Get the free Real Estate Purchase Agreement template

Show details

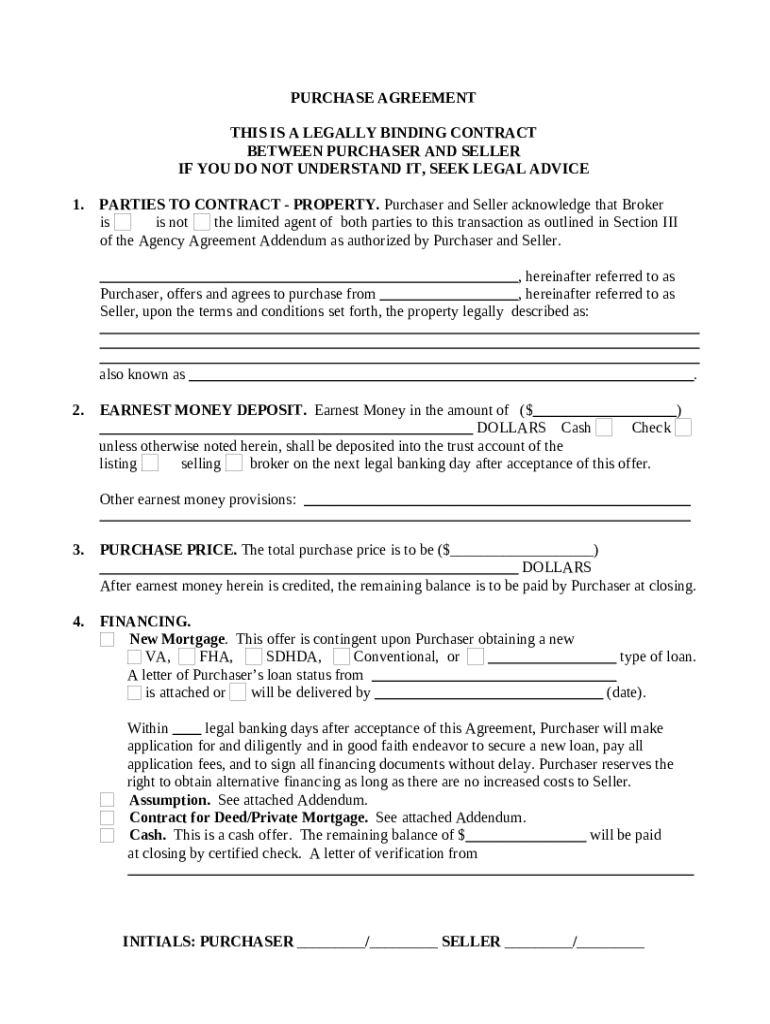

This is a sample Real Estate Purchase Agreement. If you buy a home without an agent, you'll have to negotiate and decide how much to offer on your own. The form may be customized to suit your needs.

