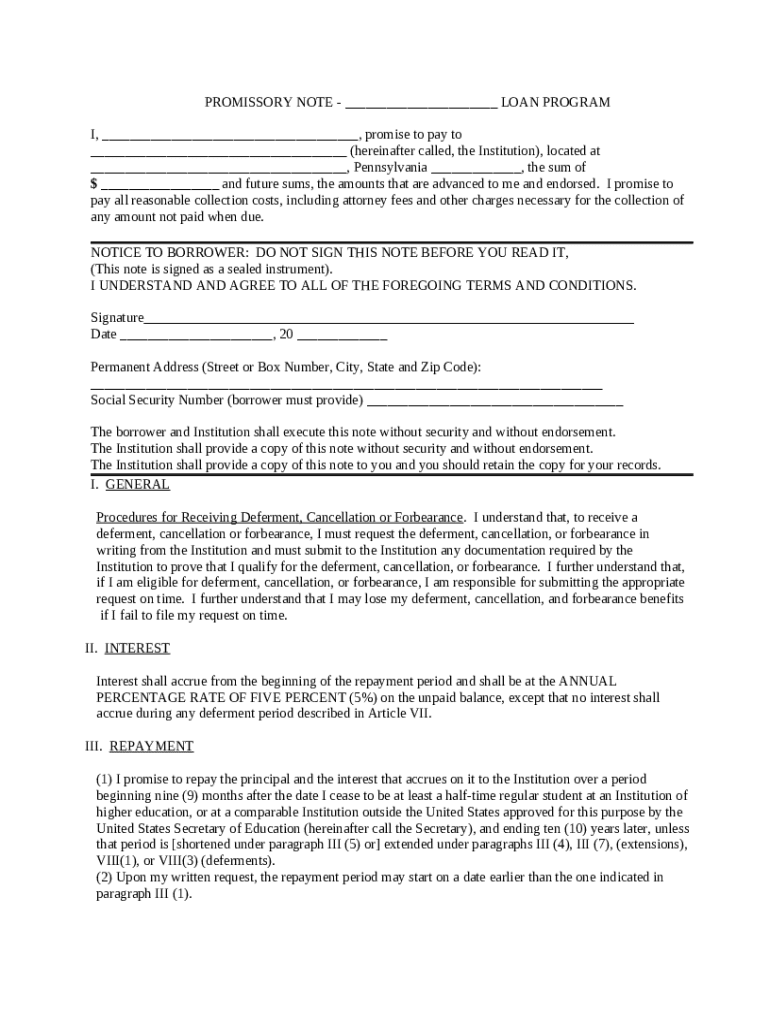

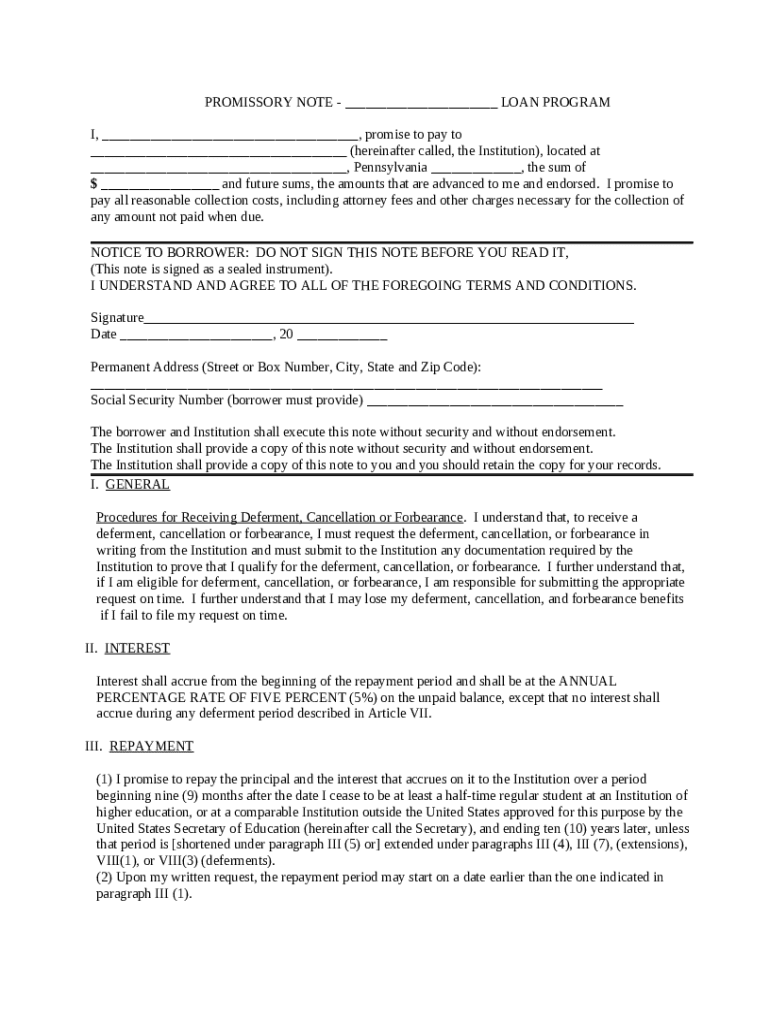

This promissory note is associated with a loan given to a student of a high education institution. The loan is made by the university or college directly. The note becomes due at nine months following

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is supplemental promissory note for

A supplemental promissory note is a legal document that provides additional terms, conditions, or information related to an existing promissory note.

pdfFiller scores top ratings on review platforms

Very helpful.

