Get the free Defendant Surety Bond template

Show details

Defendant's Bond paid by Surety Company.

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is defendant surety bond

A defendant surety bond is a financial guarantee provided by a third party (the surety) to ensure that a defendant will appear in court for their trial and comply with the court's orders.

pdfFiller scores top ratings on review platforms

SO FAR SO GOOD I WOULD LIKE TO GET INTO THE SHARING PORTION MORE, BUT SO FAR IT IS MEETING MY EXPECTATIONS!!!

It is very helpful when using forms that I don't have a template for.

Initial problem was apparently that I had failed to save the (almost) completed form that I had made, and when I went bace to it, only the original blank form was available. I see the error of my way. Quite interested in learning lots more about program and the ways it couod be useful to me.

Great app! Easy,Intuitive and Productive!

very responsive and prompt with chat answers.

Very good customer services prior 1st day of using service.

Who needs defendant surety bond template?

Explore how professionals across industries use pdfFiller.

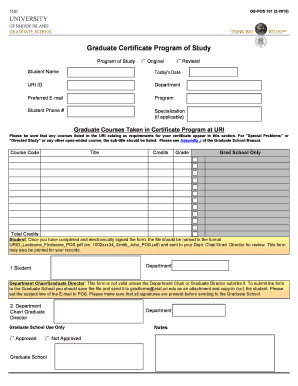

How to complete a defendant surety bond form

What is a defendant surety bond?

A defendant surety bond is a legal document that ensures a defendant will appear in court for their scheduled hearings. This form involves a three-party agreement among the court (obligee), the defendant (principal), and the surety who guarantees the bond. The bond serves as a financial guarantee that the defendant will fulfill their obligations, helping to secure their release while awaiting trial.

Why is the defendant surety bond important?

The defendant surety bond is crucial in the legal process as it provides a mechanism for ensuring the defendant’s appearance in court. If the defendant fails to comply with court requirements, the surety pays the bond amount, protecting public interest. This bond helps maintain accountability and supports the judicial system's integrity.

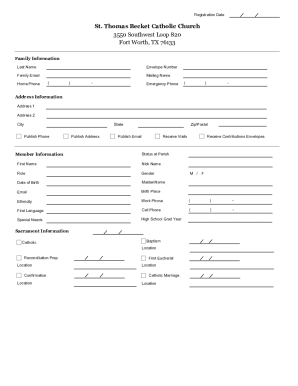

Who are the key parties involved?

-

The principal is the defendant who is required to secure the bond to be released from custody.

-

The surety is an individual or company that provides the bond, guaranteeing the principal's compliance with court obligations.

-

The obligee is typically the court that requires the bond, ensuring that the terms of release are fulfilled.

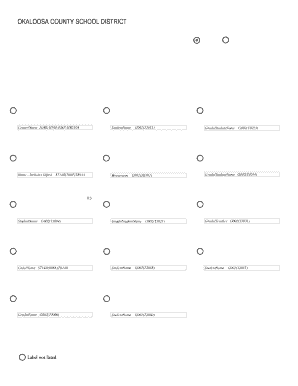

What are the key components of the form?

-

The cause number is essential for identifying the legal case associated with the bond.

-

Different states have unique requirements; for instance, Texas has specific regulations that must be adhered to.

-

The penal sum is the financial amount of the bond, outlining the obligations of the surety in case of non-compliance.

-

Sureties must be aware of financial responsibilities for re-arrest payments if the principal fails to appear in court.

How to fill out the defendant surety bond form?

Filling out the defendant surety bond form can appear complex, but a structured approach simplifies the process. Begin by reviewing the form to understand its requirements, then follow a step-by-step guide.

-

1. Gather all necessary information about the principal and surety. 2. Fill in the cause number and relevant information.

-

Ensure you provide complete details of the principal, surety, and obligations.

-

Avoid mistakes like leaving fields blank or misrepresenting information.

-

Consider using pdfFiller for a seamless process of creating and editing your bond form.

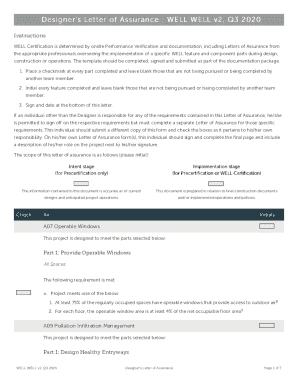

What are the legal requirements?

Legal requirements vary by jurisdiction. In Texas, for instance, local regulations dictate specific bonding procedures and penalties for non-compliance. Ensuring accuracy in the submission of the bond form is crucial to avoid legal repercussions.

What alternative forms are related to surety bonds?

-

These forms are commonly used and provide a uniform way of documenting bail agreements.

-

Many counties require unique forms to meet specific local regulations.

-

Consider using alternate forms depending on case specifics or if the principal resides in another state.

-

Providing access to Spanish forms increases accessibility for non-English speakers.

What happens after submitting the form?

After submitting the bond form, expect to receive instructions regarding court appearances. The principal is responsible for attending all scheduled hearings. Failure to comply can have serious consequences, including forfeiture of the bond amount.

How can use pdfFiller for document management?

Using pdfFiller provides numerous benefits as a cloud-based document platform, allowing for efficient document management. Its collaborative features are ideal for teams needing to work together, while eSigning enhances the signing process.

How to fill out the defendant surety bond template

-

1.Open the PDF template for the defendant surety bond.

-

2.Enter the name of the defendant in the designated field.

-

3.Input the case number and court details as required by the form.

-

4.Fill in the amount of the bond, usually determined by the court.

-

5.Provide the name and details of the surety company that is backing the bond.

-

6.Include any other necessary identifying information for the parties involved in the bond.

-

7.Review all entered information for accuracy and completeness.

-

8.Sign the document where indicated by the defendant and the surety representative.

-

9.Submit the completed bond to the appropriate court or legal entity, following local procedures.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.