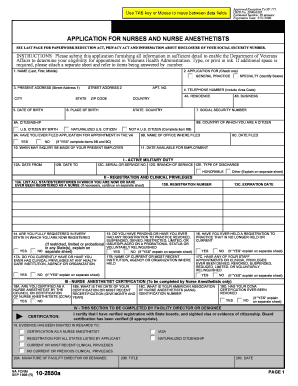

Get the free First Amendment to Loan Documents template

Show details

This form has amendments to the terms of the loan to increase the principal amount of the loan.

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is first amendment to loan

The first amendment to a loan is a legal document that outlines changes to the terms of an existing loan agreement.

pdfFiller scores top ratings on review platforms

It is very easy to use

works fine

works fine!!

It's great instead of recreating a…

It's great instead of recreating a document.

Rep had helped me with my refund.

GOOD

GOOD SERVICE RENDERED

The representative from PDF Filler was…terrific!!!

The representative from PDF Filler was great. I received a message in response to my question right away, and was granted my request. If the support team is any indication of what the company is like, I'm very impressed!

Who needs first amendment to loan?

Explore how professionals across industries use pdfFiller.

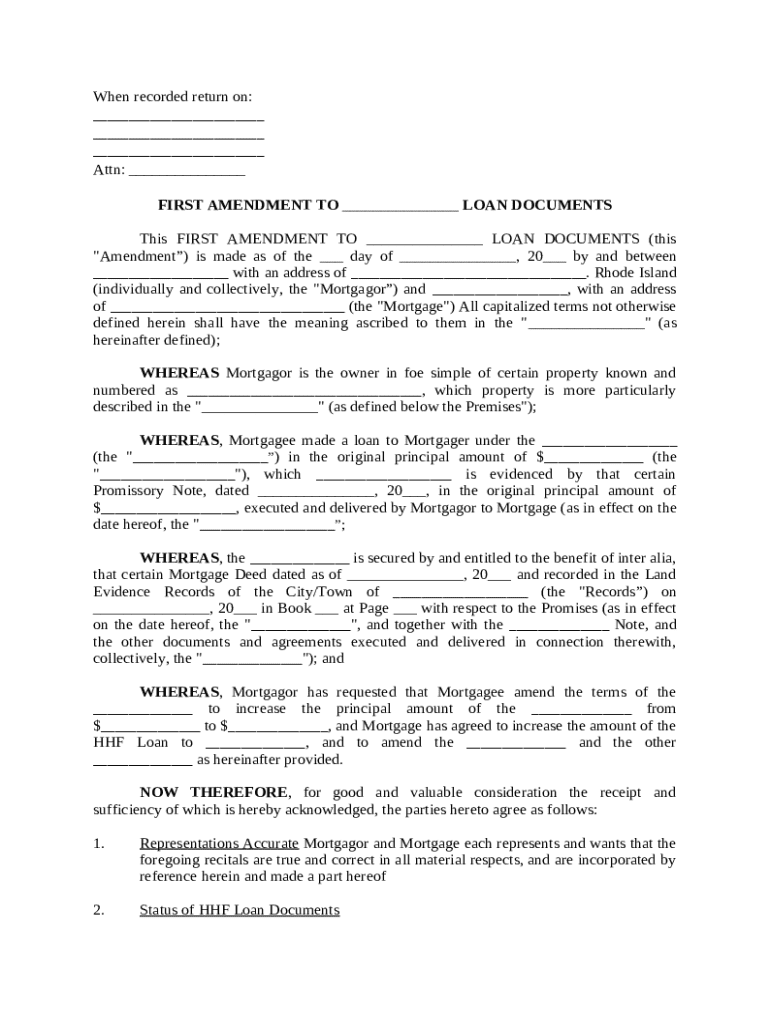

Comprehensive Guide to the First Amendment to Loan Form

What is the first amendment to loan form?

The first amendment to a loan document is a legal modification that alters specific terms of an existing loan agreement without rewriting the entire contract. This process is essential for borrowers and lenders to adjust conditions such as the loan amount, interest rates, or terms of repayment. Understanding this document can prevent potential disputes and ensure both parties remain aligned.

-

It serves as an official record of the changes made to the original loan document.

-

Amendments help reflect changes in financial situations or agreements that arise post-signing.

-

Common situations include refinancing, changes in property ownership, or alterations in interest rates.

What are the key components of the first amendment to loan form?

The amendment form must include accurate and detailed information about the loan and the parties involved. This ensures clarity and legal protection for both borrow and lender. Each component serves a unique purpose in validating the changes made.

-

Record the specific date the amendment is made and names of all parties involved.

-

Outline the property in question along with current ownership information to prevent confusion.

-

Specify the original loan amount to clearly contrast with the revised amount.

-

Detail the new loan amount and any adjustments to terms or interest rates.

How do fill out the first amendment to loan form?

Completing the first amendment to a loan form is detailed but straightforward. Following a step-by-step process can help avoid common pitfalls and ensure accuracy.

-

Collect all documentation related to the original loan and any prior amendments.

-

Enter the exact names and addresses of all parties involved as they appear in the original agreement.

-

Clearly state the initial loan amount and other relevant terms.

-

Indicate the updated principal amount and any other changes being made.

-

Confirm that all parties sign and date the document to validate the changes.

What interactive tools are available for completing your document?

With digital tools like pdfFiller, you can enhance the efficiency of completing your loan amendment. These resources facilitate editing, signing, and collaborating on important documents.

-

Edit documents directly online, making it easy to make changes and correct errors.

-

Share documents with all parties involved to enable fast feedback and updates.

-

Use electronic signatures for a quick, compliant way to finalize your agreements.

What are best practices for amendments and loan management?

Implementing best practices for loan amendments ensures that all changes comply with legal standards and agreements. Proper management can save you time and prevent disputes.

-

Double-check all information entered to prevent legal issues that can arise from incorrect data.

-

Consider seeking professional advice for complicated amendments to safeguard interests.

-

Maintain an organized archive of all documentation related to amendments for future reference.

What common mistakes should avoid with loan amendments?

Mistakes in loan amendments can lead to legal disputes or financial loss. Awareness of common errors can help ensure accuracy.

-

Failure to include all necessary details can invalidate the amendment.

-

Ensure that every party affected by the amendment is informed to maintain transparency.

-

Different states have varying rules regarding loan documentation; familiarize yourself with your area’s laws.

How do local compliance and legal considerations affect amendments?

Local laws can significantly influence the process of loan amendments. Understanding your region’s regulations can ensure legal compliance and protect your investment.

-

Different states, including Rhode Island, have specific legal requirements for loan amendments. Review these to stay compliant.

-

Local laws can affect everything from paperwork requirements to loan structure and terms.

-

Stay updated on mortgage industry best practices to assure your amendments meet established norms.

How to fill out the first amendment to loan

-

1.Obtain the original loan agreement and the required first amendment form from the lender.

-

2.Review the original terms to identify specific changes needed such as interest rate, payment schedule, or loan amount.

-

3.Carefully fill in the borrower's name, loan number, and any other required personal information in the designated sections.

-

4.Clearly outline the changes to the original terms in the appropriate fields, ensuring all modifications are precise and clear.

-

5.Include a section that stipulates the remaining terms of the original loan that are not being amended, if applicable.

-

6.Check for any additional provisions or clauses that may need to be added due to the amendment.

-

7.Sign and date the form once all changes are accurately recorded, ensuring that all parties involved have the opportunity to review.

-

8.Submit the completed amendment to the lender for approval and retain a copy for records.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.