Get the free Revocation of Transfer on Death Deed - Beneficiary Deed for Two Grantors template

Show details

This is a form is used to revoke a transfer on death or beneficiary deed. It must be executed before the death of the owner who executes the revocation and recorded in the office of the county recorder

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is revocation of transfer on

Revocation of transfer on is a legal document used to cancel a previous transfer of property or rights.

pdfFiller scores top ratings on review platforms

very pleasant

Fast and reliable

Great experience! Lots of helpful tools!

Everything i need in one place. I love it! I especially like that i can fill out these forms from my desktop.

Their customer service is great! And they didn't hesitate to refund my money and give me another option that would meet my needs!

Their customer service is great! And they didn't hesitate to refund my money and give me another option that would meet my needs!

Who needs revocation of transfer on?

Explore how professionals across industries use pdfFiller.

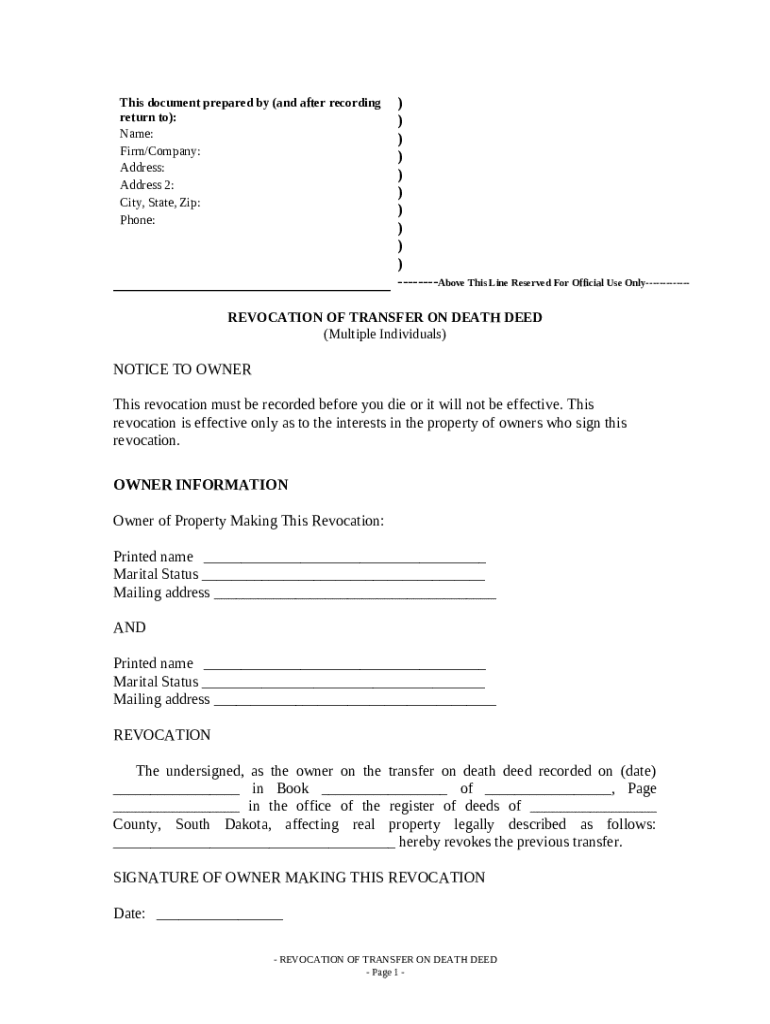

Detailed Guide on the Revocation of Transfer on Death Deed

This guide provides key insights on how to navigate the revocation of a transfer on death deed form effectively, ensuring that property ownership and beneficiary designations are accurately managed.

What is the revocation of a transfer on death deed?

A transfer on death deed (TOD deed) allows property owners to designate beneficiaries to inherit their real estate upon their death without going through probate. Revoking such a deed entails formally cancelling the designated transfers to ensure the property is not passed on as previously intended.

-

This deed serves to facilitate smoother property transfers after the property owner's death, bypassing the lengthy probate process.

-

Understanding why and when to revoke a TOD deed is crucial, especially during changes in estate plans or beneficiary designations.

-

Revocation alters the intended outcome of property transfer, necessitating proper legal procedures to avoid disputes.

Who needs to consider revocation?

-

Partners or co-owners may need to revoke a TOD deed if their ownership status or roles change.

-

New circumstances like marriage or divorce could warrant revising beneficiaries listed in the deed.

-

Changes in marital status may lead couples to revoke and update TOD deeds to reflect new intentions.

What are the prerequisites for revocation?

-

Confirming the status of ownership ensures that the right information is presented in the revocation process.

-

Select the correct form based on state requirements, which might differ significantly.

-

In many jurisdictions, a notary's signature is required for the revocation form to be legally binding.

How to file a revocation?

-

Gather all relevant details about the property, including titles and existing TOD deeds.

-

Accuracy in filling out the form is vital to prevent future disputes or delays.

-

Submit the completed form to the appropriate county office to officially nullify the deed.

-

Review state-specific regulations regarding deed revocations to ensure compliance.

What interactive tools are available for managing your forms?

-

Leverage powerful editing features to customize forms easily and ensure all needed information is captured.

-

Utilize electronic signing tools for a swift and secure signing process.

-

Work with team members in real-time to manage documents for various properties efficiently.

What are the key elements of the revocation form?

-

Correctly filling in the owner's details ensures that the document accurately represents the property right holder.

-

Ensuring all signatures are valid is imperative for the document’s enforceability.

-

Providing necessary notary information according to state laws guarantees legal validity.

What are the common mistakes to avoid during revocation?

-

Delay in filing the revocation can lead to complications if the property owner passes away before it is officially documented.

-

Mistakes in filling out the form can render it ineffective, leading to potential legal disputes.

-

It’s vital to communicate updates in beneficiary designations to all parties involved.

What are the post-revocation steps?

-

Verify that the revocation has been properly recorded in the county records.

-

Communication is key; inform all relevant parties about the revocation to avoid confusion.

-

Remove or amend related documents to reflect the changes in property transfer intentions.

What clarity exists on legal compliance and state regulations?

-

Virginia provides specific statutes detailing the processes governing deed revocation which must be adhered to.

-

This code delineates the legal process and requirements for revoking transfer on death deeds.

-

Different states may have unique deadlines and rules regarding revocation, necessitating careful review.

How to fill out the revocation of transfer on

-

1.Open pdfFiller and upload the 'revocation of transfer on' form.

-

2.Begin by entering the date at the top of the document.

-

3.Provide your full name and current address in the designated fields.

-

4.Identify the original transfer by including details such as the date of transfer and involved parties.

-

5.Clearly state your intention to revoke the transfer in the appropriate section.

-

6.Sign and date the document at the bottom where indicated.

-

7.If required, have the document notarized to validate your signature.

-

8.Download or save the completed document in your preferred format.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.