Get the free Payment Bond template

Show details

This Labor and Material Payment Bond ensures that the Principal (or contractor) and the Surety (bond company) commit to payment of all amounts that become due under the Contract with a property

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is payment bond

A payment bond is a type of surety bond that guarantees payment to subcontractors and suppliers in construction projects.

pdfFiller scores top ratings on review platforms

Paul was amazing!! He took the time to walk me through the entire process and he was very patient and determined to solve my issues

easy to use easy to understand and process

I AM NEW JUST LEARNING THE SYSTEM SO FAR I LOVE WHAT I SEE!

Pretty user friendly - perfect for what I needed

REALLY SIMPLIFIED FILLING OUT A WRETCHED FORM

Excellent performance in filling most forms

Who needs payment bond template?

Explore how professionals across industries use pdfFiller.

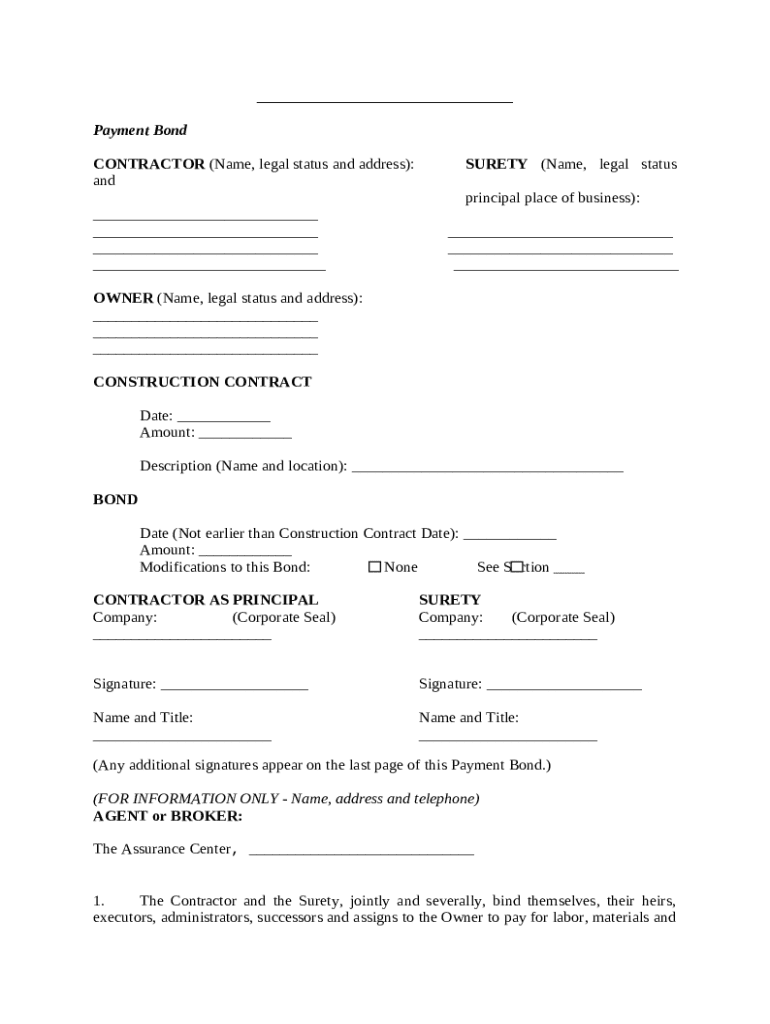

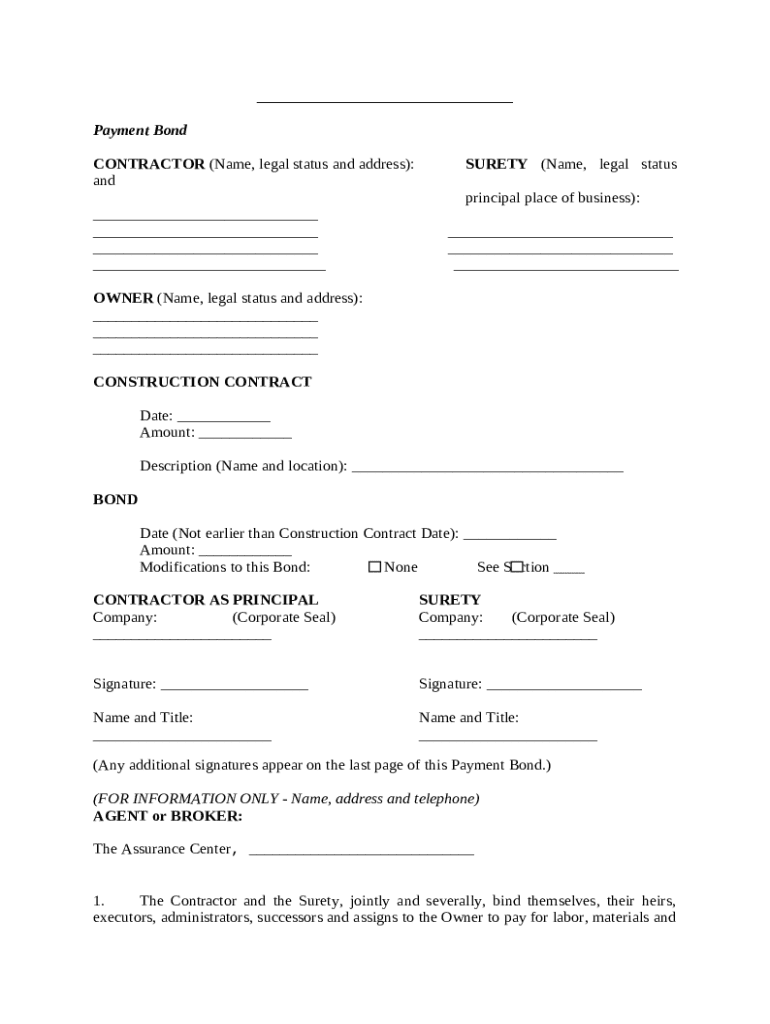

Detailed Guide to the Payment Bond Form

Filling out a payment bond form can be straightforward if you understand the process. This guide will walk you through the essential aspects involved in completing a payment bond form correctly.

What are payment bonds?

Payment bonds are guarantees that a contractor will pay all subcontractors, laborers, and suppliers engaged in a project. These bonds are crucial in construction contracts as they provide financial security and protect project owners from potential defaults.

-

A payment bond is a contractual agreement ensuring compensation for specified parties in the event of a contractor's default.

-

Payment bonds are essential to ensure that all parties involved in a construction project receive their due payments.

-

Issuing a payment bond involves legally binding commitments, which makes it crucial for parties to understand their obligations.

What key components are in the payment bond form?

Understanding the structure of a payment bond form can help streamline the completion process. Each section of the form holds specific requirements.

-

This includes the contractor's name, legal status, and contact details—vital for identification and accountability.

-

Information regarding the surety provides backing for the bond, showing that funds are available for claims.

-

The project owner's details establish the relationship and responsibilities between the owner, contractor, and surety.

How do you fill out the payment bond form?

Filling out the payment bond form is simplified with clear instructions and useful tools like those from pdfFiller, which provide interactive assistance.

-

Carefully follow each section of the form, ensuring all details are correct and complete.

-

Platforms like pdfFiller offer features that allow users to fill out forms online with ease.

-

Double-check all entries for accuracy and compliance with any relevant laws or regulations.

How to edit and manage your payment bond document?

Once you've filled out your payment bond form, managing it efficiently is vital for ongoing compliance and communication.

-

Easily update details on your payment bond form using pdfFiller's editing features which save you time and effort.

