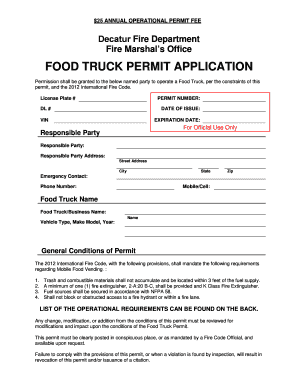

Get the free Assumption of Certain Loan Documents template

Show details

Assumption agreement of deed of trust and release of original mortgagors. Corporate or Individuals. Signed by Lender, Mortgagors and new Purchasers.

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is assumption of certain loan

An assumption of certain loan is a legal agreement allowing a borrower to take over another person's loan obligations.

pdfFiller scores top ratings on review platforms

very user friendly

Easier to use than I thought it would be.

NA

Good for vacation

It is very easy to use. No issues at all.

Fast and easy

Who needs assumption of certain loan?

Explore how professionals across industries use pdfFiller.

Assumption of Certain Loan Form Guide

What is loan assumption and why is it important?

Loan assumption refers to a financial agreement in which a buyer takes over the seller's current mortgage, thereby assuming the remaining balance and terms. This can be crucial in real estate transactions, offering buyers an opportunity to benefit from potentially lower interest rates that were set before market fluctuations. Understanding how loan assumption works can empower you to make informed decisions as the home-buying process unfolds.

How does loan assumption work in real estate?

In a typical loan assumption, the buyer must meet specific eligibility criteria set by the lender, and the seller's mortgage must allow for such an assumption. The process enables buyers to take over the mortgage payments, which could lead to significant savings in interest costs over time. Furthermore, the terms of the original mortgage might remain unchanged, making this an attractive option for many.

What are the differences between loan assumption and refinancing?

Loan assumption differs significantly from refinancing. While refinancing involves obtaining a new mortgage to pay off the existing one, loan assumption allows the buyer to take over the seller's existing loan, usually under the same terms. This can save time and costs associated with closing fees often prevalent in refinancing processes.

What are the key elements of the assumption agreements?

Assumption agreements contain essential elements to ensure clarity and legal validity. At the heart of the agreement are the recitals that state the background and intent of the parties involved.

-

These are introductory statements outlining the purpose of the agreement, ensuring all parties are on the same page.

-

The agreement specifies the roles of the Grantor (the seller), Successor Grantor (the buyer), and Lender (the financial institution), establishing clear responsibilities.

-

These documents include the original mortgage agreement and any amendments, crucial for understanding the terms being assumed.

How to apply for a loan assumption step by step?

Applying for a loan assumption process is straightforward but requires attention to detail. Following a structured approach can significantly reduce the risk of errors.

-

Collect all relevant documents, including the original loan agreement, any amendments, and proof of income to demonstrate financial capability.

-

Fill out the assumption agreement carefully, ensuring all details are accurate to avoid future disputes.

-

Submit the completed documents to the lender for approval, requiring both buyer and seller signatures to validate the assumption.

-

Once approved, file the necessary documents with local authorities to finalize the assumption legally.

What are the cost implications of loan assumption?

Loan assumptions can carry specific costs that vary by lender and agreement terms. These may include administrative fees and potential legal costs for document preparation.

-

Seek an overview of any application fees, processing fees, or administrative charges that may apply when initiating an assumption.

-

Conduct a comparative analysis between loan assumption and refinancing options to determine which is more cost-effective based on personal financial situations.

-

Develop a realistic budget before proceeding with the loan assumption process, accounting for potential fees and costs.

What legal considerations are involved in loan assumption?

Legal considerations are paramount in any loan assumption process, particularly in specific jurisdictions like Tennessee. Understanding local regulations can help avoid legal pitfalls.

-

Make sure to familiarize yourself with the specific regulations in Tennessee that influence loan assumptions and may affect your application.

-

Closely inspect the Deed of Trust and other secured agreements to understand your obligations and rights fully.

-

Research potential legal issues that can arise during the assumption process and consult with a legal expert to protect your interests.

How can pdfFiller help in managing assumption documents?

pdfFiller offers powerful tools for users managing loan assumption documents. With its user-friendly platform, individuals can easily create, edit, and sign necessary forms.

-

Users can seamlessly upload and edit their loan assumption documents, simplifying the document management process.

-

pdfFiller allows users to sign documents securely, ensuring that all transactions are valid and protected.

-

For teams involved in the loan assumption process, pdfFiller offers collaborative tools to enhance teamwork and document flow.

About pdfFiller

pdfFiller provides a broad suite of services aimed at simplifying document management for users through easy access and comprehensive tools. It's designed to support users throughout the assumption process with a high regard for security and usability, ensuring seamless experiences in managing all document interactions.

How to fill out the assumption of certain loan

-

1.Visit pdfFiller and log into your account or create a new one if you haven't already.

-

2.Search for the 'Assumption of Certain Loan' template in the document library.

-

3.Select the template and click 'Fill Now' to begin editing the document.

-

4.Fill in the required fields with the borrowing details, including both parties' names and the loan amount.

-

5.Provide necessary financial information as requested in the form, ensuring accuracy.

-

6.Review all entries for any errors or missing information before submission.

-

7.Once filled, save the document to your local drive or cloud for future access.

-

8.You may choose to print the document for physical signatures if required.

-

9.Lastly, submit the completed form as instructed through the platform or to the lender directly.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.