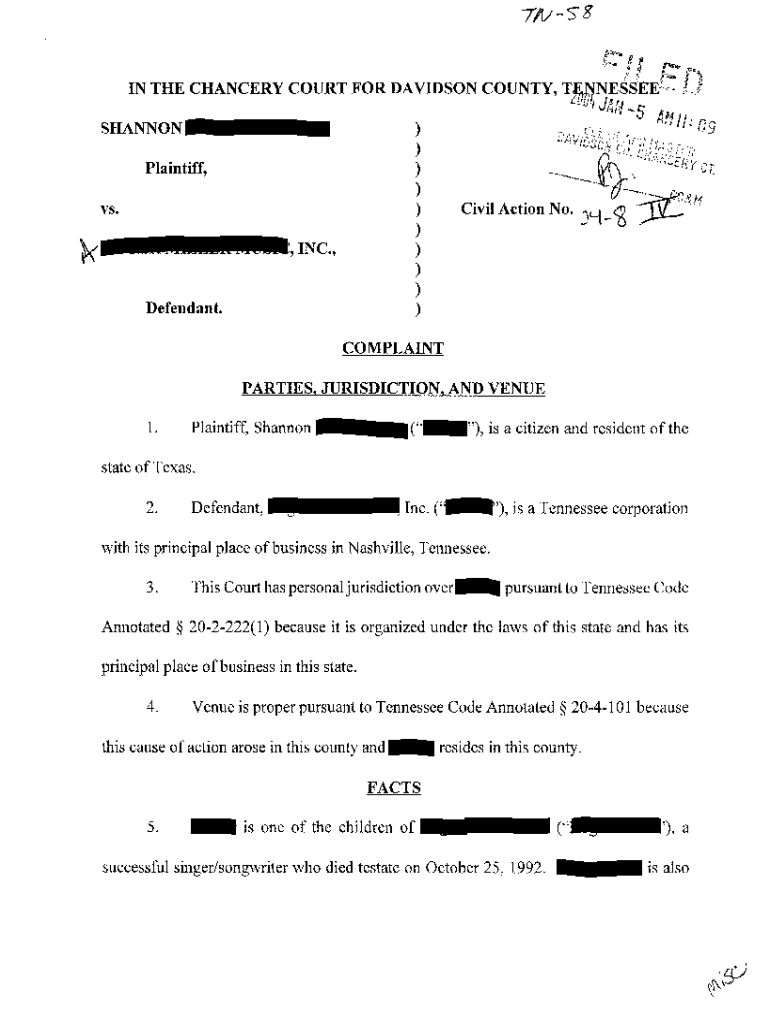

Get the free A01 Complaint to Collect Royalties Under Copyright

Show details

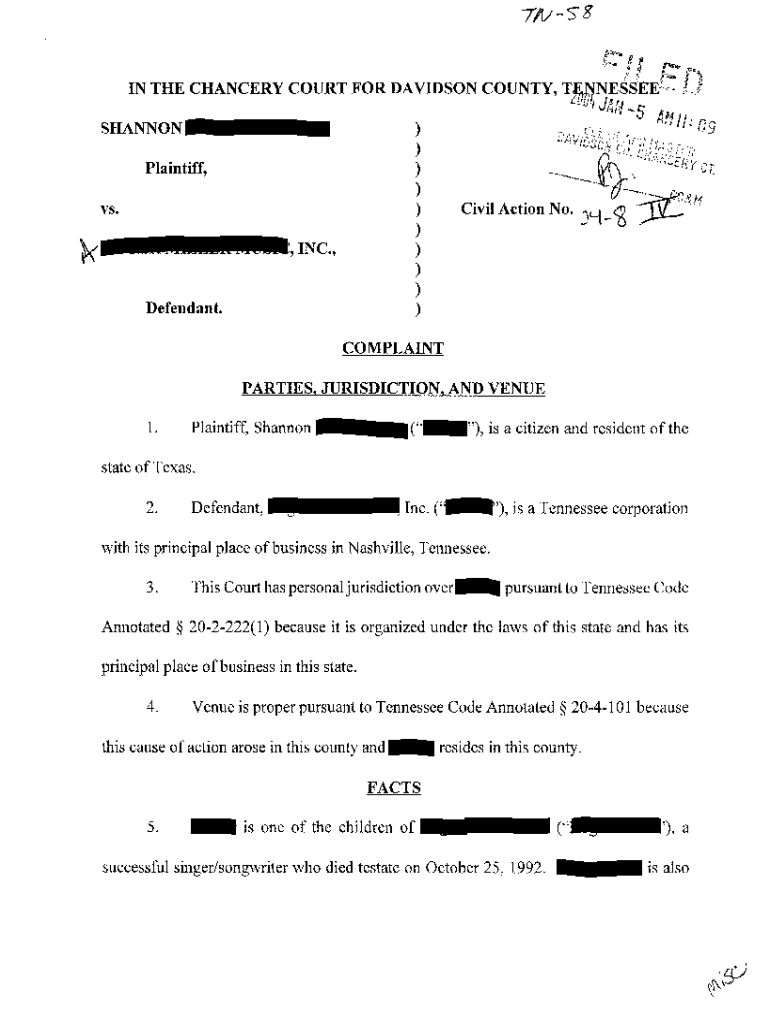

A01 Complaint to Collect Royalties Under Copyright

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is a01 complaint to collect

An A01 complaint to collect is a legal document filed by a creditor to initiate the collection of a debt owed by a debtor.

pdfFiller scores top ratings on review platforms

Exceptionally great and intuitive tool for PDF management. Thank you so much.