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

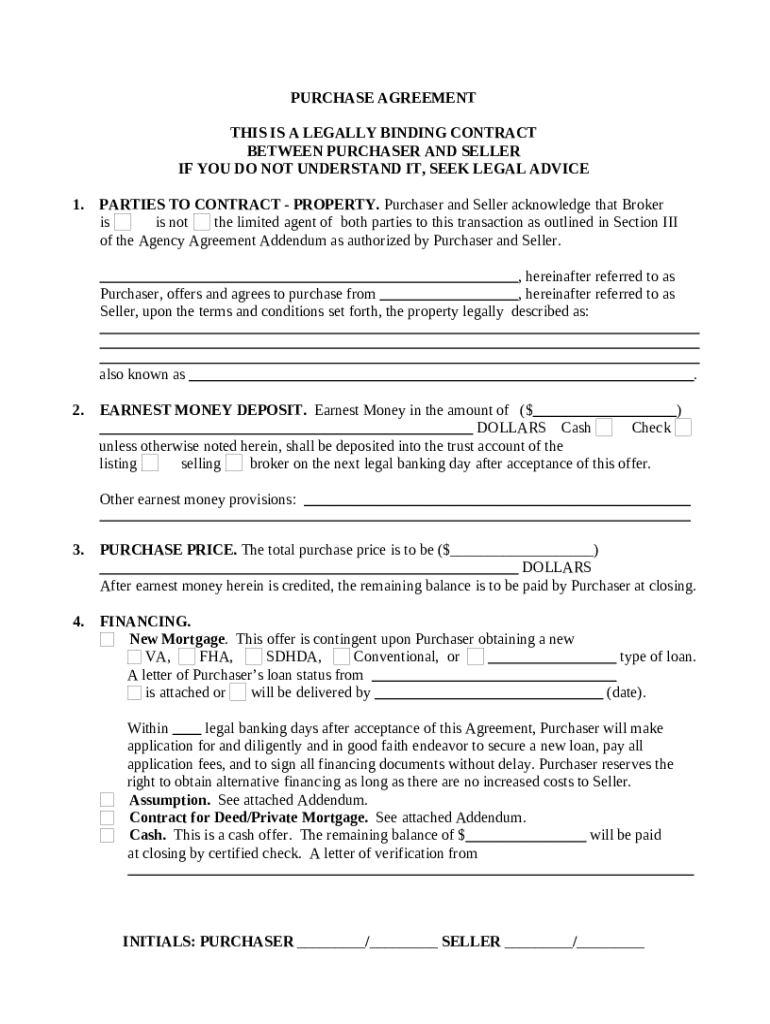

What is real estate purchase agreement

A real estate purchase agreement is a legally binding contract between a buyer and a seller outlining the terms for the sale of real property.

pdfFiller scores top ratings on review platforms

I have been on it all day. as first time user. love it. I have been modifying blue prints and it works great. Nice quick support via chat as well along with helpful videos'

comes in very handy when outgoing officers haven't filed reports correctly!!!!

Really good..haven't quite worked everything out yet..but so far so good

Sometimes hard to find the doc template you are looking for but otherwise, it is great!

this is the best operation for the entreprenue

GREAT! Please be more clear about5.99 monthly rate, not actually monthly charge, all one charged lumped into 1 yearly charge,

Who needs real estate purchase agreement?

Explore how professionals across industries use pdfFiller.

Real Estate Purchase Agreement Form Guide

How does a real estate purchase agreement work?

A real estate purchase agreement is crucial for any property transaction, outlining the terms between the buyer and seller. It acts as a legally binding document that ensures both parties are in agreement about the sale of the property. Drafting a purchase agreement with precision helps mitigate risks and misunderstandings throughout the buying process.

-

Definition and importance of a Real Estate Purchase Agreement: This document serves as the foundation for real estate transactions, detailing all crucial elements of the sale.

-

Key parties involved: The primary parties are the purchaser (buyer) and the seller, each having rights and obligations outlined in the agreement.

-

Importance of seeking legal advice: Consulting a legal expert can clarify terms and ensure all necessary clauses are included for protection.

What are the key components of a real estate purchase agreement?

A comprehensive real estate purchase agreement includes several core components that safeguard both the buyer's and seller's interests. Understanding these components helps parties negotiate effectively and avoid potential disputes.

-

Identifying the Property: The agreement should detail the property’s address, legal description, and any included fixtures or personal property.

-

Earnest Money Deposit: This upfront payment indicates the buyer's seriousness, typically ranging from 1% to 3% of the sale price.

-

Total Purchase Price: Clearly stated financial terms ensure everyone knows the costs involved, including closing costs and any seller concessions.

How do earnest money deposits work?

Earnest money acts as a security deposit for the buyer’s commitment to purchase the property. It shows the seller that the buyer is serious about completing the transaction, which can expedite the sales process.

-

Specific requirements for earnest money deposits vary by region, and it’s crucial to understand these guidelines before committing.

-

Acceptable forms may include cash, check, or a wire transfer, and should be secured in an escrow account until closing.

-

Failing to provide earnest money can jeopardize the transaction, often resulting in the seller's decision to accept another offer.

How is the purchase price structured?

Understanding purchase price structure is critical for both parties to ensure transparency and clarity in the transaction. The agreement should break down how the total price is finalized and the terms of payment involved.

-

A clear breakdown should indicate the total purchase price while showing how the earnest money will be credited.

-

Payment terms, including any contingencies regarding financing options or additional requirements before closing, must be outlined.

-

Understanding how closing costs are calculated will ensure both parties remain aware of the financial responsibilities involved.

