Get the free Promissory Note - Horse Equine s template

Show details

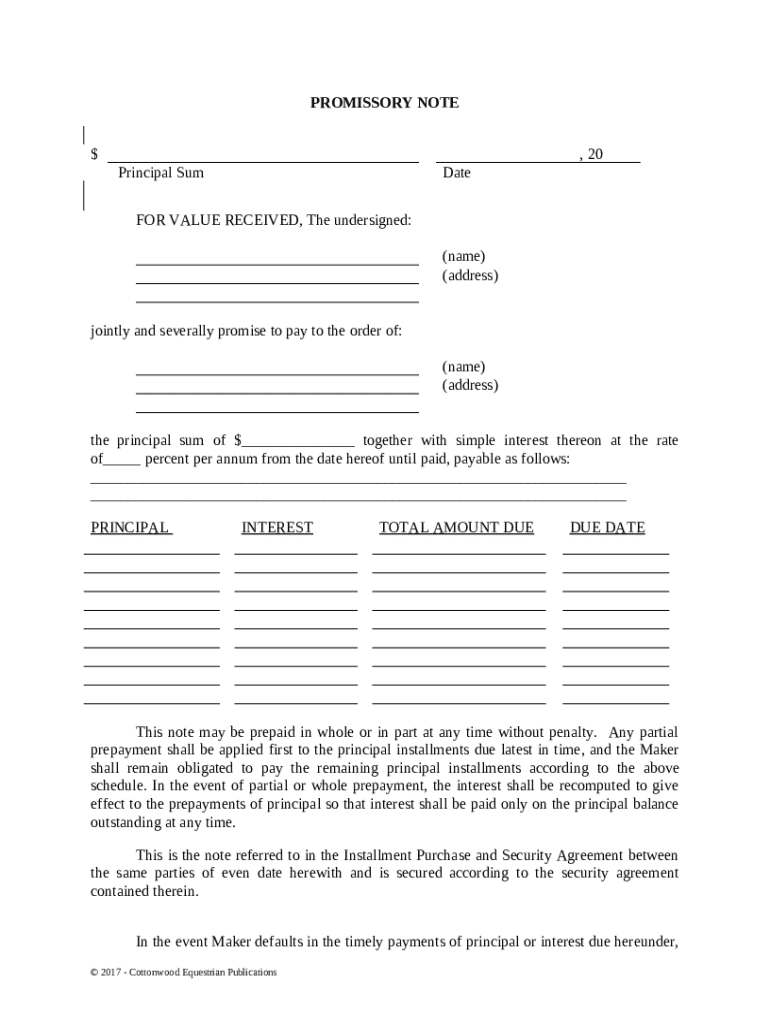

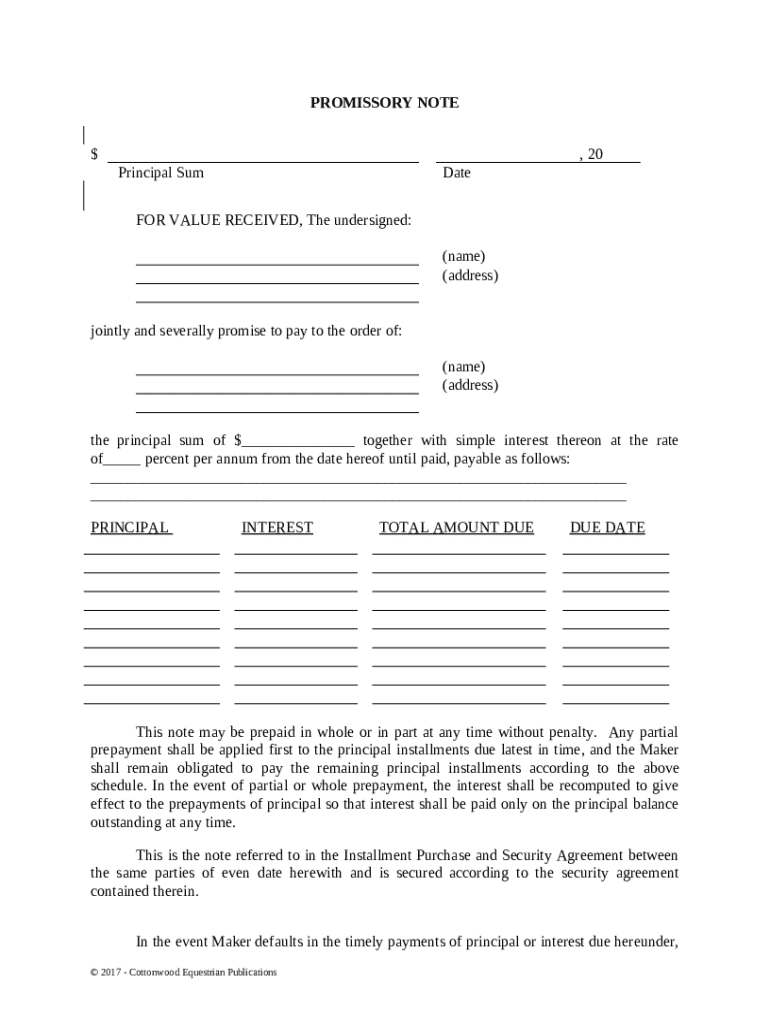

This is a promissory note for use in connection with the sale and purchase of a horse where financing is involved. It is a simple interest note that may be used in conjunction with an Installment

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is promissory note - horse

A promissory note for a horse is a written promise to pay a specified amount for the purchase of a horse under agreed-upon terms.

pdfFiller scores top ratings on review platforms

It was my first time uploading forms. It was pretty easy. I think the more I use it the better.

