Get the free Deed of Trust Home Equity

Show details

Deed of Trust Home Equity

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

pdfFiller scores top ratings on review platforms

Still learning the system but good so…

Still learning the system but good so far. If my 1099's go through, I'll be thrilled!

I am satisfied

I am satisfied. Since I am a senior, this was a first for me to fill the forms on-line. The prompts helped very much. Thank you.

THIS PAGE IS SO USEFUL THE ONLY THING…

THIS PAGE IS SO USEFUL THE ONLY THING IS I WOULD LIKE TO HAVE THE OPTION TO SAFE OR PRINT MORE THAN FIVE DOCUMENTS AT THE SAME TIME.

Great company

Great company! So smooth!

The way the price was advertised was a…

The way the price was advertised was a bit scammy but Im happy with the product

great app love ? it

great app love ? it

How to complete a deed of trust home form form

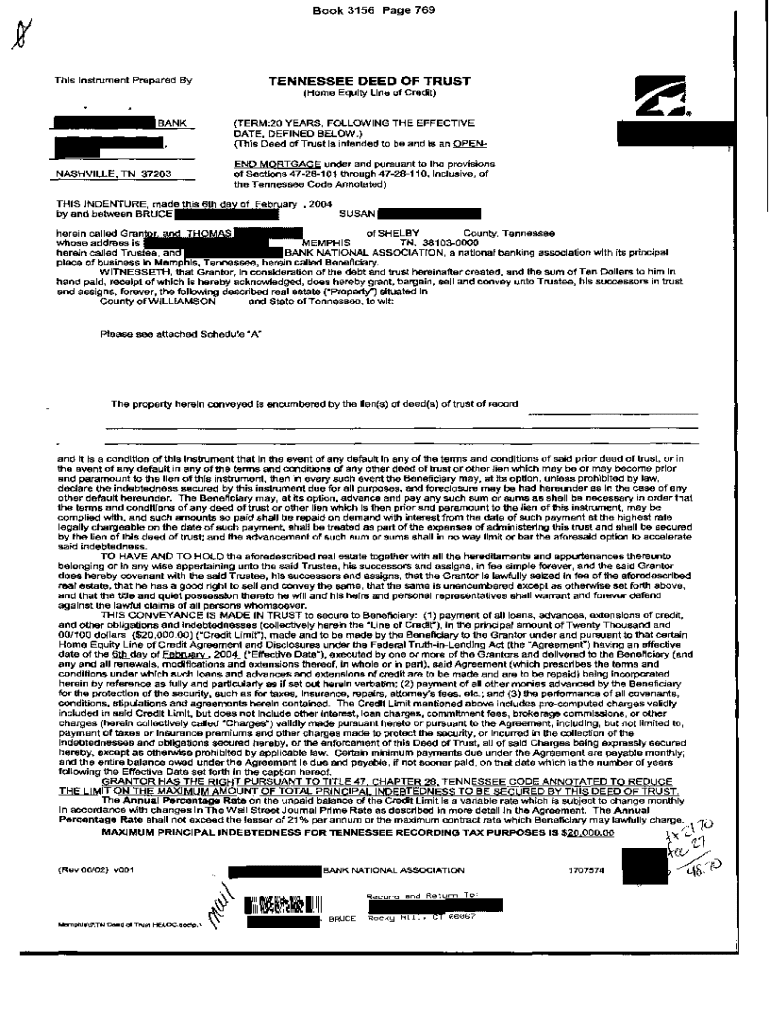

What is a deed of trust?

A deed of trust is a legal document that secures a loan used to purchase real estate. It involves three parties: the borrower, the lender, and a trustee. The primary significance of a deed of trust in real estate transactions is to ensure that the lender has a legal claim to the property until the borrower repays the loan in full.

-

A deed of trust acts similarly to a mortgage, but it typically has a third-party trustee.

-

While deeds of trust and mortgages serve similar functions, the main difference lies in the foreclosure process.

-

The deed serves to secure loan obligations, meaning if the borrower defaults, the lender can initiate foreclosure through the trustee.

What are the key components of a deed of trust?

A deed of trust must include essential elements to be legally enforceable. This includes the details of the borrower, lender, and trustee, along with signatures to validate the document.

-

The deed must clearly identify the parties involved, specifying their roles.

-

Signatures on the deed of trust must be notarized to ensure legality.

-

Understanding legal jargon in the deed is crucial for avoiding misinterpretations.

How to fill out the deed of trust form?

Filling out the deed of trust form involves several steps to ensure accuracy. It’s crucial to gather all required information before beginning to fill it out.

-

Ensure all necessary details about the borrower, lender, and property are ready.

-

Leverage interactive features in pdfFiller to fill out the form smoothly, avoiding common mistakes.

-

Refer to each section of the guide carefully as you input information.

Can customize my deed of trust form?

Yes, tailoring your deed of trust form to meet specific state requirements is possible. Using pdfFiller's editing tools allows you to modify the template easily.

-

Use pdfFiller’s functionality to make necessary adjustments to the deed.

-

Ensure that changes align with local laws, especially for North Carolina.

-

Share the document for collaborative editing with relevant parties.

What are the steps for signing and finalizing the deed of trust?

After completing the deed of trust, it’s essential to focus on the signing process. Understanding signature requirements is crucial for legal validation.

-

Identify who needs to sign and their roles in the process: borrower, lender, and trustee.

-

Utilize pdfFiller’s eSignature capabilities for convenience.

-

Review the document thoroughly to ensure all sections are completed and accurate.

How to manage my deed of trust document?

Managing your deed of trust is essential for ease of access and security. Utilizing pdfFiller’s platform allows you to store and share your document safely.

-

Store your deed of trust electronically on pdfFiller for safety against loss.

-

Monitor revisions to maintain an accurate record of document updates.

-

Share the document with interested parties while ensuring sensitive information is protected.

What common mistakes should avoid?

Errors in filling out a deed of trust can lead to legal implications. Recognizing common pitfalls can help ensure the document is accurate.

-

Identify typical mistakes like incorrect names or missing signatures.

-

Understand the consequences of providing incorrect information.

-

Follow clear guidelines to ensure your document remains clear and accurate.

What should know about North Carolina-specific deeds of trust?

In North Carolina, there are certain laws governing deeds of trust that are important to know. These may differ from standard practices in other states.

-

Familiarize yourself with the unique laws that govern deeds of trust in North Carolina.

-

Recognize any variations in documentation or processes specific to the state.

-

Seek out local resources for guidance on compliance and legal assurances.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.