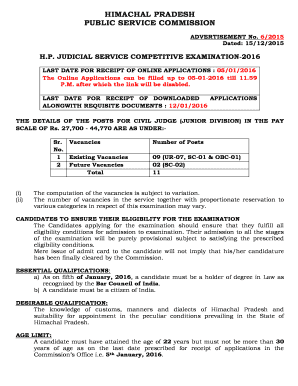

Get the free Promissory Note - Horse Equine s template

Show details

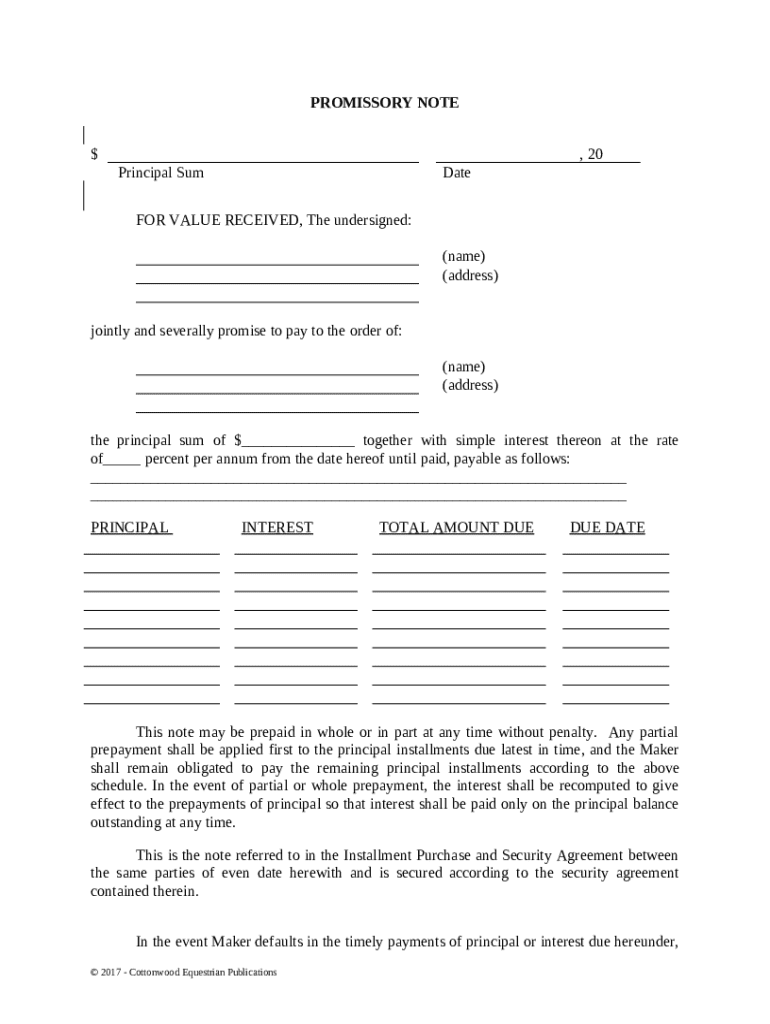

This is a promissory note for use in connection with the sale and purchase of a horse where financing is involved. It is a simple interest note that may be used in conjunction with an Installment

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is promissory note - horse

A promissory note for a horse is a written promise from one party to pay a specified amount to another party for the purchase or ownership of a horse.

pdfFiller scores top ratings on review platforms

I run a business, and sometimes PDF Filler is the perfect solution to fill that gap in my standard software. Works great!

It wasn't easy to find a new W-2. Once I figured it out, it wasn't too bad.

I am loving it. I have found it very useful.

I had a few challenges lining up text and numbers to make the form look neat. Overall a decent experience. Was the best fill-in form I could find.

i dont like the tool that hovers while typing and could not quickly locate how to turn it off

WOW! So easy to use! It is an extremely helpful tool! I LOVE PDF Filler! Thank you!

Who needs promissory note - horse?

Explore how professionals across industries use pdfFiller.

Comprehensive Guide to Promissory Note - Horse Form

How do fill out a promissory note - horse form?

Filling out a promissory note - horse form involves gathering necessary information, such as borrower and lender details, principal amount, interest rates, and payment schedules. Ensure you complete all sections to validate the document legally. Remember to use a format that meets the specific requirements of horse-related transactions.

Understanding the promissory note: An essential overview

A promissory note is a financial document in which one party promises to pay a specified sum of money to another party at a defined future date. Promissory notes serve as evidence of debt and can be used in various personal and business transactions, highlighting their importance and the need for clarity in terms.

-

The main purpose of a promissory note is to act as a legally binding contract that outlines the terms of a loan, ensuring both parties are clear about their obligations.

-

Promissory notes protect lenders by providing legal recourse in the event of non-payment, while also instilling trust and accountability in the borrowing process.

