Last updated on Feb 17, 2026

Get the free Tennessee Charter of Incorporation for Domestic For-Profit Corporation

Show details

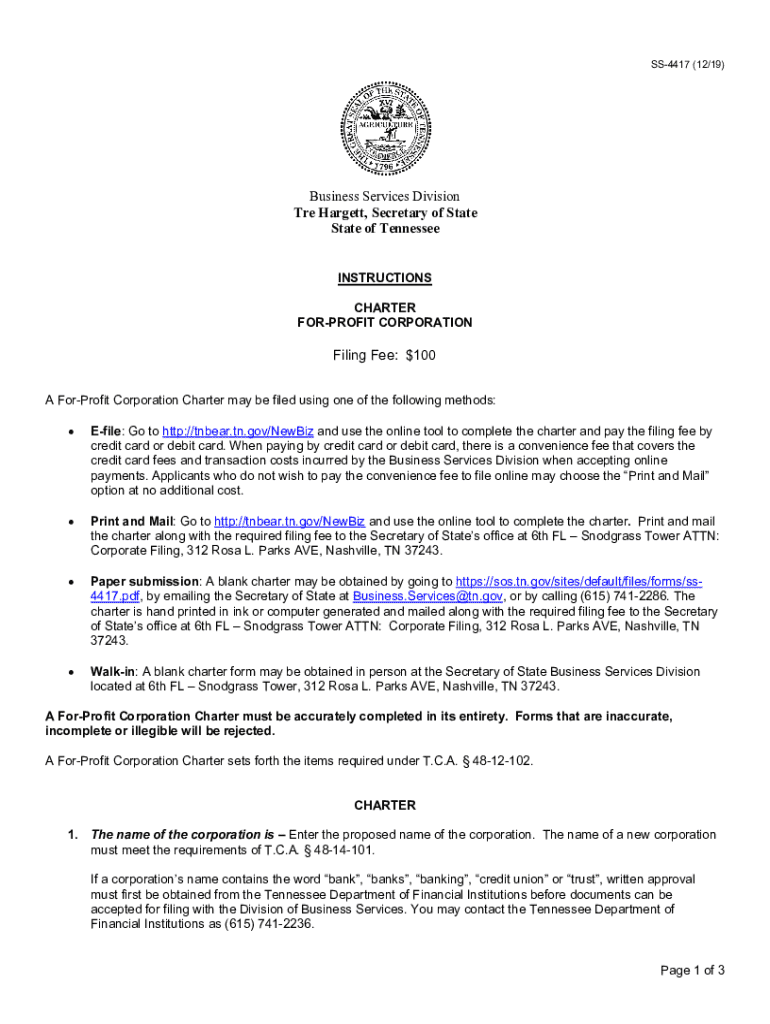

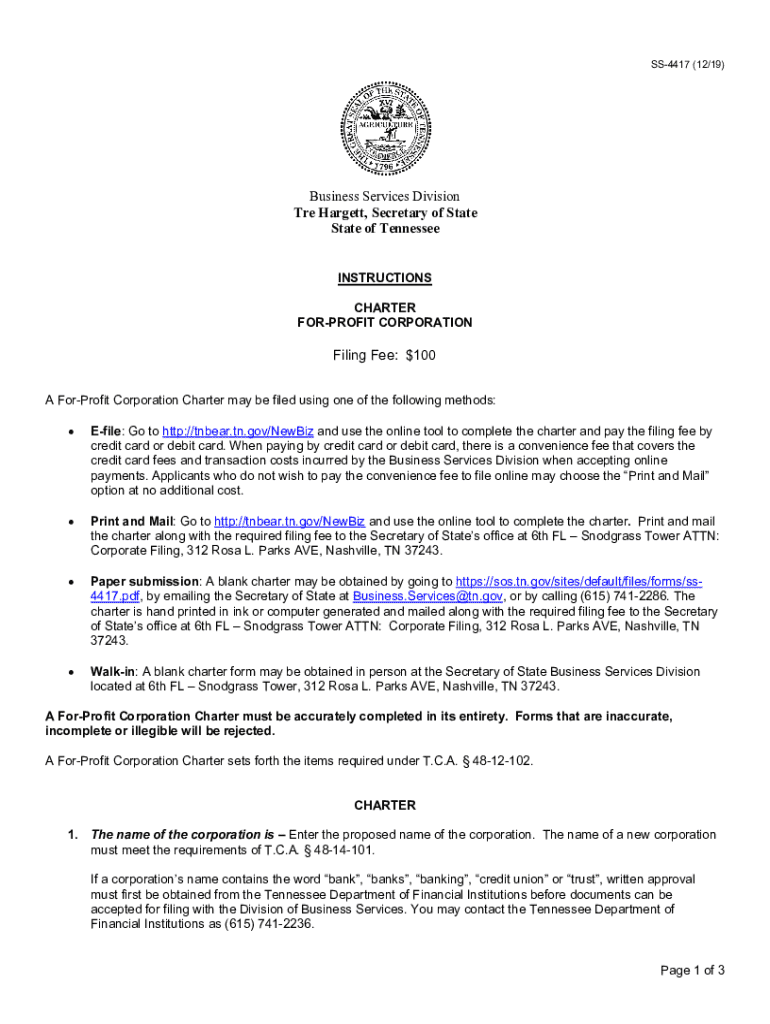

This state-specific form must be filed with the appropriate state agency in compliance with state law in order to create a new corporation. The form contains basic information concerning the corporation,

