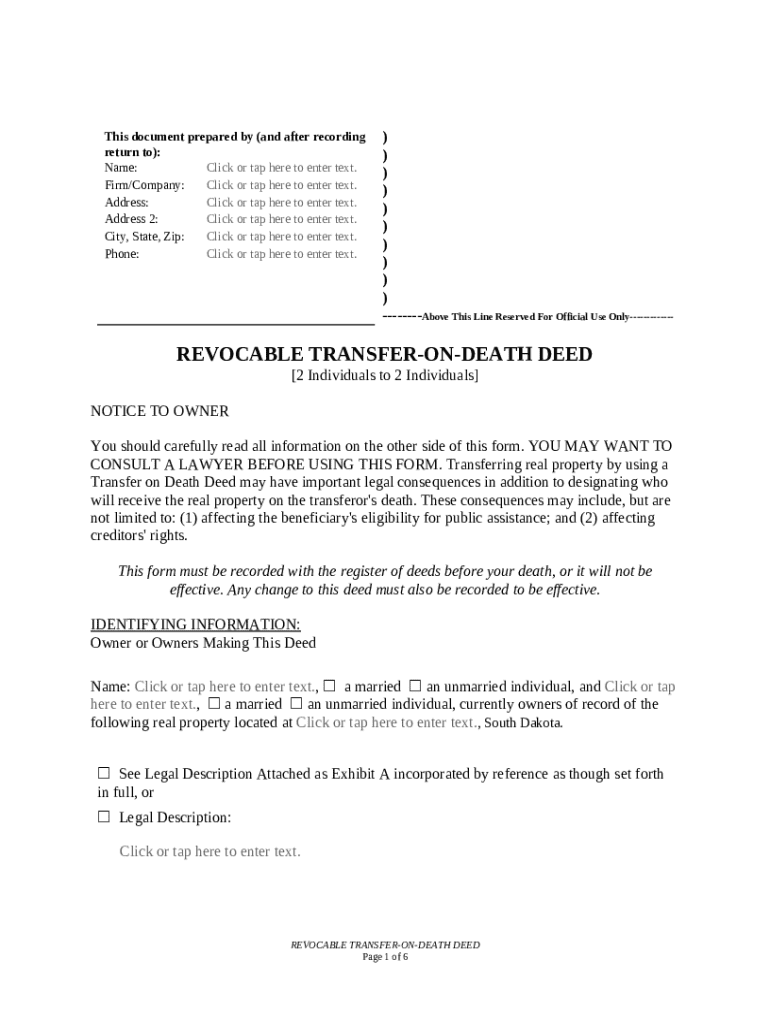

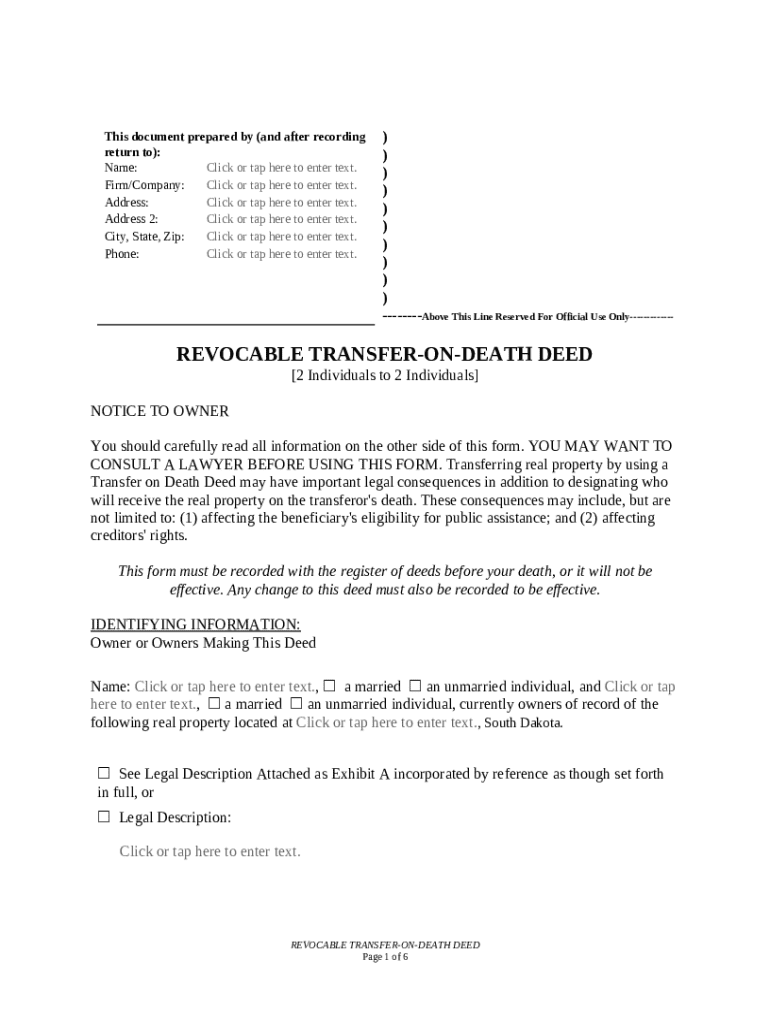

Get the free Transfer on Death Deed or TOD - Beneficiary Deed for Two Married Individuals to Two ...

Show details

This deed is used to transfer the ownership or title of a parcel of land, attaching any existing covenants, upon the death of the Grantor to the Grantee. It does not transfer any present ownership

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is transfer on death deed

A transfer on death deed is a legal document that allows an individual to transfer ownership of real estate to a beneficiary upon their death, bypassing probate.

pdfFiller scores top ratings on review platforms

PDF is a great product…

PDF is a great product ....unfortunately I have to go through backagent with my real estate career to get paid and it prints all my documents needed. Thank you

I signed up for the free trial and was…

I signed up for the free trial and was able to amend 2 documents with ease.If I had the kind of life that required me to need further amendments in this way, this service is absolutely one I would use. Thing is, I just don't, so I didn't sign up after the free trial! Had a little difficulty cancelling the subscription, but honestly - I think that was 'on me', I just wasn't entirely sure what I was doing.However, it's a great service and the company responded to my concern when the subscription fee was taken by emailing me back and confirming that they would be refunding the cost. So, I think you can trust this company.

Top Notch product and team

