Get the free pdffiller

Show details

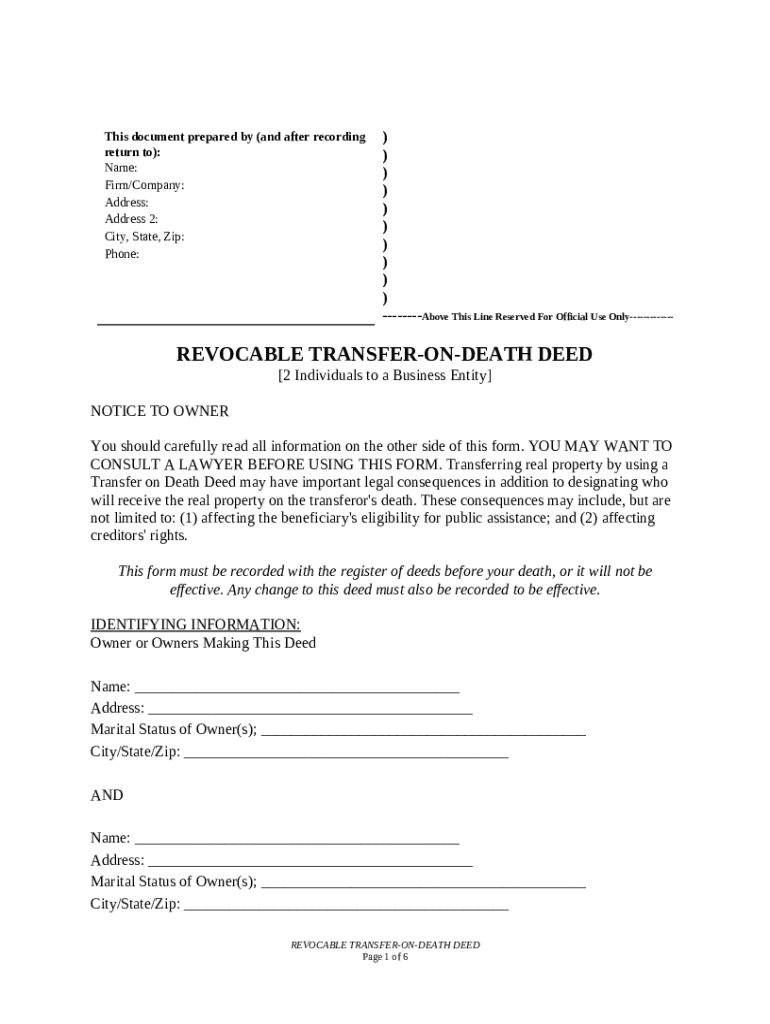

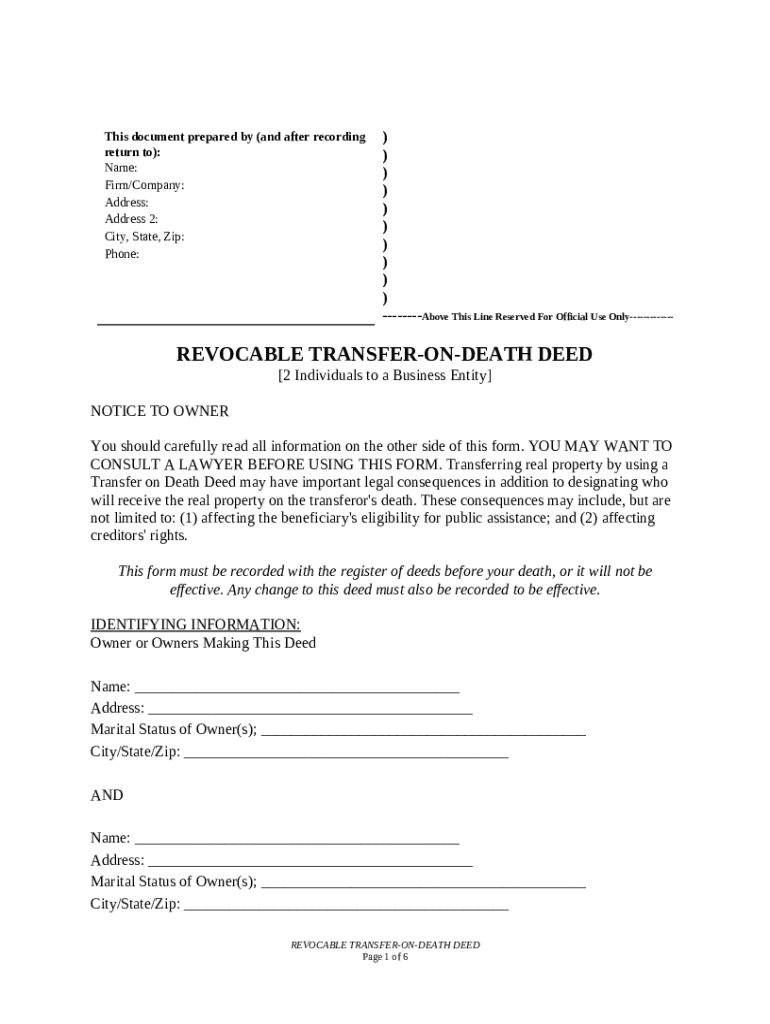

This deed is used to transfer the ownership or title of a parcel of land, attaching any existing covenants, upon the death of the Grantor to the Grantee. It does not transfer any present ownership

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is transfer on death deed

A transfer on death deed is a legal document that allows an individual to transfer ownership of real estate to a designated beneficiary upon the individual's death without going through probate.

pdfFiller scores top ratings on review platforms

It's easy to use, eliminating the need to printout, fill in and scan forms. It makes my life easier.