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is tennessee charter of incorporation

The Tennessee Charter of Incorporation is a legal document that establishes a corporation in the state of Tennessee.

pdfFiller scores top ratings on review platforms

I had a very important document to sign and send at midnight one night and PDFfiller was recommended as a possible avenue. It was so easy to set up and even easier to use. I've used it a number of times since.

It's great to find the forms I need. Sometimes the documents are a little hard to manipulate.

HELPED ME IN AN EMERGENCY WITH MY CLASS WORK.. LOVE IT!!!

It was easy to use, my one complaint would be exporting one document at a time was time consuming. Wish I could have selected all documents to export one time.

So good so far. I hope billing doesn't become an issue because this is a good product.

a little confusing but I think it will be useful for my docs

Who needs tennessee charter of incorporation?

Explore how professionals across industries use pdfFiller.

How to fill out a Tennessee charter of incorporation form

Understanding Tennessee's charter of incorporation

Incorporating a business in Tennessee requires filling out a charter of incorporation form. This document serves as the foundational paper that legally creates your for-profit corporation in the state.

-

The charter outlines the essential information about your corporation, including its name, purpose, and structure. It essentially acts as your business’s birth certificate.

-

Incorporation provides a layer of legal protection for your personal assets against business liabilities. Moreover, it also helps your business gain credibility with customers and partners.

-

Registered corporations can take advantage of tax benefits, attract investors more easily, and establish a clearly defined business structure.

How can you file for a for-profit corporation charter?

Tennessee offers multiple methods for filing your charter of incorporation form, ensuring flexibility depending on your needs.

-

This method allows for speedy processing of your application through the state’s online portal.

-

If you prefer traditional methods, you can print your completed application and mail it directly to the Secretary of State.

-

You can also request a physical charter form, complete it by hand, and submit it through mail.

How do you e-file your charter with pdfFiller?

E-filing is the most efficient way to file your charter. With pdfFiller, you can complete the online form easily.

-

Visit the provided link to access Tennessee's online business registration portal.

-

Follow the provided prompts to enter your corporation details correctly.

-

When e-filing, be aware of the convenience fees associated with online payments.

What is the print and mail filing process?

Some people prefer the print and mail approach for physical documentation. Here's how to navigate this method.

-

You can design your application through the online tool, then print it out.

-

Ensure you gather all necessary documents and calculate the filing fees before submission.

-

Your completed application must be mailed to the correct address of the Secretary of State's office.

What are the paper submission instructions?

For those opting for traditional paper submission, follow these essential steps.

-

You can download a blank form from the state’s website or request one to be mailed to you.

-

Pay attention to the guidelines, ensuring all necessary information is filled in correctly.

-

Include the right filing fee and address your envelope correctly to avoid delays.

How can you submit in person at the Secretary of State office?

If you're in Nashville, consider walk-in submissions for immediate processing of your charter.

-

The division's location is accessible through the state’s business registry information.

-

Ensure you have all required documents and your completed form to facilitate a swift process.

-

Immediate feedback and the possibility of avoiding postal delay are significant advantages of walk-in submissions.

How to avoid common mistakes when filing?

Understanding common mistakes can save you time and headaches during the incorporation process.

-

Incomplete forms, incorrect filing fees, and missing signatures are frequent pitfalls.

How can pdfFiller assist in document management?

pdfFiller's features streamline document management, making it easier than ever to handle essential forms.

-

Modify your documents quickly using pdfFiller's editing tools.

-

Facilitate easy collaboration with eSign options that allow various parties to sign documents.

-

Keep tabs on document progress and manage your files efficiently from anywhere.

How to fill out the tennessee charter of incorporation

-

1.Begin by obtaining the Tennessee Charter of Incorporation form from the state’s business registration website or through pdfFiller.

-

2.Open the form in pdfFiller, ensuring you have a stable internet connection for seamless access.

-

3.Fill in the corporation's name at the top of the document, ensuring it complies with Tennessee naming laws.

-

4.Provide the principal office address of the corporation, including city, state, and ZIP code.

-

5.Indicate the purpose of the corporation clearly, stating its business objectives in a brief manner.

-

6.List the name and address of the registered agent who will accept service of process on behalf of the corporation.

-

7.Fill in the details of the incorporators, including their names and addresses, usually at least one incorporator is required.

-

8.Review all filled details for accuracy and completeness before proceeding to the next step.

-

9.Sign and date the document where indicated, ensuring that the signatures are provided by the incorporators.

-

10.Submit the completed form along with the required filing fee to the Tennessee Secretary of State, either online or by mail.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.