PDFfiller is a great service! Easy to use and my project was complete in no time at all. Customer service is fast and really helpful. I created a billing error and the team fixed it immediately. Their communication was also swift and friendly!

Very good

Very good, didn't think I could ever write over a pdf document but thanks guys!

Really quite a simple program

Really quite a simple program. Easy to figure out even for someone technologically challenged like myself!

Works great

Works great, low prices, I only wish I could get an app on my Microsoft computer.

Who needs transfer on death deed?

Explore how professionals across industries use pdfFiller.

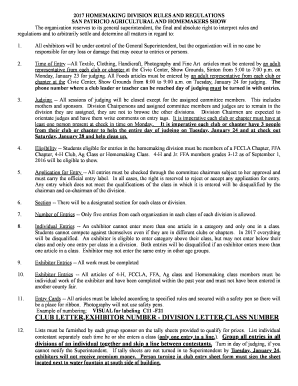

Transfer on Death Deed Form Guide

Understanding Transfer on Death Deeds

A Transfer on Death (TOD) Deed allows you to transfer your real estate to your beneficiaries upon your death without going through probate. This legal document has significant implications for estate planning and is increasingly favored over traditional wills and trusts for its simplicity and effectiveness.

-

A TOD Deed automatically transfers ownership of property at death to designated beneficiaries.

-

It enables the transfer of property outside of probate, simplifying the process for heirs.

-

Unlike traditional wills, TOD Deeds avoid the complicated probate process and can be simpler to execute.

Before you get started

Prior to completing a TOD Deed form, it's essential to understand certain prerequisites and consequences. Knowing the benefits as well as the potential legal ramifications can help you make informed decisions before moving forward.

-

You must be the owner of the property and of legal age to execute a TOD Deed.

