Get the free Inter Vivos Trust

Show details

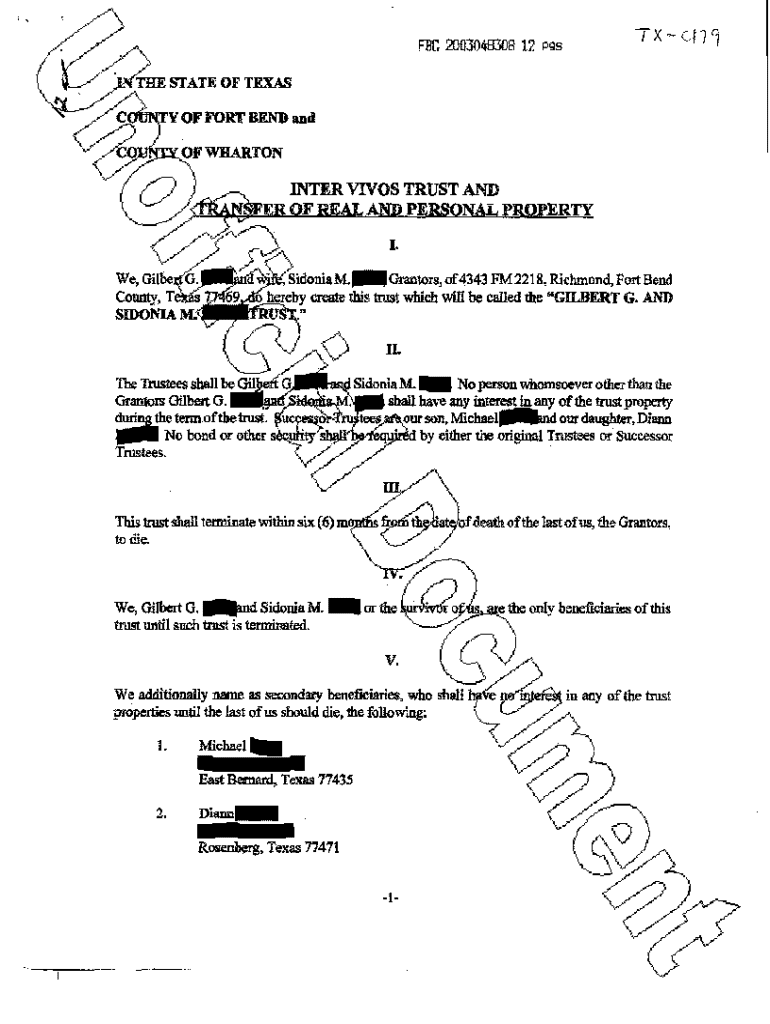

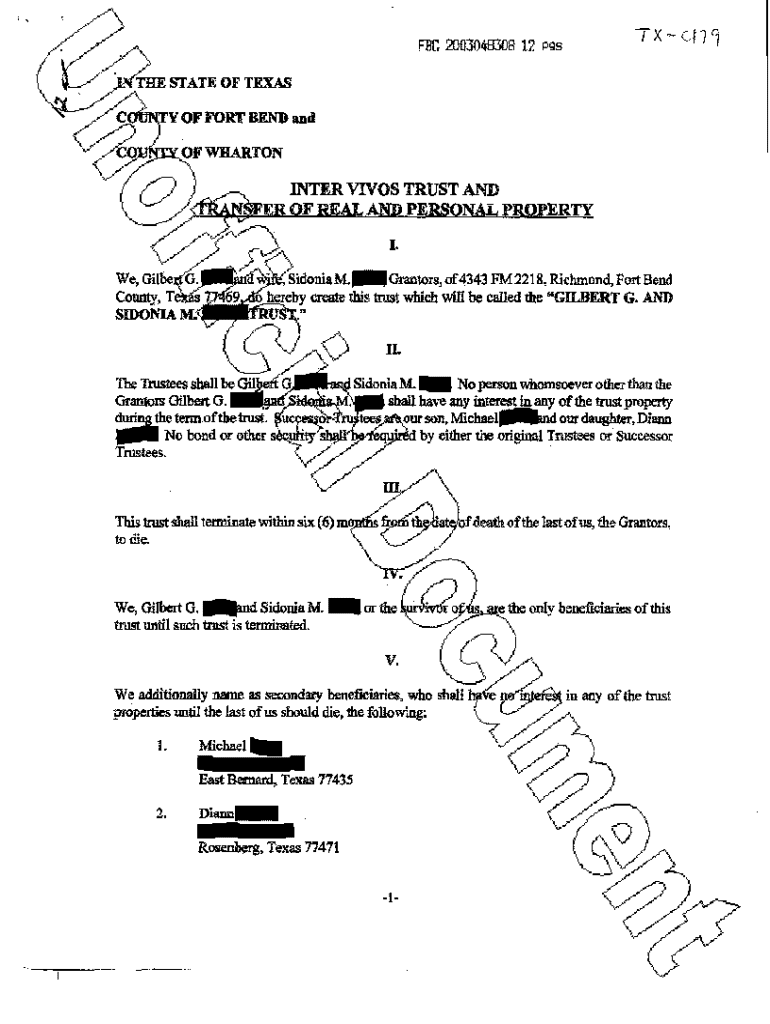

Inter Vivos Trust

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is inter vivos trust

An inter vivos trust is a legal arrangement where assets are transferred into a trust during a person's lifetime, providing benefits like asset management and avoiding probate.