-

Promissory notes are commonly used in various situations including personal loans, business financing, and transactions related to livestock such as horse purchases.

What are the key components of a promissory note?

Key components of a promissory note include essential details that dictate the terms of the loan agreement. Understanding these elements is crucial for both the lender and borrower.

-

This refers to the total amount of money being borrowed, which forms the basis of the repayment obligations documented in the note.

-

The interest rate is a critical factor that defines how much extra the borrower will pay over the principal amount over time, often calculated simply or compounded.

-

The 'Payee' is the individual or entity receiving the payment, while the 'Maker' is the one promising to make the payment, each having specific responsibilities under the note.

-

Payment terms outline the due dates and schedule for repayments, clarifying expectations to prevent disputes.

What are the specifics of the horse form usage?

The horse form promissory note is tailored for transactions involving horses, with specific legal considerations to ensure protection for both parties in such agreements.

-

Horse form promissory notes are designed to handle the unique circumstances surrounding horse transactions, reflecting the specialized nature of this type of debt.

-

Utilizing a specific template can help ensure that legal requirements are met, which is crucial in safeguarding transactions involving equestrian assets.

-

Such forms are particularly beneficial in breeding agreements, sale transactions, or when finances are structured for equine business operations.

How to fill out a promissory note step-by-step

Filling out a promissory note requires methodical attention to detail in several steps to ensure accuracy and completeness.

-

Begin by filling in the borrower's full name and address to officially identify the party responsible for repayment.

-

Clearly indicate the total loan amount and the agreed-upon interest rate, ensuring both parties understand their financial commitments.

-

Outline the payment plan including due dates, payment amounts, and total amount due, supporting clear expectations.

-

Include conditions around prepayment of the loan, as well as the consequences of default, to provide clarity on penalties.

Why use pdfFiller for editing and customizing your promissory note?

Using pdfFiller offers the advantage of easy editing and customization of your promissory note templates. Its user-friendly interface makes the document management process seamless.

-

pdfFiller allows users to edit existing templates, simplifying the process of tailoring documents for specific needs.

-

It includes features such as eSigning, enabling quick and secure signing processes, as well as options for collaboration and storing documents on the cloud.

-

Once the promissory note is finalized, pdfFiller provides simple options for saving and securely downloading your completed document.

What are common mistakes to avoid when creating a promissory note?

Many individuals make mistakes when drafting promissory notes, which can lead to significant legal issues. Awareness of these pitfalls is key to crafting effective agreements.

-

Failing to include necessary legal language can make the promissory note unenforceable in court.

-

Not detailing full terms, especially regarding interest rates, can lead to disputes about payment expectations.

-

Unclear payment timelines can result in confusion and missed payments, risking default and potential loss.

How does the enforcement of a promissory note work?

Enforcing a promissory note is a legal process that protects the rights of the lender in the event of a default. Understanding the implications of enforcement is essential for both parties.

-

If the borrower defaults, the lender has the right to pursue legal claims to recover the owed amount, which may include suing for breaches.

-

Providing written notice of default is often a required step before further legal action can be taken, as it officially alerts the borrower.

-

Failure to meet the payment terms can lead to serious financial and legal repercussions for the borrower, including loss of collateral.

What are the industry compliance & legal insights for promissory notes?

Compliance with state-specific laws is critical when drafting a promissory note, especially in the horse industry where unique regulations may apply.

-

Each state may have different legal stipulations for promissory notes; familiarity with these laws is essential.

-

In the horse industry, it's important to consult legal professionals to ensure that all practices align with industry standards.

-

Engaging with a qualified legal expert ensures all aspects of the promissory note are compliant and reduces the chances of future disputes.

How to get support and contact information for pdfFiller users?

pdfFiller offers extensive support for users needing assistance with promissory note templates. Understanding how to access this support can enhance user experience.

-

Users can contact customer support through the pdfFiller website for any questions or concerns about promissory note usage.

-

pdfFiller provides various resources related to document management, helping users optimize their document processing strategies.

-

Users can also find FAQs and tutorials on the pdfFiller site, guiding them through the nuances of document management systems.

How to fill out the promissory note - horse

-

1.Open the promissory note template on pdfFiller.

-

2.Enter the buyer's legal name and address in the designated sections.

-

3.Fill in the seller's legal name and address accurately.

-

4.Specify the amount being financed in clear figures and words.

-

5.Outline the interest rate, if applicable, in decimal format, or indicate if it is interest-free.

-

6.Set a due date for the repayment clearly stated in the document.

-

7.Include the payment intervals, such as monthly or quarterly, and the duration of the note.

-

8.Add any collateral information if the horse serves as security for the loan.

-

9.Review the entire document for completeness and accuracy.

-

10.Sign and date the note at the bottom, ensuring to have a witness or notary if required.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.