Get the free Transfer on Death Deed or TOD - Beneficiary Deed for Two Married Individuals to Indi...

Show details

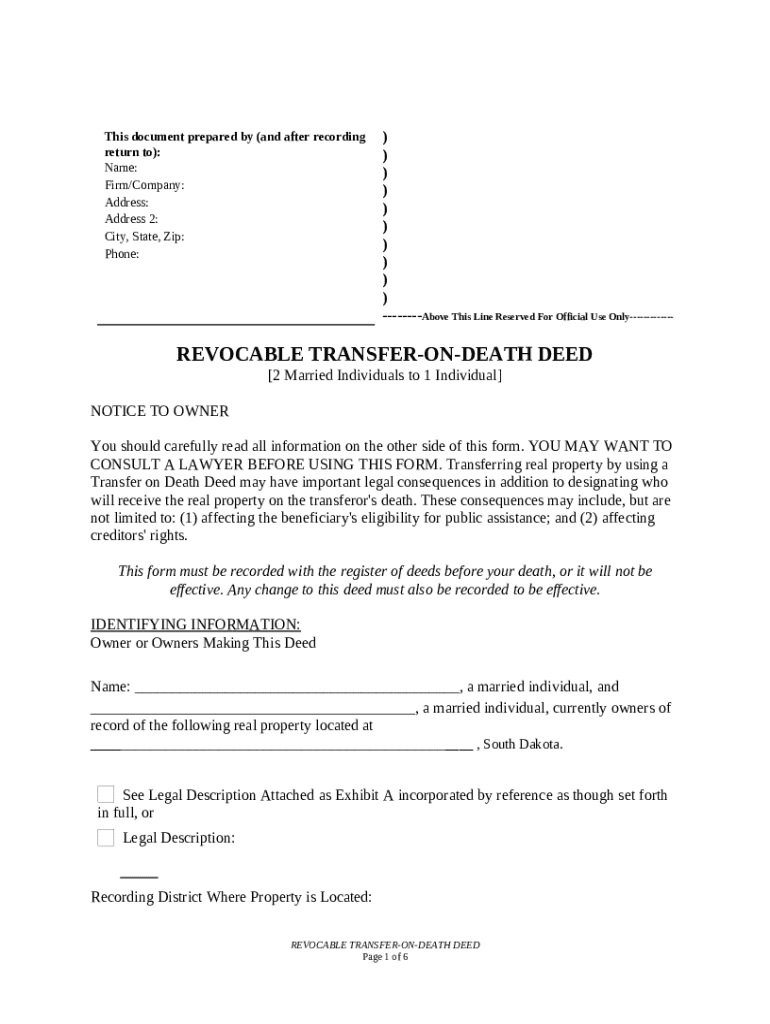

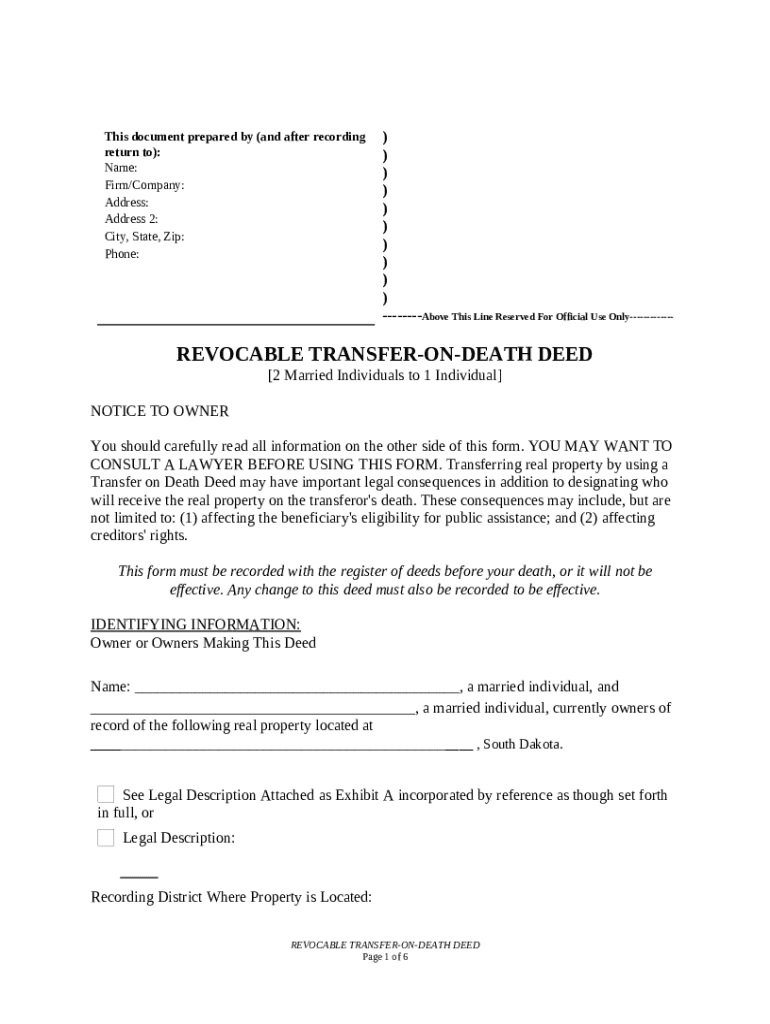

This deed is used to transfer the ownership or title of a parcel of land, attaching any existing covenants, upon the death of the Grantor to the Grantee. It does not transfer any present ownership