I have tried many different PDF fillable forms... this one, BY FAR, is the easiest to use and I LOVE IT!

Very user friendly and looks like a very good lease form

Easy! But it's not free to use just to fill!

Really love the ease of filling out electronic forms with your website! What a difference it makes!

i loved this. i was confused though at first about whether i could use a free trial or if i would be charged. i would recommend highlighting the free trial offer upfront to get more people to use this great product.

Who needs promissory note - horse?

Explore how professionals across industries use pdfFiller.

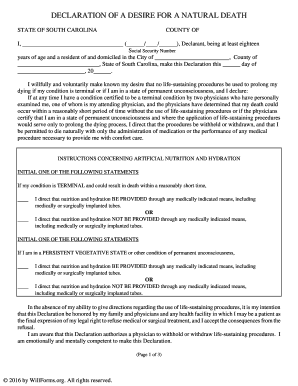

Comprehensive Guide to Creating a Promissory Note

What is a promissory note?

A promissory note is a financial instrument that serves as a written, unconditional promise to pay a specified amount of money to a designated party at a fixed or determinable future time. It typically includes crucial terms such as loan amount, interest rate, and payment schedule, making it essential for any lending or borrowing transaction.

-

Principal refers to the initial amount of money loaned, which must be repaid. Understanding this amount is crucial as it constitutes the core of all borrowing agreements.

-

The interest rate determines the cost of borrowing. Setting an accurate rate is key to both parties agreeing on the terms.

-

Incorrect details in a promissory note can lead to legal disputes or confusion. Hence, standard practice involves double-checking all information.

How do fill out a promissory note: Step-by-step instructions

Filling out your promissory note correctly is critical to ensuring that all parties are clear about the loan terms. Here’s a step-by-step guide to help you through the process.

-

Determine how much money you are borrowing by reviewing your financial needs. This amount should be clearly stated in the note.

-

Selecting an interest rate that reflects market conditions and the risk level involved in your arrangement is essential.

-

Clearly define the 'Maker' (the borrower) and the 'Payee' (the lender) in your promissory note, ensuring accurate contact information is included.

-

Clearly outline the payment schedule, including due dates and installment amounts to avoid miscommunication later.

How to edit and customize your promissory note using pdfFiller

Customizing your promissory note can enhance its precision and address unique needs. Using a cloud-based platform like pdfFiller allows you to easily make edits and share your document securely.

-

Simply log in to pdfFiller from any device to start editing your document immediately, making changes wherever needed.

-

Take advantage of the wide range of editing tools provided by pdfFiller for personalizing your document with ease.

-

Share your promissory note with your team for input and approval, which allows for a more collaborative document management experience.

What are the compliance and legal considerations should know?

Legal compliance is vital when creating a promissory note. Understanding your obligations under the law can prevent costly mistakes.

-

Ensure you know how security agreements work, particularly if collateral is involved, impacting the enforceability of your note.

-

Discuss the legal consequences that arise if a borrower defaults on their payments. This could involve legal action or loss of collateral.

-

Consider including flexible terms for early payment without penalties. This can attract lenders or borrowers with changing financial needs.

How do finalize my promissory note?

Finalizing your promissory note is critical for its validity. Make sure to include all necessary signatures to ensure it is legally binding.

-

Electronic signatures can expedite the signing process while ensuring a secure and verifiable agreement between parties.

-

You can easily add signatures using pdfFiller, ensuring all required parties have signed before finalization.

-

After signing, utilize pdfFiller to store and share your completed promissory note securely with all parties involved.

How can navigate pdfFiller tools for document management?

pdfFiller is equipped with a variety of tools that facilitate smooth document management. Understanding these can greatly improve your experience.

-

Explore options like editing, eSigning, and collaboration that can cater to all your document needs.

-

Reduce time spent on document creation by utilizing templates, which can help standardize your business agreements.

-

Keep track of changes made to your promissory note, ensuring that all amendments are documented and easily viewable.

How to fill out the promissory note - horse

-

1.Open the promissory note template on pdfFiller.

-

2.Begin by entering the date at the top of the document.

-

3.Fill in the borrower's full name and address in the designated fields.

-

4.Next, input the lender's name and address.

-

5.Specify the amount being borrowed in the appropriate box.

-

6.Detail the interest rate, if applicable, and ensure it's stated clearly.

-

7.Outline the payment schedule, including due dates for payments and any late fees.

-

8.Include a description of the horse being financed, including breed, age, and any registration numbers.

-

9.Provide a space for both parties to sign and date the document to formalize the agreement.

-

10.Review all entered information for accuracy before saving or printing the completed form.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.