Get the free Transfer on Death Deed or TOD - Beneficiary Deed for Two Individuals to a Trust temp...

Show details

This deed is used to transfer the ownership or title of a parcel of land, attaching any existing covenants, upon the death of the Grantor to the Grantee. It does not transfer any present ownership

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

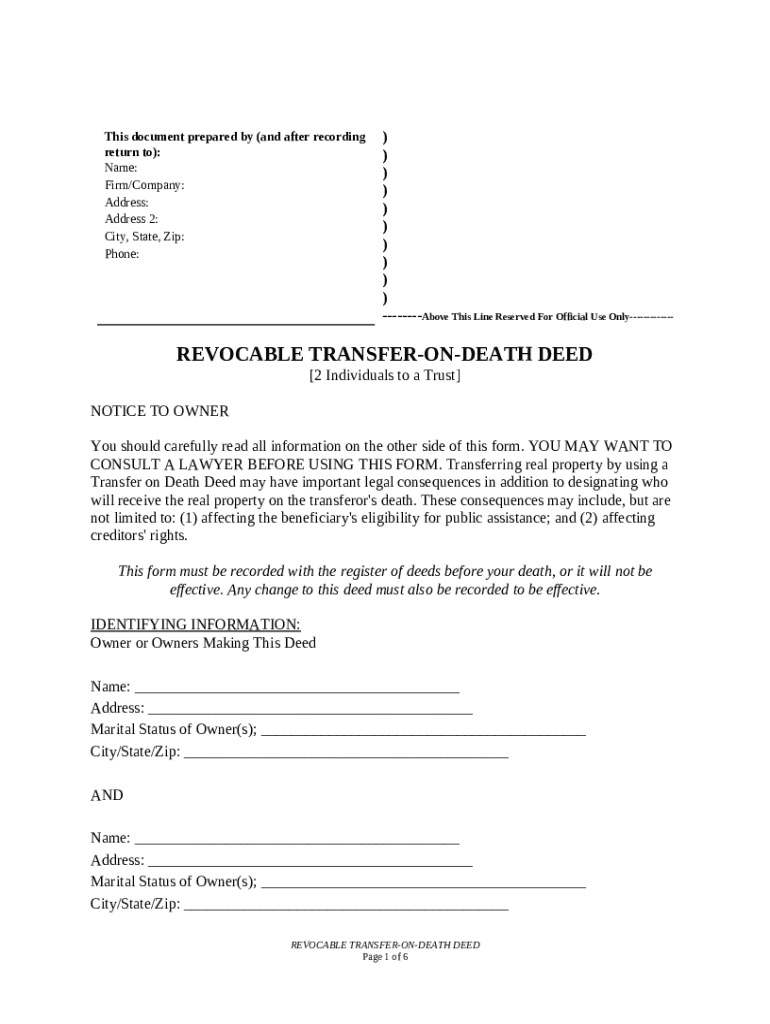

What is transfer on death deed

A transfer on death deed is a legal document that allows an individual to transfer ownership of real property to a beneficiary upon their death without going through probate.

pdfFiller scores top ratings on review platforms

This program is very useful for filling out tax forms. Although my returns are not complicated, getting the credit that I am due for foreign taxes is too much for tax programs like HR Block and too much for most accountants. I have returned to my old habit of doing my returns manually. This PDFfiller program makes it feasible.

Fantastic website for filling in any application!

Perfect for our company needs!! Easy to use and user friendly!!

I have just started using it, but so far, so good!

I thought it was easy to use PDFfiller and I would recommend it to my family and friends. What would have taken me hrs. to do only took minutes.

It was confusing at first, but now its super easy to do!

Who needs transfer on death deed?

Explore how professionals across industries use pdfFiller.

How to fill out the transfer on death deed

-

1.Open the PDF form of the Transfer on Death Deed.

-

2.Begin by entering the names of the property owner(s) at the top of the document.

-

3.Fill in the legal description of the property; this can usually be found on the property deed.

-

4.Next, designate the beneficiary or beneficiaries who will receive the property upon your death by writing their full names.

-

5.If there are multiple beneficiaries, indicate how the property will be divided among them.

-

6.Include your signature and the date in the designated areas at the bottom of the document.

-

7.Some jurisdictions may require a witness signature or notarization, so check local laws accordingly.

-

8.Finally, ensure that the completed form is filed with the appropriate local recording office to be valid.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.