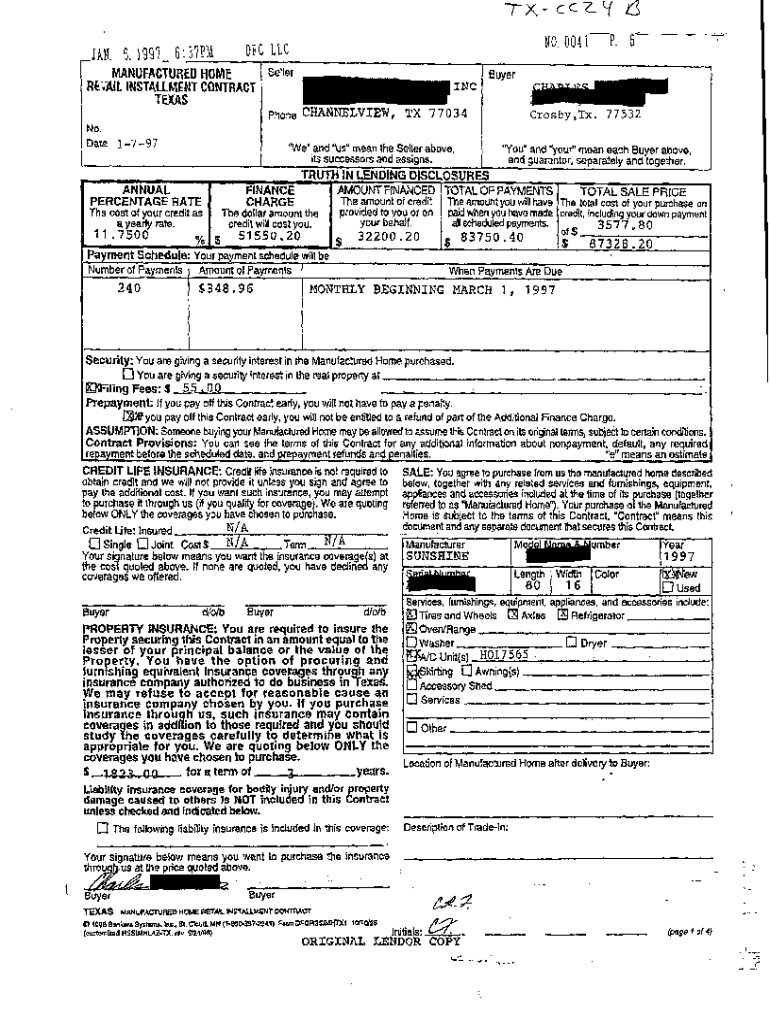

Get the free A03 Truth In Lending Disclosures

Show details

A03 Truth In Lending Disclosures

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

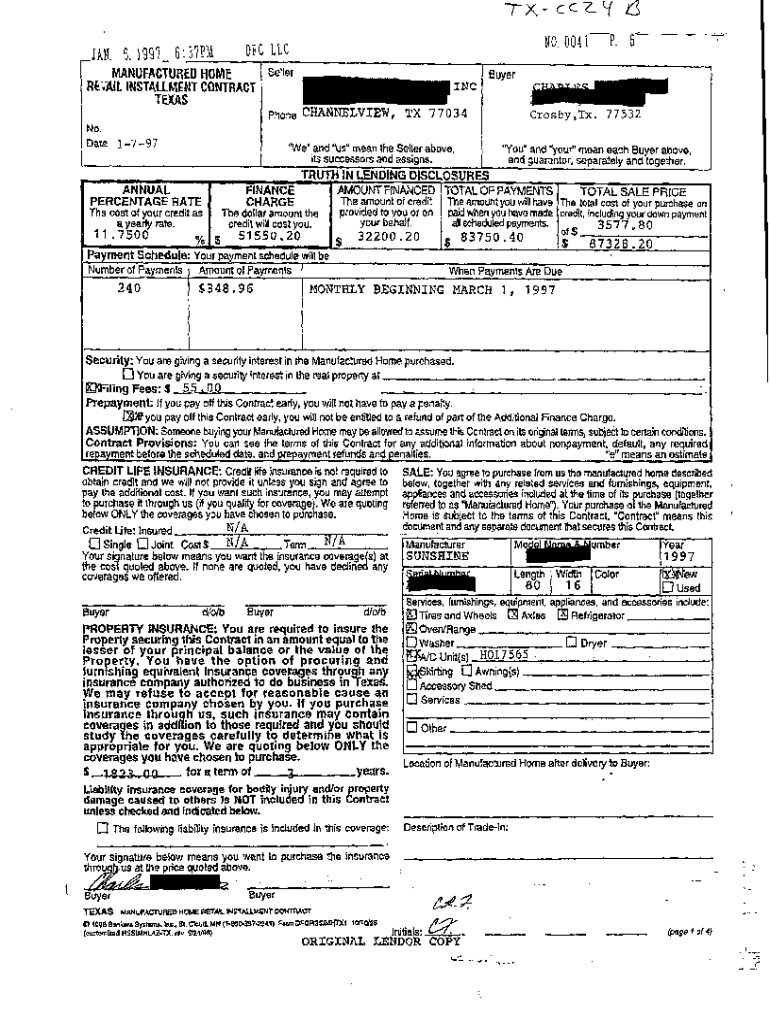

What is a03 truth in lending

The A03 Truth in Lending document provides borrowers with essential information regarding the terms and costs of their loans, ensuring transparency and informed decision-making.

pdfFiller scores top ratings on review platforms

great. works well. except I dislike taking surveys.