-

Maintain different versions of your document to track changes over time effectively.

-

Use collaborative features to share and work on the payment bond form alongside your team members.

What common errors should be avoided on payment bond forms?

Navigating the complexity of a payment bond form means you need to be vigilant about common pitfalls that could lead to errors.

-

Common errors include missing signatures, incorrect dates, and inaccurate monetary amounts.

-

Thoroughly review your payment bond form before submission to ensure all elements are correct.

-

Errors can lead to claims disputes and potential legal complications, affecting project timelines and budget.

What are your obligations under the payment bond?

Understanding your obligations under a payment bond is crucial for all parties involved in a construction project to avoid possible disputes.

-

Contractors must fulfill their roles as per the bond's terms and ensure payment to all specified parties.

-

In cases of owner default, contractors might face challenges fulfilling their obligations, affecting project continuity.

-

Be prepared for how to handle claims against the owner, which can include gathering necessary documents and evidence.

How do payment bond requirements vary by region?

Payment bond requirements can differ significantly across regions, which can influence compliance and procedural effectiveness.

-

Different states may have unique laws governing payment bond requirements, which contractors must follow.

-

Understanding local statutes is vital for compliance and ensuring valid contracts.

-

Utilize online repositories and local legal counsel to verify bond requirements specific to your region.

How can pdfFiller enhance your payment bond process?

pdfFiller provides robust features that can streamline your payment bond process, making document management seamless.

-

Leverage cloud-based solutions for easy access and modifications to your payment bond forms.

-

Utilize eSigning features for a more efficient signing process, minimizing delays.

-

Work together with your team to finalize the payment bond form, improving communication and efficiency.

How to fill out the payment bond template

-

1.Start by opening the payment bond form on pdfFiller.

-

2.Enter the bond amount, which should reflect the total contract value.

-

3.Fill in the principal's name, which is typically the general contractor on the project.

-

4.Include the surety company's details, ensuring you have their name, address, and contact information.

-

5.Next, input the obligee's name—this is often the project owner or the governmental entity requiring the bond.

-

6.Provide a description of the project, including the location and scope of work.

-

7.After all relevant fields are filled in, review the information for accuracy.

-

8.Sign the bond where specified, either electronically or by printing it out.

-

9.If required, provide recipient information for where the bond needs to be submitted.

-

10.Finally, save the document and submit it according to the specified requirements of the project or agency.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.