Get the free pdffiller

Show details

An Income and Expense Statement for Plaintiff, simply lists any and all expenses and income that the Plaintiff currently has in his/her budget. This information is needed by the Court in order to

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

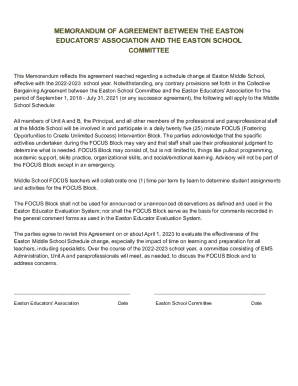

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is income and expense statement

An income and expense statement is a financial document that summarizes the revenues and expenses of an individual or business over a specified period.

pdfFiller scores top ratings on review platforms

Pretty straight to the point. I love it!

love it, it's easy to use and very intuitive

It's great so far, thank you

I edited a document - the program was user friendly - it did what it was supposed to do.

Extremely useful and a great user interface. Just wish it were free (beyond the free trial time...)

test

Who needs pdffiller template?

Explore how professionals across industries use pdfFiller.

Detailed guide to filling out the income and expense statement form

Filling out an income and expense statement form is essential for accurate financial documentation. This guide provides a comprehensive overview of the process, ensuring you understand each section and its importance.

What is an income and expense statement?

An income and expense statement is a financial document that summarizes an individual's or organization's income and expenses over a specific period. Its main purpose is to provide a clear picture of financial health, which is crucial in legal proceedings and financial disclosures.

-

The income and expense statement helps track the flow of money, enabling users to assess profitability and manage cash flow effectively.

-

In legal contexts, such documentation can prove essential for cases such as divorce, bankruptcy, or tax disputes.

-

The form is typically divided into sections that delineate personal information, income sources, deductions, and total expenses.

How do complete the income and expense statement step-by-step?

Completing the statement involves filling out various sections accurately, ensuring that all income and expenses are accounted for.

-

Collect your personal details, including name, date of birth, and contact information. Additionally, provide information about your current employer and any health insurance details.

-

This section requires you to break down your gross income sources. Make sure to include income from wages, freelance work, rents, and any other sources.

-

Identify and list common deductions such as medical expenses, student loan interest, and retirement contributions. Accurate reporting is vital for federal and state tax compliance.

What other income and additional deductions should include?

In addition to primary income, understanding the various other income sources and allowable deductions is crucial for accurate reporting.

-

Include any side gigs, dividends, or investment income that contribute to your overall financial picture.

-

Different income types might have specific deductions. Be sure to research and include them to maximize your net income.

-

Different types of income have varying tax implications. Consult tax resources to ensure accurate reporting.

How do finalize my income and expense statement?

Finalizing your statement is crucial for submitting a credible document. Ensure each section is filled out accurately.

-

Double-check that all sections are filled out completely. Missing information can delay processes.

-

Review the declaration of truthfulness to ensure all information provided is accurate.

-

Make sure to sign and date the document. Authentication is essential for legal validity.

What are the compliance and legal considerations?

Understanding compliance is vital when dealing with financial documents. Legal ramifications can ensue from misstated information.

-

Be aware that providing false information on your income and expense statement can have severe legal consequences.

-

Familiarize yourself with federal and state laws regarding income reporting and expense disclosures.

-

Keep accurate and thorough records, including receipts, to substantiate your financial claims.

How can use pdfFiller’s tools for my income and expense statement?

Leveraging pdfFiller's cloud-based tools can simplify the process of filling out and managing your income and expense statement.

-

Easily fill, edit, and sign your income and expense statement form with user-friendly tools.

-

Utilize collaborative features for team inputs, ensuring everyone has access to the necessary data.

-

Access your documents from anywhere, with secure cloud storage safeguarding your sensitive information.

How to fill out the pdffiller template

-

1.Gather all relevant financial documents, including bank statements and receipts for the specified period.

-

2.Log into your pdfFiller account and open the income and expense statement template.

-

3.Begin with the income section: list all sources of income, including salaries, business revenues, and any additional earnings.

-

4.Enter the total amounts for each income source, ensuring accuracy in numerical entry.

-

5.Next, move to the expense section: categorize all expenses such as rent, utilities, payroll, and supplies.

-

6.Detail each expense within its category and input the respective amounts for the period.

-

7.Once all income and expenses are documented, calculate the total income and total expenses by summing the respective sections.

-

8.Subtract total expenses from total income to determine the net income or loss for the period.

-

9.Review all entries for accuracy and completeness before saving the document.

-

10.Save or download the completed income and expense statement for your records or further analysis.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.