Excellent customer service. Quick response to user needs.

It allows for many different use for my company and the role I [play in both sales and safety

It is okay. The only problem I had was renaming inside the pdf itself

I like this site. Pretty easy to use, even for an "oldster."

First time user. experience was very good.

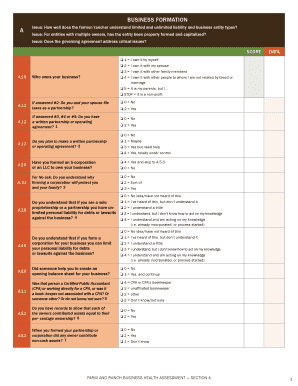

Who needs a03 truth in lending?

Explore how professionals across industries use pdfFiller.

How to fill out a03 truth in lending form: A detailed guide

What is the A03 Truth in Lending Form?

The A03 Truth in Lending Form is a critical document used in the lending industry, designed to ensure transparency in the terms and conditions of a loan. It outlines essential details such as loan amounts, interest rates, and repayment terms, ensuring consumers have a clear understanding before committing. This form is significant in fostering a trustworthy relationship between lenders and borrowers, thus contributing to informed financial decisions.

-

The A03 form is primarily aimed at enhancing consumer awareness regarding the terms of lending. It ensures that borrowers fully understand their obligations.

-

Accurate reporting on the A03 form can prevent future disputes and issues, both for the lender and the borrower.

-

Filling out the form correctly is a legal requirement in many jurisdictions, reinforcing the need for compliance to avoid penalties.

What are the steps to complete the A03 form accurately?

Completing the A03 form involves several detailed steps that require attention to detail. By following a structured approach, individuals and teams can minimize errors and ensure compliance with local regulations.

-

Before you start filling out the A03 form, gather all necessary supporting documents such as income verification and credit reports to provide accurate information.

-

Carefully navigate through each section of the A03 form, ensuring each field is completed precisely, as any errors can cause delays in processing.

-

Be aware of local regulations governing loan documentation to ensure that the form meets all legal standards.

How does PDFfiller enhance the A03 form experience?

PDFfiller provides a versatile platform that simplifies the process of filling out the A03 Truth in Lending Form. The tool not only aids in editing but also streamlines collaboration and approval processes.

-

You can easily change text, add new fields, and customize the A03 form using PDFfiller's comprehensive editing tools.

-

PDFfiller allows users to eSign their A03 form directly on the platform, facilitating quicker approvals and reducing the need for physical signatures.

-

Teams can work together on the A03 form within PDFfiller, providing real-time comments and suggestions, which enhances the overall accuracy.

What common mistakes should be avoided while filling the A03 form?

When completing the A03 form, it's crucial to be aware of potential mistakes that can hinder the accuracy and legality of the document. Understanding and avoiding these pitfalls can lead to a smoother submission process.

-

Double-checking each entry on the A03 form is essential to avoid incorrect information that can lead to legal issues.

-

Many users overlook specific terms and conditions associated with the loan; reading them carefully is crucial for understanding.

-

Utilizing PDFfiller’s features, like error-checking tools and collaboration options, can significantly reduce mistakes in form completion.

How can you manage your A03 form using PDFfiller?

Managing your A03 Truth in Lending Form is straightforward with PDFfiller's cloud-based platform. It offers numerous features that streamline document management.

-

PDFfiller allows secure storage of the A03 form in the cloud, making it accessible from anywhere at any time.

-

You can easily share the A03 form with stakeholders, allowing for quick feedback and revisions.

-

PDFfiller's version control feature keeps track of changes made, allowing you to revert to previous document states if needed.

How to fill out the a03 truth in lending

-

1.Start by downloading the A03 Truth in Lending form from a reliable source or your lender's website.

-

2.Open the document in a PDF reader or PDF editing software like pdfFiller.

-

3.Begin filling out your personal information at the top of the form, including your name, address, and contact details.

-

4.Input the loan amount you are seeking and the annual percentage rate (APR) associated with it.

-

5.Provide any applicable fees such as transaction fees, closing costs, and other related charges in the designated fields.

-

6.Specify the loan term, indicating the duration in months or years it will take to repay the loan.

-

7.If applicable, include information about any prepayment penalties associated with the loan agreement.

-

8.Review the form thoroughly for accuracy, ensuring all necessary fields are completed and there are no errors.

-

9.Save the completed document securely and prepare to submit it to your lender as part of your loan application process.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.