Last updated on Feb 17, 2026

Get the free Trust Deed template

Show details

Trust Deed is a legal instrument which is used to create a security interest in real property wherein legal title in real property is transferred to a trustee, which holds it as

security for a

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is trust deed

A trust deed is a legal document that establishes a trust and outlines the terms and conditions under which it operates.

pdfFiller scores top ratings on review platforms

Great App. I have used it numerous times and like its ease of use and features.

Please stop having these surveys pop up, they're doing my head in. Otherwise, I love this product

I find it a little confusing to use. I would like to see a tutorial.

I really like PDFiller. I would like to see that you are allowed to crop files and to merge.

Have not used this in 2 years and it was still great

Although I initially had thought this was free, the overall experience is a positive one. The insertion process could be initially a little more self-setting / precise but overall good to use for my purposes

Who needs trust deed template?

Explore how professionals across industries use pdfFiller.

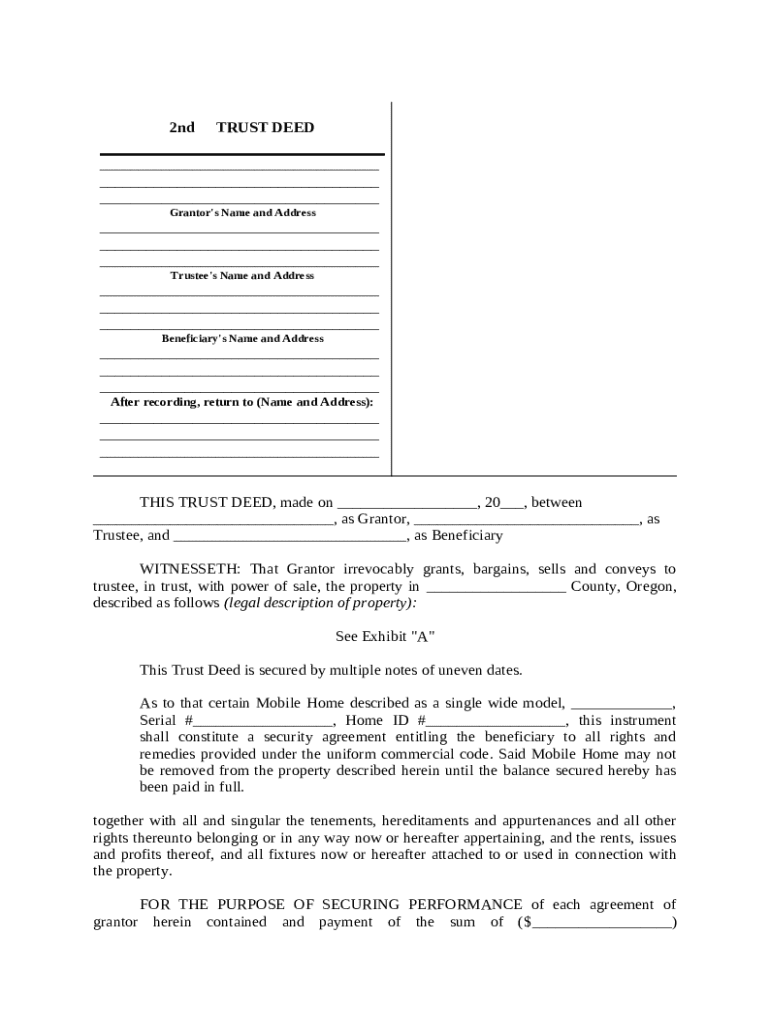

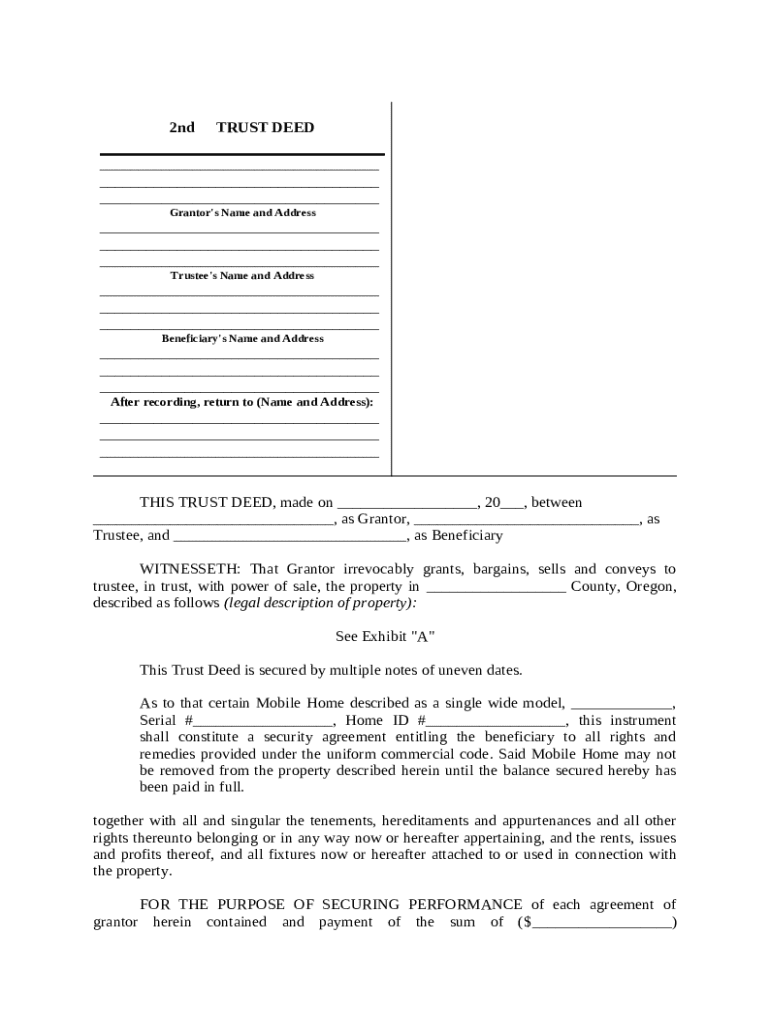

Comprehensive Trust Deed Form Guide

Filling out a trust deed form can seem daunting, but understanding its components and guidelines can make the process smooth and straightforward. This guide provides a comprehensive overview of trust deeds, their essential components, and step-by-step instructions for completing the form.

What is a trust deed?

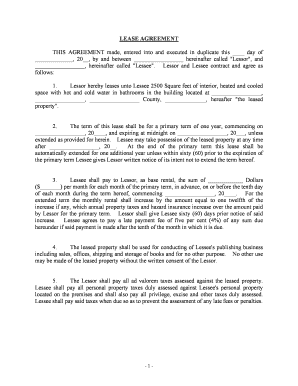

A trust deed is a legal document that outlines the terms of a trust arrangement, typically used in real estate transactions. Its primary purpose is to secure a loan with real property as collateral. Understanding the structure and function of a trust deed is essential for all parties involved.

-

A trust deed serves to outline property rights and obligations, ensuring proper management of the property on behalf of the borrower (grantor) and the lender (trustee).

-

These roles define the parties involved: the grantor is the borrower, the trustee manages the loan, and the beneficiary is the lender entitled to repayment.

-

Trust deeds facilitate property transactions by allowing lenders to manage properties directly, bypassing lengthy foreclosure processes.

What are the components of a trust deed form?

Understanding the necessary information within a trust deed form is crucial to avoid legal issues. A properly completed form ensures that the rights and responsibilities of all parties are clearly established.

-

The form should include vital details about the parties involved and the property.

-

The full legal name and address of the borrower must be clearly stated.

-

Identifying the trustee is crucial as they manage the property and enforce the trust terms.

-

Clarifying who holds the entitlement to the property ensures legal transparency.

-

A precise legal description, often requiring an attachment (e.g., Exhibit A), defines the boundaries and specifics of the property involved.

How do you complete the trust deed form?

Accurate completion of the trust deed form is critical for its validity. Knowing how to fill in your details correctly is the first step toward securing your transaction.

-

Ensure that all names, addresses, and legal designations are accurate to avoid future disputes.