What financing options are available for buyers?

Financing terms within a real estate purchase agreement can significantly affect the buyer's ability to purchase a home. Potential buyers need to understand various loans to determine which is best suited for their financial situation.

-

Contingencies are commonly included that specify conditions under which the purchase hinges on securing a mortgage.

-

Various loan types, such as VA, FHA, and Conventional loans, each come with distinct eligibility requirements and benefits.

-

Loan status letters, confirming financial approval, are essential documents that should be attached to the agreement to strengthen the buyer's position.

What alternative financing methods can be used?

In some situations, buyers might explore alternative financing methods outside traditional mortgages. Understanding these options can be crucial for those unable to obtain standard financing.

-

Assumptions allow a buyer to take over the seller’s existing mortgage, beneficial if the rate is lower than current market rates.

-

A Contract for Deed can provide an alternative approach where the buyer makes payments directly to the seller over time, gaining ownership rights upon final payment.

-

Cash offers should include clauses in the purchase agreement that cover all required disclosures and potential contingencies.

What are the legal requirements for signing the agreement?

For a real estate purchase agreement to be legally binding, certain criteria must be met. Both parties need to understand their rights and responsibilities to enforce the agreement effectively.

-

An agreement is legally binding once all parties sign it, demonstrating mutual consent to the terms outlined.

-

Brokers play a crucial role in ensuring legal compliance and representing the interests of their clients throughout the transaction.

-

Potential legal implications arise if the agreement is not adhered to, including the possibility of lawsuits or financial penalties.

How can modify my purchase agreement?

Modifying a purchase agreement can be necessary due to changing circumstances. Having the right tools simplifies this process, ensuring that all changes are accurately documented.

-

A step-by-step guide can outline how to edit a PDF real estate purchase agreement, facilitating quick changes when needed.

-

Using pdfFiller tools to modify documents allows users to add or adjust critical information without starting from scratch.

-

It's vital to save and share edited documents securely to maintain confidentiality and legal integrity throughout the process.

What interactive features does pdfFiller offer for your purchase agreement?

The ability to utilize interactive features can greatly enhance the efficiency of managing purchase agreements. These features streamline the process of collaboration and signing.

-

eSign capabilities allow for remote signing of agreements, eliminating the need for physical meetings and expediting processes.

-

Collaborative features enable teams to work together on agreements, ensuring input from all necessary stakeholders.

-

Managing document versions and tracking changes can help maintain oversight during negotiations and revisions.

What common terms and definitions should know?

Familiarizing oneself with common terms in a real estate purchase agreement can prepare buyers and sellers for discussions. Understanding the legal language creates clarity and confidence.

-

Key terms buyers and sellers should know include 'closing costs,' 'escrow,' and 'contingency,' each with specific implications in real estate transactions.

-

Definitions specific to earnest money and financing should be included to avoid confusion or misinterpretation of the purchase agreement.

-

Legal language often used in agreements should be reviewed to understand potential risks and obligations properly.

What are the steps to terminate a real estate purchase agreement?

Termination of a purchase agreement can occur under specific circumstances. Knowing the process and potential ramifications can help parties navigate this sensitive situation.

-

Valid reasons for termination can include financing issues or significant misrepresentations of the property.

-

The process to formally terminate an agreement typically involves providing written notice to the other party.

-

Potential consequences may arise, from the forfeiture of earnest money to renegotiation of terms if approached correctly.

How to fill out the real estate purchase agreement

-

1.Begin by opening the real estate purchase agreement template in pdfFiller.

-

2.Enter the date at the top of the document to specify when the agreement is created.

-

3.Fill in the buyer's full legal name and contact information in the designated fields.

-

4.Provide the seller's full name and contact information as well.

-

5.Describe the property being sold, including the legal description and address, to ensure clarity.

-

6.Specify the purchase price of the property and any deposit to be made by the buyer.

-

7.Outline financing details, including whether the buyer is obtaining a mortgage or paying cash.

-

8.Include any contingencies such as inspection periods or financing approval timelines.

-

9.Add details about closing costs, who is responsible for paying them, and the closing date.

-

10.Review all the entered information carefully for accuracy and completeness before finalizing.

-

11.Once satisfied, save the document to retain a copy for your records.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.