Get the free Transfer on Death Deed or TOD - Beneficiary Deed for Individual to Individual template

Show details

This deed is used to transfer the ownership or title of a parcel of land, attaching any existing covenants, upon the death of the Grantor to the Grantee. It does not transfer any present ownership

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is transfer on death deed

A transfer on death deed is a legal document that allows an individual to designate beneficiaries to receive their property upon their death, avoiding probate.

pdfFiller scores top ratings on review platforms

I like the service just wish the process of saving and/or printing docs wasn't as cumbersome - two or three pop up windows before action is completed and not automatically redirected to doc list.

Still new to the site but as of now it has been great. Very user friendly and very well designed. Definitely a professional look for my business.

The experience has been good overall. Thank you. Getting the hang of things . Will contact support if i need.

I only have one contract to fill out as a real estate agent...My contracts are months apart so only need one month of service. after the learning curve this program is fairly easy to finish my needs....

It's great, aside from it being a littele tricky to fill in the text boxes

Its's great for insurance form preparation for our office.

Who needs transfer on death deed?

Explore how professionals across industries use pdfFiller.

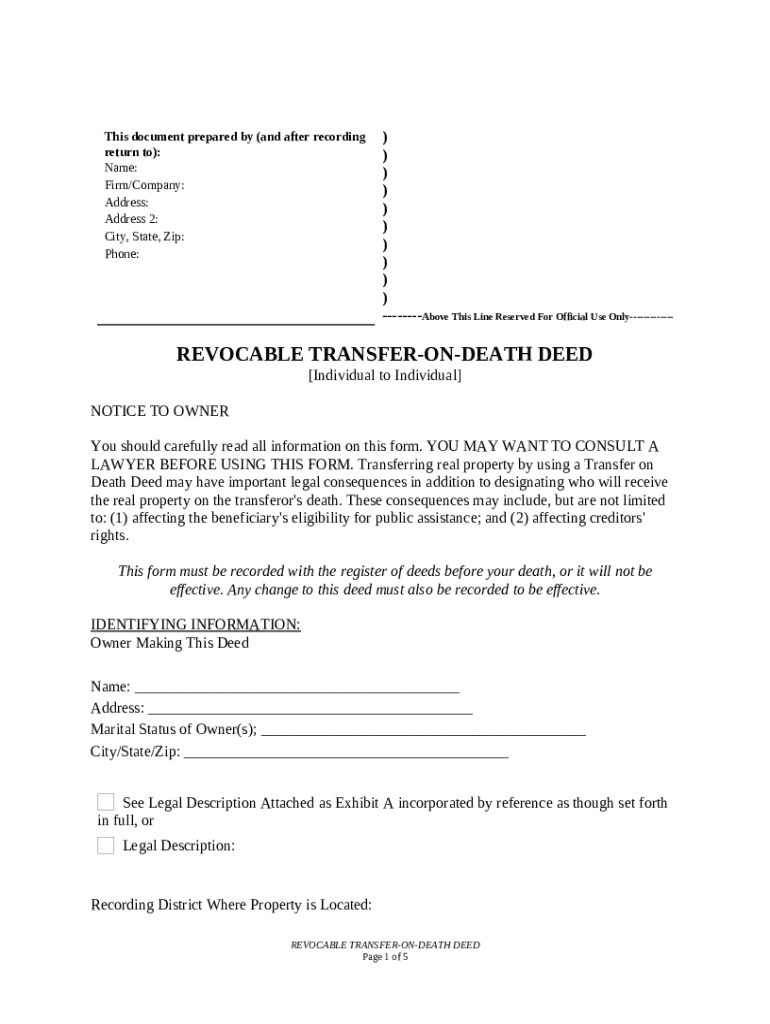

Comprehensive Guide to Transfer on Death Deed Form on pdfFiller

Transferring property after one’s death can be complex and emotional. A transfer on death deed form simplifies this process, allowing property to be transferred directly to a named beneficiary upon the owner's death, avoiding probate.

What is a transfer on death deed?

A Transfer on Death (TOD) Deed is a legal document that enables property owners to designate a beneficiary who will inherit their property directly after their death. The primary purpose of a TOD deed is to ensure a smooth transfer of real property to loved ones without the need for probate, streamlining the estate planning process.

-

Constructs a bridge between ownership and inheritance, making it easier for the beneficiary to claim the property.

-

Minimizes delays and costs associated with probate, providing peace of mind for property owners and financial security for their heirs.

-

Transfers property rights effectively, but can affect public assistance eligibility and creditors’ rights.

How should you prepare before completing the form?

Before filling out the transfer on death deed form, consulting with a legal expert is highly advisable. Understanding the specifics of your situation ensures that your estate planning aligns with your overall financial goals and protection of assets.

-

Seek an expert’s opinion to evaluate your unique circumstances, especially regarding rights of beneficiaries.

-

Ensure you comply with state laws concerning ownership and beneficiary conditions applicable to a TOD deed.

-

Consider how designating heirs may affect access to public assistance and creditor claims.

How do you fill out the transfer on death deed form?

Completing the transfer on death deed form involves specific details that must be accurately filled out for it to be legally binding. Below are the essential steps.

Identifying information

-

Include the full legal name and residential address of the property owner.

-

Indicate whether the owner is single, married, or divorced, as this can impact property rights.

-

Attach a detailed description of the property as Appendix A to the deed.

Beneficiary information

-

Clearly specify the name and contact details of the primary beneficiary.

-

Option to list alternate beneficiaries in case the primary beneficiary predeceases the owner.

-

Explain this rule, which states typically that beneficiaries must survive the owner to inherit.

How do you record the form?

-

Instructions on how and where to submit your completed TOD deed for recording.

-

Verify specific recording requirements in each county where the property is located.

-

Failure to correctly record the deed could nullify its efficacy upon death.

What if you need to modify or revoke the deed?

-

Outlines the process for making legal adjustments to an existing TOD deed.

-

Guidance on how to legally revoke an earlier TOD deed to avoid confusion.

-

Always keep documentation of any changes made for accurate record keeping.

How can you manage your transfer on death deed using pdfFiller?

PdfFiller provides an intuitive platform for managing your TOD deed. Users can leverage powerful tools for editing, signing, and sharing documents securely.

-

Easily adjust your TOD deed with our user-friendly editing tools and eSign features.

-

Work with multiple beneficiaries or advisors for comprehensive estate planning.

-

Access your documents anywhere, anytime, ensuring you stay organized.

What are the final steps after completing your TOD deed?

After successfully recording your TOD deed, there are essential actions to take to ensure effective communication and compliance with legal changes. Keeping beneficiaries informed is crucial.

-

Confirm that the recorded deed is accessible to your beneficiaries and that they understand its implications.

-

Communicate clearly with your beneficiaries about their rights and what steps they need to take after your death.

-

Stay informed about any changes in state laws regarding TOD deeds that might affect your planning.

How to fill out the transfer on death deed

-

1.Access the document template on pdfFiller by searching for 'transfer on death deed'.

-

2.Fill in your name as the granter and the names of the beneficiaries you wish to designate.

-

3.Include a legal description of the property being transferred, which can be found on your property deed or tax statement.

-

4.Make sure to clearly state whether you wish to maintain the rights to the property during your lifetime.

-

5.Review the form for accuracy and completeness before submission.

-

6.Sign the document in the presence of a notary public to ensure it is legally binding.

-

7.File the completed transfer on death deed with your local county recorder's office to make it effective.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.