Last updated on Feb 10, 2026

Get the free A02 Loan Application and Personal Loan Agreement

Show details

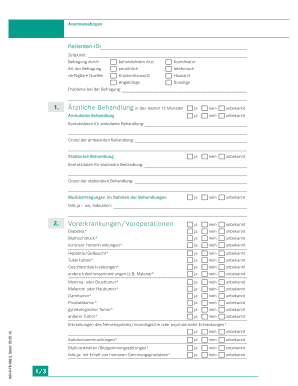

A02 Loan Application and Personal Loan Agreement

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is a02 loan application and

The A02 loan application is a standardized form used for applying for a loan, detailing the applicant's financial status and loan requirements.

pdfFiller scores top ratings on review platforms

It popped up along with a State of FL form that I needed to complete. I'm annoyed that they didn't tell me right from the start that you could only use it with a paid prescription.

I have been very happy with the functionality thus far. I may be interested in a webinar in the future. A survey in a month or two would allow me a better sample to assess how PDFfiller will work to meet my needs.

I have difficulty find a new blank copy of what I just used to make a new one for another purpose.

The only issue I have is paying for a year upfront and not paying the $6.00 / month like I expected to.

Much easier than hand writing documents.

Very useful. Glad this was available - great service for small businesses.

Who needs a02 loan application and?

Explore how professionals across industries use pdfFiller.

How to Successfully Complete the A02 Loan Application and Form

How to fill out an A02 loan application form

Filling out the A02 loan application effectively is crucial for any applicant. This guide will walk you through the necessary steps while leveraging functionalities from pdfFiller to streamline the process. By the end of this article, you'll have the confidence and knowledge to complete your A02 loan application accurately.

What is the A02 loan application?

The A02 loan application is designed to assist individuals and businesses in securing funding for various purposes, such as business expansion or personal emergencies. Understanding its purpose and importance can significantly enhance your chances of approval.

-

The A02 loan serves to provide financial assistance when required, whether it’s for personal needs or business operations.

-

This loan is generally targeted towards individuals with approved financial backgrounds, as well as small business entities looking for moderate funding.

-

Eligibility often includes age, credit score requirements, and proof of income.

What are the key sections of the A02 loan form?

Understanding the key sections of the A02 loan form is essential to completing it accurately.

-

Include required details like your name, address, and contact information, which are fundamental for identification purposes.

-

You'll need to disclose your income details, credit history, and any financial obligations to assess your repayment ability.

-

Specify the amount you are requesting, the loan's purpose, and repayment terms to align expectations.

How to fill out the A02 loan application step-by-step?

Following a step-by-step guide is one of the most efficient ways to navigate through the A02 loan application.

-

Open the A02 loan application in pdfFiller to access and fill it electronically with ease, ensuring all details are captured.

-

Each section of the application comes with specific instructions that guide you on what information to provide.

-

The platform offers interactive tools that simplify data entry, allowing you to auto-fill or validate information.

How to edit and sign the A02 loan form with pdfFiller?

Editing and signing the A02 loan form electronically can significantly speed up the process.

-

Before submission, use pdfFiller to review and edit the PDF form, ensuring that all information is accurate.

-

pdfFiller provides various eSigning options that are valid by law, facilitating a smoother signing process.

-

You can collaborate with team members through pdfFiller for a final review before submission.

What are common mistakes to avoid on your A02 loan application?

Avoiding common mistakes on your loan application can improve your approval chances.

-

Review a checklist that includes incomplete forms, incorrect personal details, and missing signatures.

-

Utilize pdfFiller’s error-checking features to review your application before submission.

-

Inaccurate information can have legal implications, leading to denial or repercussions.

What to expect after submission?

Understanding what happens after you submit your A02 loan application helps manage your expectations.

-

Expect a timeline for processing that varies based on the lender but generally ranges from a few days to weeks.

-

Familiarize yourself with the approval criteria to prepare for next steps, like additional documentation requests.

-

pdfFiller will help you manage follow-up documents and communications effectively after submission.

How to fill out the a02 loan application and

-

1.Download the A02 loan application from the official website or pdfFiller.

-

2.Open the downloaded form using pdfFiller or upload it directly to the platform.

-

3.Begin by entering your personal information, including your full name, address, and contact details.

-

4.Fill in your employment information, including your employer's name, job title, and salary.

-

5.Provide details about your financial situation, such as monthly income, expenses, and any existing debts.

-

6.Specify the loan amount you are seeking and the purpose of the loan in the designated sections.

-

7.Review the completed application for accuracy and completeness before submission.

-

8.Sign the form electronically and save a copy for your records.

-

9.Submit the application through pdfFiller, or print it out and send it to the lender's address.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.