Good staff that you can use for a lot…

Good staff that you can use for a lot of defirent things

able to fill in all forms and sign

able to fill in all forms and sign. also able to save to computer or cloud. email feature also included.

I think it is good however I already…

I think it is good however I already see methods to improve it. I desire to fax a smart folder of documents I already created. This would be a facilitate faster communication of information as opposed to finding out how to merge the documents and then fax the complete file. All in all, I like the platform. If you may obtain DocuSign options, it would be nice long term perhaps. Many corporations and companies like to use DocuSign.

Pdfiller is the best I have ever used

Pdfiller is the best I have ever used. They provide all the tools you need to do whatever you need with your documents. Customer support is also the best. They solve your issues right away. I highly recommend PDFfiller.

Great App!

Great Application.

Who needs supplemental promissory note for?

Explore how professionals across industries use pdfFiller.

Detailed Guide to Supplemental Promissory Note

A supplemental promissory note serves essential purposes in finance, adding clarity and coverage to loan agreements. This guide is meant to provide comprehensive insights into creating and managing your supplemental promissory note for form applications.

What is a supplemental promissory note?

A supplemental promissory note is a legal document that acts as an addition to an existing agreement, detailing further terms or obligations between a borrower and a lender. Unlike standard promissory notes, which serve as primary agreements for borrowings, supplemental notes are used to clarify, amend, or add conditions to these existing obligations.

How does it differ from a standard promissory note?

Standard promissory notes typically cover the entirety of a loan's terms, including the repayment schedule and interest rate. Conversely, a supplemental promissory note addresses additional specifics without changing the original agreement's core terms.

When do you need a supplemental promissory note?

-

If the lender decides to alter the loan terms from the original contract, a supplemental promissory note is necessary to officially document these adjustments.

-

When a borrower secures additional funds on an existing loan, a supplemental note can outline the new terms associated with these funds.

What are the key components of a supplemental promissory note?

-

This section includes the borrower's name, address, and social security number, which helps identify the individual responsible for payment.

-

Includes the institution's name and location to clarify who the lender is.

-

Clearly states the principal amount being borrowed, the issue date, and details of any future disbursements.

-

Outlines the interest rates, payment schedule, and any late fees that may apply.

-

Emphasizes the importance of thoroughly reading the note before signing, ensuring both parties understand their obligations.

How to fill out a supplemental promissory note form?

Filling out the document accurately is crucial for ensuring clarity. Users should begin with the borrower's information, ensuring all details match legal identification documents.

-

It's vital to state the precise loan amounts and interest rates as misunderstandings can lead to conflicts later.

-

Both parties should have a clear understanding of the legal implications of the agreements they are entering into.

-

Utilize pdfFiller’s editing tools for a streamlined filling process, ensuring accuracy and ease of use.

What legal considerations should you be aware of?

For a promissory note to be legally binding, it must contain specific elements established by law, including signatures from both parties. Additionally, it's essential to know state-specific regulations, such as those in Pennsylvania, which can influence how loans are managed and enforced.

-

Legal stipulations require clear and unequivocal agreements between the borrower and lender.

-

Differences in state regulations can affect the structure and enforceability of promissory notes.

What are your options for modification and cancellation?

Borrowers should be aware of their rights to modify or cancel existing agreements. Procedures for requesting deferment, cancellation, or forbearance often require specific documentation to be submitted promptly to avoid penalties.

-

Documented requests for changes must be sent before the deadline to ensure they are processed on time.

-

Asking for changes usually necessitates submitting specific forms to validate the request.

-

Failing to adhere to submission timelines can lead to increased penalties or a lost right to modify terms.

How can pdfFiller assist with document management?

Managing supplemental promissory notes can be simplified using pdfFiller's comprehensive tools. Users can easily upload their documents, edit them as needed, and electronically sign for a hassle-free experience.

-

Easily upload your supplemental promissory note for convenient editing directly in pdfFiller.

-

Seamlessly integrate electronic signatures for quick and valid execution of the document.

-

Engage others in the document review process for collaborative editing and agreement revisions.

How to finalize your supplemental promissory note?

Before concluding the process, it’s prudent to carefully review the completed supplemental promissory note for accuracy. Ensuring all parties receive copies and securely storing the document adds a layer of trust and readiness for the future.

-

Check all entered information for errors before finalizing the note.

-

Ensure all involved parties have their copies of the signed document to prevent disputes.

-

Utilize both digital and physical storage solutions to protect your document for future reference.

How to fill out the supplemental promissory note for

-

1.Open the supplemental promissory note document in pdfFiller.

-

2.Begin by entering the borrower's full name and address in the designated fields.

-

3.Input the lender's name and address accurately.

-

4.Specify the loan amount, including any additional amounts being provided.

-

5.Fill in the interest rate applicable to the new supplemental loan terms.

-

6.Indicate the repayment schedule, including due dates and repayment installments.

-

7.Include any additional terms or provisions relevant to the supplemental financing.

-

8.Review all completed information for accuracy and ensure no sections are left blank.

-

9.Sign the document electronically, and have the lender sign as well.

-

10.Download or save a copy of the completed form for your records.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.