-

Include a thorough legal description, ensuring that all property identifiers are clear and precise.

-

If financing a mobile home, add relevant details to meet specific loan requirements.

-

Double-check all information, verify legal descriptions, and consult an attorney if in doubt.

How do you interact with the trust deed on pdfFiller?

Utilizing digital tools like pdfFiller simplifies the management of trust deed forms. With features designed for collaboration and ease of use, your trust deed management becomes far more manageable.

-

Navigate to pdfFiller to find a reliable version of the trust deed form.

-

Use online editing tools to modify any fields as required fundamentally.

-

The eSigning feature allows for secure signature application, streamlining the signing process.

-

Engage with other stakeholders using interactive tools to ensure all parties have the information needed.

What are the legal considerations for trust deeds?

Complying with legal requirements regarding trust deeds is crucial. Different states may have specific regulations concerning how trust deeds must be executed and maintained.

-

Recognize the legal obligations that come with managing a trust deed, as they can include financial responsibilities.

-

In Oregon, specific filings and notifications are required to ensure compliance with the state laws.

-

Improper handling can lead to legal disputes, loss of property rights, and financial penalties.

Where can find trust deed examples and templates?

Sample trust deed forms can aid in understanding best practices and proper formatting. Utilizing templates can guide you through the creation of a legally sound document.

-

Explore a selection of pre-existing trust deed forms available on pdfFiller to get started quickly.

-

Learn the distinctions between different types of trust deeds, such as open-end versus closed-end.

-

Access templates tailored to specific situations involving trust deeds to streamline your process.

How to manage your trust deed after completion?

Post-completion management of a trust deed is essential for protecting rights and preventing disputes. Knowing how to secure and record your deed ensures its legality and relevance.

-

Store your completed trust deed in a secure location to prevent loss or damage.

-

Follow state procedures to file your trust deed where necessary, ensuring public record compliance.

-

Plan for any future modifications to the trust deed, understanding the legal processes required.

How to fill out the trust deed template

-

1.Open the trust deed template on pdfFiller.

-

2.Begin with the title, clearly stating 'Trust Deed'.

-

3.Fill in the names and details of the trustor (the person creating the trust).

-

4.Specify the trustees, who will manage the trust assets, including their names and addresses.

-

5.Outline the beneficiaries—those who will benefit from the trust—along with their details.

-

6.Detail the assets included in the trust, such as properties, bank accounts, and investments.

-

7.Clearly state the terms under which the trust operates, including distribution rules and any conditions or limitations.

-

8.Review all information for accuracy and completeness.

-

9.If applicable, add any additional clauses or conditions required by the trustor.

-

10.Sign and date the document according to legal requirements, including the signatures of witnesses if necessary.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.