At the first, i had some problems with using the application but later on, I learned how to use it, still, I need further study to be more familiar with it

good job

It was very helpful in editing PDF, saves a ton of manual works

GREAT AND FRUSTRATED DUE TO MY LACK O EDUCATION BUT IM LEARNING HOW TO USE THIS SITE N I LOVE IT!

Easy to do and send

Who needs a01 complaint to collect?

Explore how professionals across industries use pdfFiller.

Guide to 'A01 Complaint to Collect Form' on pdfFiller

Filling out an A01 Complaint to Collect Form is crucial for anyone looking to initiate a formal complaint process and ensure their issues are addressed by the appropriate authorities. This guide will walk you through every step needed to effectively complete the form using pdfFiller, a powerful tool that helps streamline document management.

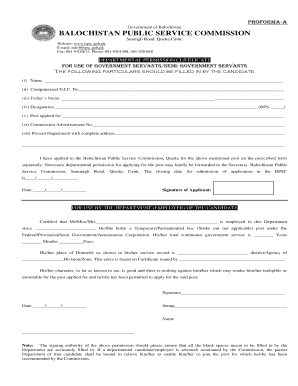

What is the A01 Complaint to Collect Form?

The A01 Complaint to Collect Form is a legal document used by individuals or entities to formally submit a complaint regarding issues related to debt collection. Understanding the purpose of this form is essential for ensuring your complaint is considered valid. It is particularly important for those who believe they are being wronged by a debt collector.

-

The A01 Complaint serves as a formal request to investigate the practices of a debt collector.

-

Anyone who feels they have been treated unfairly in the context of debt collection can file this form.

-

Completing the form accurately is critical; inaccuracies can lead to delays or rejection of your complaint.

Who is eligible to file the A01 Complaint?

Filing the A01 Complaint requires certain eligibility criteria to be met, ensuring that the complaints are valid and actionable. Individuals must demonstrate that they have been subject to practices outlined in the complaints regulations.

-

Individuals or teams who have experienced deceptive practices can file the complaint.

-

Supporting documents, such as letters from the debt collector, are necessary.

-

Eligibility may vary by state, so checking local regulations is crucial.

How can you complete the A01 Complaint to Collect Form?

Completing the A01 Complaint requires careful attention to detail, but breaking down the process into manageable steps makes it easier.

-

Collect all relevant details such as personal info, complaint specifics, and supporting documents.

-

Focus on important sections to fill out: Personal Information, Description of the complaint, and uploads.

-

Take advantage of pdfFiller’s features for efficient form filling.

Can you edit and customize the A01 Complaint Form?

Editing the A01 Complaint Form using pdfFiller's tools is simple and effective, allowing users to tailor the document to their needs. It’s important to comply with legal standards while ensuring clarity and professionalism.

-

Use pdfFiller to modify text, images, and layout within the PDF.

-

Insert notes, comments, or signatures where needed.

-

Always ensure your edits meet legal guidelines.

How to manage your A01 Complaint to Collect Form documents?

Properly managing your completed A01 Complaint documents is essential for following up and ensuring your complaint is addressed promptly.

-

Utilize pdfFiller's storage options for easy access to your completed forms.

-

Email your form directly or share through cloud services.

-

Use version control to keep track of modifications made to the document.

What is the filing process after completing your A01 Complaint Form?

Once you’ve finished filling out the A01 Complaint Form, the next step is to submit it to the appropriate authority. Knowing where and when to file can significantly impact the outcome of your complaint.

-

Identify where to send your complaint, typically to a state agency or consumer protection office.

-

Be aware of submission timelines to ensure your complaint is not dismissed due to lateness.

-

After submission, check the status of your complaint in a timely manner.

What common issues arise with the A01 Complaint Form?

While filling out the A01 Complaint Form, users may encounter issues that can impede their progress. Being aware of common pitfalls can help streamline the process.

-

Issues such as mismatched information or incomplete fields are frequent.

-

pdfFiller offers tools to correct mistakes efficiently.

-

If problems persist, reaching out to pdfFiller's customer support is advisable.

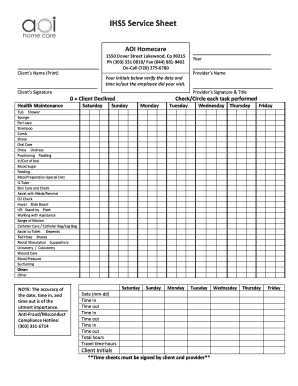

How to fill out the a01 complaint to collect

-

1.Open the PDF filler application.

-

2.Locate the A01 complaint to collect template.

-

3.Review the instructions provided at the top of the template.

-

4.Fill in the plaintiff's information, including name and contact details.

-

5.Enter the defendant's information accurately as required.

-

6.Provide a concise description of the debt, including amount and basis for the claim.

-

7.Attach any required supporting documents or evidence of the debt owed.

-

8.Review the completed form for accuracy and make necessary corrections.

-

9.Sign the document where indicated.

-

10.Save the document and, if necessary, print copies for filing in court.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.