-

TOD Deeds provide an efficient way to transfer real estate directly to beneficiaries without probate.

-

If not recorded properly, the deed may be challenged or deemed ineffective.

-

Engaging legal advice ensures your deed adheres to local regulations and fulfills your estate planning goals.

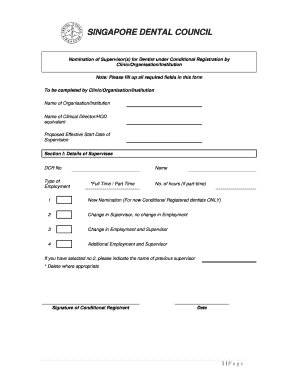

Filling out the transfer on death deed form

Accurate completion of the TOD Deed form is crucial for its effectiveness. You'll need personal information alongside detailed property descriptions to avoid any confusion later on.

-

Provide details including your name, address, and contact information.

-

Include the legal description of the property intended for transfer. This often includes parcel numbers or lot specifications.

-

Correctly identify the recording district where the property is located to ensure proper filing.

Identifying information

When documenting ownership, accuracy is vital. Ensure you provide complete details to avoid potential issues during transfer.

-

Complete the form with your name, marital status, and indicate any co-ownership arrangements.

-

Clarify if the property is solely owned or jointly owned with a spouse or another party.

-

Examples can help clarify how to format property addresses properly.

-

Ensure all property addresses are correctly formatted to avoid future complications.

Beneficiary information

Designating beneficiaries is a critical part of the TOD Deed process. Clear, accurate information guarantees a smooth transfer later on.

-

Clearly indicate the names of each beneficiary you wish to designate, ensuring spelling accuracy.

-

Each beneficiary's name, address, and relationship to you must be included.

-

Consider designation strategies for multiple beneficiaries, which may include percentages or shares.

-

Be aware of the implications of designating registered beneficiaries versus non-registered.

After you finish

Once the deed is completed, the next step is ensuring it is correctly recorded. Failure to do this can nullify the benefits of the transfer.

-

Submit the completed document to the local register of deeds to ensure it is officially recorded.

-

Different counties may have specific requirements or forms needed for recording.

-

Check with local legal advisors or the recording office to confirm the deed has been recognized.

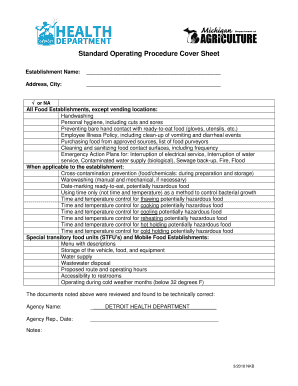

Additional information and compliance notes

Understanding state-specific regulations regarding Transfer on Death Deeds can protect you from legal pitfalls. This allows for the effective transfer of properties while adhering to local laws.

-

Each state has its own rules regarding TOD Deeds; familiarize yourself with them.

-

Failing to record can lead to complications for beneficiaries, potentially leading to family disputes.

-

Regularly update your deed as life circumstances change to maintain its effectiveness.

How pdfFiller simplifies your document needs

pdfFiller offers an array of features that make creating, editing, and managing your transfer on death deed forms easy and efficient. From cloud-based accessibility to intuitive collaboration tools, you can complete your forms hassle-free.

-

pdfFiller enables users to effortlessly edit, fill, and customize forms.

-

Efficient collaboration features are available for individuals and teams, streamlining the document management process.

-

Access your documents from anywhere, promoting greater flexibility in completing your tasks.

How to fill out the transfer on death deed

-

1.Open pdfFiller and select the transfer on death deed form from templates.

-

2.Fill in the names of the property owner(s) in the designated fields.

-

3.Enter the address and legal description of the property being transferred.

-

4.Provide the name of the beneficiary who will receive the property upon death.

-

5.Select whether the transfer is to be effective immediately or upon death.

-

6.Sign and date the document in the appropriate fields, ensuring all owners sign if applicable.

-

7.Review the document for accuracy and completeness before submitting.

-

8.Save the completed deed to your account, and ensure you print copies for your records.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.