pdfFiller scores top ratings on review platforms

great

Easy to use and feature-rich

It is relatively easy to use, and fits my needs for the purposes I use it.

hello howru, let me know when is the webinar.... thanks

Great, simple to use, the use experience is seamless

great and easy to use

Who needs inter vivos trust?

Explore how professionals across industries use pdfFiller.

How to fill out an inter vivos trust form: A comprehensive guide

An inter vivos trust form is a legal document used to establish a trust during the lifetime of the grantor. Filling out this form accurately is crucial for effective estate planning.

Understanding the inter vivos trust

What is an inter vivos trust, and why should you consider one? This type of trust becomes effective during the grantor's lifetime and can help manage assets, streamline estate processes, and provide specific benefits to beneficiaries.

-

An inter vivos trust allows a grantor to transfer assets to a trustee for the benefit of the beneficiaries during their lifetime.

-

Benefits include avoiding probate, tax advantages, and the ability to control asset distribution post-death.

-

Unlike testamentary trusts, which are effective after death, inter vivos trusts are set up and managed while the grantor is alive.

Essential components of an inter vivos trust form

When preparing your inter vivos trust form, it's vital to include specific information so it meets legal requirements and serves its intended purpose.

-

Clearly state the names and contact information of the grantor (the person creating the trust) and the trustee (the person managing the trust).

-

Identify who will benefit from the trust and detail their respective shares to avoid conflicts later.

-

Explicitly lay out how and when assets will be managed and distributed, ensuring clarity for all parties.

Filling out the inter vivos trust form

To ensure your inter vivos trust form is filled out correctly, follow a systematic approach.

-

Use pdfFiller’s user-friendly interface for an easy completion process. The platform offers customizable templates.

-

Double-check names, dates, and details to avoid discrepancies that could affect your trust.

-

Avoid vague language and incomplete information which can lead to legal issues later.

Editing and customizing your inter vivos trust template

After your form is created, you might need to make adjustments for clarity or additional provisions.

-

Easily edit your document with pdfFiller to tailor your trust as circumstances change.

-

Customize your trust with specific clauses, like conditions for asset distribution.

-

Utilize pdfFiller’s collaboration features to consult with your lawyer directly on the document.

Signing and finalizing your inter vivos trust

Finalizing your inter vivos trust is crucial to make it legally binding. This process includes signing and possibly notarizing the document.

-

Using electronic signatures accelerates the finalization process, providing convenience and traceability.

-

Follow pdfFiller’s step-by-step guide on how to eSign your document securely.

-

Depending on your jurisdiction, you may need witnesses or notarization for legality, so check local requirements.

Managing your inter vivos trust post-completion

Once completed, managing your inter vivos trust involves ongoing responsibilities to ensure it meets your goals.

-

Regularly review and manage the assets within the trust according to the outlined instructions.

-

If your circumstances change, amendment procedures allow for the trust to be updated appropriately.

-

Keep an eye on the trust's performance and ensure compliance with state regulations and tax laws.

Addressing common concerns with inter vivos trusts

Many people have concerns about the implications of inter vivos trusts, particularly regarding taxes and estate planning.

-

Inter vivos trusts can offer tax benefits, but they may also affect how taxes are assessed on the trust assets.

-

Establishing an inter vivos trust could impact eligibility for Medicaid benefits, so consult a tax professional.

-

Ensure your trust complies with state-specific regulations to avoid complications, such as fines or invalidation.

Additional considerations for inter vivos trusts

Incorporating your inter vivos trust into a broader estate plan can ensure fuller protection and efficiency.

-

Your trust should fit within your overall estate strategy, considering other assets and possible conflicts.

-

Clear beneficiary designations help avoid disputes that can arise from ambiguous language.

-

Regularly revising your trust with the help of legal advisors ensures it continues to meet your needs.

How to fill out the inter vivos trust

-

1.Access the pdfFiller website and log into your account.

-

2.Search for the inter vivos trust form using the search bar.

-

3.Select the correct template and open it in the editor.

-

4.Start by entering your name and the date at the top of the document.

-

5.Fill in the name of the trustee who will manage the trust, along with their contact information.

-

6.Detail the beneficiaries of the trust, including names and relationships.

-

7.Describe the assets to be placed in the trust, specifying what should be included.

-

8.Outline the terms under which the trust will operate, including any specific instructions about distribution.

-

9.Review the entire document thoroughly for accuracy and completeness before signing.

-

10.Once finished, save the document and follow any provided instructions for notarization or witnessing, if required.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.