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is transfer on death deed

A transfer on death deed is a legal document that allows an individual to transfer property to heirs upon their death without going through probate.

pdfFiller scores top ratings on review platforms

IT IS WONDERFUL

I converted jpg to pdf using pdf…

I converted jpg to pdf using pdf filler, very good experience with it, easy & handy to use

System is easy to follow

System is easy to follow, changes can be made quickly and efficiently.

took a little to get used to but overall, very satisfied

Its so versatile and meets all my business and personal needs

awesome

Who needs transfer on death deed?

Explore how professionals across industries use pdfFiller.

Transfer on Death Deed Form Guide

How does a Transfer on Death Deed work?

A Transfer on Death Deed (TODD) allows real property assets to be passed on to beneficiaries without going through probate. This legal document simplifies the transfer process during the owner's death, ensuring quick access to real estate for loved ones.

-

A TODD enables the property owner to designate beneficiaries who will receive property automatically upon the death of the owner.

-

Benefits include avoiding probate, streamlined estate management, and maintaining property control until death.

-

Legal considerations must include understanding tax implications and the rights of creditors.

-

Beneficiaries must be residents of the state where the property is located and must meet specific age and capability requirements.

What should be considered before implementation?

Before finalizing a Transfer on Death Deed, consider consulting a lawyer to discuss potential impacts on your estate plan and the rights of beneficiaries.

-

Consulting a legal professional aids in understanding how the deed intersects with other estate planning methods.

-

Transferring real property can impact eligibility for public assistance programs and may have tax implications.

-

Understanding how the deed affects the rights of creditors is crucial to ensure asset protection and compliance with state laws.

How do fill out the Transfer on Death Deed Form?

Completing the Transfer on Death Deed form involves several key sections, each requiring accurate and thorough information to ensure validity. Below, we break down the critical sections.

-

This section requires full names and contact details of property owners along with property descriptions including the address and legal description as per local jurisdiction.

-

Ensure to include primary beneficiaries' names and relations, and understand the 'survival rule' affecting the distribution of assets among multiple beneficiaries.

-

If there are prior Transfer on Death Deeds, this section outlines how to formally revoke them to ensure clarity in beneficiary designation.

What happens after completing the Transfer on Death Deed?

After completing the Transfer on Death Deed, the form must be filed with the appropriate register of deeds. Proper recording is critical for the deed's legality and must be done before the owner's death.

-

File the completed deed with the register of deeds in the county where the property is located to ensure it is enforceable.

-

If any changes occur after filing, these must be properly documented to maintain the validity of the deed.

-

Regularly review the deed to confirm its compliance with current laws and your current wishes regarding the property.

What common mistakes should avoid?

Avoiding certain pitfalls when preparing the Transfer on Death Deed can save time, stress, and potential legal issues later.

-

Neglecting to seek professional advice may lead to complications in the deed's execution and distribution process.

-

Make sure all beneficiary information is accurate to avoid disputes and legal challenges after death.

-

Failure to record the deed in all necessary counties can jeopardize the legal transfer of property.

How can pdfFiller assist with your Transfer on Death Deed?

pdfFiller offers tools to simplify the editing and management of your Transfer on Death Deed form. With integrated e-signature features, users can easily sign documents and collaborate effectively.

-

Utilize pdfFiller to make necessary changes to your deed efficiently, ensuring all information is accurate and up-to-date.

-

Sign your document electronically with our user-friendly e-signature tools.

-

Work together with attorneys or family members on document preparation, making the process more efficient.

How to fill out the transfer on death deed

-

1.Obtain the transfer on death deed template from pdfFiller.

-

2.Open the template with pdfFiller.

-

3.Fill in the full legal name of the property owner in the designated field.

-

4.Enter the full legal description of the property being transferred, including address and parcel number.

-

5.List the beneficiaries who will receive the property, including their full names and relationship to the owner.

-

6.Specify if the transfer applies to all or a percentage of the property.

-

7.Review the filled form for accuracy and completeness.

-

8.Sign the deed in the presence of a notary public to ensure legal validity.

-

9.File the signed transfer on death deed with the local county recorder's office to finalize the transfer.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.