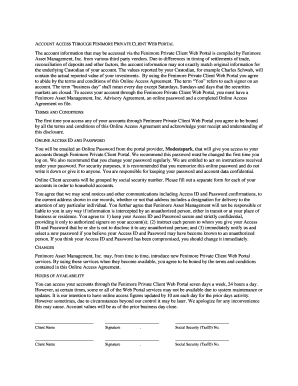

Get the free Grant of Option and Right of First Refusal

Show details

Grant of Option and Right of First Refusal

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is grant of option and

A grant of option and is a legal document that provides an individual the right to purchase or lease a property at a specified price within a certain timeframe.

pdfFiller scores top ratings on review platforms

great and easy to use with easy to understand directions

Thanks for your help on resetting my password.

We absolute love the ease of use and sharing capabilities!

The product is really friendly, easy to use and smart. I have NO problems using this product and I feel it very helpful to improve productivity.

By far, one of the best programs out there. You guys did a great job on this. I will certainly renew every year. Well worth every penny. There hasn't been one document where i was left unhappy with the outcome. Thank you again! JG Houston, TX

I am happy with how to fill out the health claim form template. It is user-friendly and reliable. It is a little slow to open documents and I waste some time looking for the right one. I don't like the organization system and I haven't figured out Templates. I am not looking for a practice management system so I like buying only what I need. Overall, I like the app and I paid for a year subscription.

Who needs grant of option and?

Explore how professionals across industries use pdfFiller.

Guide to grant of option and form form

Understanding how to fill out a grant of option and form form is essential for employees and startups looking to leverage stock options effectively. This guide will provide insights on stock option grant agreements, their benefits, and how to complete the necessary forms efficiently.

What is a stock option grant agreement?

A stock option grant agreement permits employees to purchase shares of the company's stock at a predetermined price, known as the grant price. This agreement serves as a key component of employee compensation packages in many businesses. The core purpose is to incentivize employees, aligning their interests with long-term company performance.

-

A legal contract delineating the terms under which stock options are granted.

-

To motivate and retain employees by offering them potential financial rewards tied to the company's success.

-

Typically involves employers, employees, and potentially investors or board members.

What types of stock options are available for startups?

Startups commonly utilize two main types of stock options: Incentive Stock Options (ISOs) and Non-Qualified Stock Options (NSOs). Understanding the differences helps founders choose suitable equity compensation strategies.

-

These options qualify for preferential tax treatment, benefiting both the company and the employees.

-

Do not qualify for tax benefits under the Internal Revenue Code, providing more flexibility but with immediate tax implications.

-

ISOs generally offer tax advantages but have strict regulations, while NSOs are easier to administer with fewer restrictions.

What are the benefits of a stock option grant agreement?

Stock option grants can significantly enhance employee motivation and retention. The prospect of ownership often leads to increased loyalty and productivity, which is vital for the growth of startups.

-

Stock options empower employees, as they can directly benefit from the company's success.

-

Depending on the structure, both ISOs and NSOs can offer potential tax benefits to employees and employers.

-

Granting options creates a sense of ownership, encouraging employees to contribute positively to the company's future.

What are the key components of a stock option grant agreement?

A well-structured stock option grant agreement should encompass crucial clauses that protect both the company and the employee. Key components include detailed vesting schedules, termination options, and essential terms that govern the options.

-

Include terms regarding the grant price, number of shares, and duration of the option.

-

Define when employees can exercise their options, often tied to time or performance milestones.

-

Outline what happens to the options upon employee departure or company restructuring.

How do fill out the stock option grant form?

Filling out a stock option grant form requires attention to detail to ensure accuracy. Tools like pdfFiller streamline this process, guiding users through the completion with interactive features.

-

Follow each prompt carefully while entering your information to avoid errors.

-

Utilize platforms like pdfFiller that offer templates and auto-fill options for efficiency.

-

Always double-check your entries before submission; accurate information is crucial.

How do sign and manage my stock option grant agreement?

Utilizing eSignature features on platforms like pdfFiller enables quick signing of stock option grant agreements. This not only speeds up the process but also ensures that all stakeholders can easily manage and store their agreements securely.

-

Make use of electronic signatures for quick and convenient signing processes.

-

Share documents with team members to ensure necessary revisions and approvals are captured.

-

Manage and store your signed agreements securely in cloud-based systems.

What are common pitfalls in stock option agreements?

Navigating the complexities of stock option agreements can lead to potential missteps. Common pitfalls include failing to comply with regulations or inaccuracies in the documentation that can impact a company's future.

-

Thoroughly review agreements to eliminate errors that may affect their validity.

-

Understand regulations that govern stock options to avoid legal complications.

-

Incorrect information can lead to financial losses or operational disruptions.

What are local examples of stock option agreements in [region]?

Examining local case studies can provide valuable insights into how startups in [region] utilize stock option agreements. Analyzing successful examples helps to adapt practices that comply with local laws.

-

Review stories of startups that have effectively implemented stock options to incentivize their workforce.

-

Different regions may have unique requirements that must be adhered to for stock option agreements.

-

Highlight how regional regulations affect the structure and execution of stock option agreements.

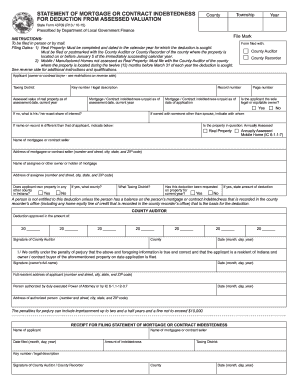

How to fill out the grant of option and

-

1.Open pdfFiller and upload the blank grant of option document.

-

2.Begin with the 'Grantor' section, providing the name and contact information of the property owner.

-

3.Next, fill in the 'Grantee' section with the name and address of the person or entity receiving the option.

-

4.Specify the property details, including the address and legal description, in the designated space.

-

5.In the 'Option Price' section, indicate the price at which the grantee can purchase the property.

-

6.Set the 'Option Period' by entering the start and end dates during which the option can be exercised.

-

7.Review the terms and conditions of the option grant and fill in any additional required clauses.

-

8.Sign the document using the 'Signature' tool and ensure all parties involved do the same before submitting.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.