Customer service is helpful and quickly resolved my problem.

I love the site, I don't like all of the pop ups though! I constantly have to click out of the pop ups when opening a new form. That is my only complaint! But, all in all, I love this site and it helps me be more efficient.

Very Quick, saves me a lot of time. I regularly get pdf's that need to be completed and sent back. Now I can upload, fill out and return in a fraction of the time. Since the data is typed, I never get a question about what I wrote.

I can't believe how easy it is to fax with PDFiller! Awesome!

google drive connection issues, but overall great product

Random scrolling down pages with the scroll on the mouse fix would be appreciated.

Who needs pdffiller template?

Explore how professionals across industries use pdfFiller.

Transfer on death deed form guide

How does a transfer on death deed work?

A transfer on death (TOD) deed is a legal document that allows the owner of a property to designate a beneficiary who will inherit the property upon the owner's death. This deed effectively transfers ownership without the need for probate, thus streamlining the process of property inheritance. Understanding its implications and uses is crucial for effective estate planning.

Understanding the benefits of a transfer on death deed

One of the primary advantages of using a TOD deed is that it helps avoid the probate process, saving time and legal expenses. Additionally, it allows the current property owner to retain control over their property during their lifetime, as they can use, sell, or modify it without restriction. Another benefit is the flexibility to change beneficiaries at any time, accommodating changing family dynamics or personal preferences.

-

Saves beneficiaries from handling estate-related expenses, resulting in quicker access to assets.

-

Gives the property owner peace of mind, knowing they can alter property usage without restrictions.

-

Allows the owner to update who inherits the property as family situations evolve.

What to consider before filling out the form

It's essential to evaluate whether a transfer on death deed aligns with your estate planning goals. Factors such as current relations with potential beneficiaries, ownership type, and the structure of your estate should be considered. Consulting with a qualified legal professional can provide valuable insights into how a TOD deed may affect your estate, public assistance eligibility, and creditors' rights.

-

Selve whether a TOD deed fits within your overall estate strategy.

-

Professional guidance can clarify legal implications and ensure compliance.

-

Be aware of how property transfers can influence eligibility for aid programs.

How to fill out the transfer on death deed form

To properly fill out a transfer on death deed form, certain fields are crucial, including the property owner's and beneficiary's details. It's important to address the marital status of all owners and include the legal descriptions of the property to avoid future disputes. To simplify the process, owners may opt to waive the hour survivorship rule, which requires careful wording in the document.

-

Provide full name and contact details of the property owner.

-

Clearly list the beneficiary's name and relationship to the owner.

-

Include a detailed property description, often found on the current deed.

-

Specify the marital status of the owner to clarify any potential ownership issues.

What steps to take for recording the deed

Recording the transfer on death deed properly is essential for its legal integrity. This involves choosing the correct recording office within your jurisdiction and ensuring that all required documentation accompanies the deed. After recording, you should confirm the status to ensure the deed is retained and recognized legally.

-

Identify the local, county, or state office responsible for property records.

-

Ensure you have all forms and identification needed for the process.

-

Confirm the deed is officially recorded and obtain a copy for your records.

How to manage the deed after completion

After completing and recording the transfer on death deed, ongoing management is essential. Keeping accurate records of any changes, such as beneficiary updates or property modifications, will help prevent disputes later. Regularly revisiting the deed will ensure it still aligns with your desires, and notifying beneficiaries about their designation will avoid confusion in the future.

-

Keep a copy of the recorded deed and document any changes promptly.

-

Assess the deed periodically to confirm it meets your current estate planning needs.

-

Ensure all designated beneficiaries are informed of their status to prevent disputes.

Key resources and tools for managing your deed

pdfFiller provides various features to ease the management of your transfer on death deed form. You can access interactive tools to edit and manage your deed efficiently. The eSignature feature enables smooth transitions for beneficiaries while maintaining collaboration directly through pdfFiller’s cloud-based platform.

-

Edit your TOD deed form easily, ensuring all information is accurate.

-

Utilize electronic signatures for quick and reliable beneficiary designation.

-

Work with heirs or legal advisors directly through the pdfFiller platform.

How to fill out the pdffiller template

-

1.Obtain a blank transfer on death deed form from a reliable source such as pdfFiller.

-

2.Fill in your name as the grantor at the top of the form.

-

3.Enter the legal description of the property you wish to transfer, including the address and parcel number.

-

4.Identify the beneficiary or beneficiaries by providing their full names and addresses.

-

5.Include any specific instructions if there are conditions on the transfer or if there are multiple beneficiaries.

-

6.Sign the document in front of a notary public to ensure its legality.

-

7.Have the notary public sign and seal the document, making it legally binding.

-

8.Record the completed and notarized deed with your local county recorder’s office to finalize the transfer and make it public.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.