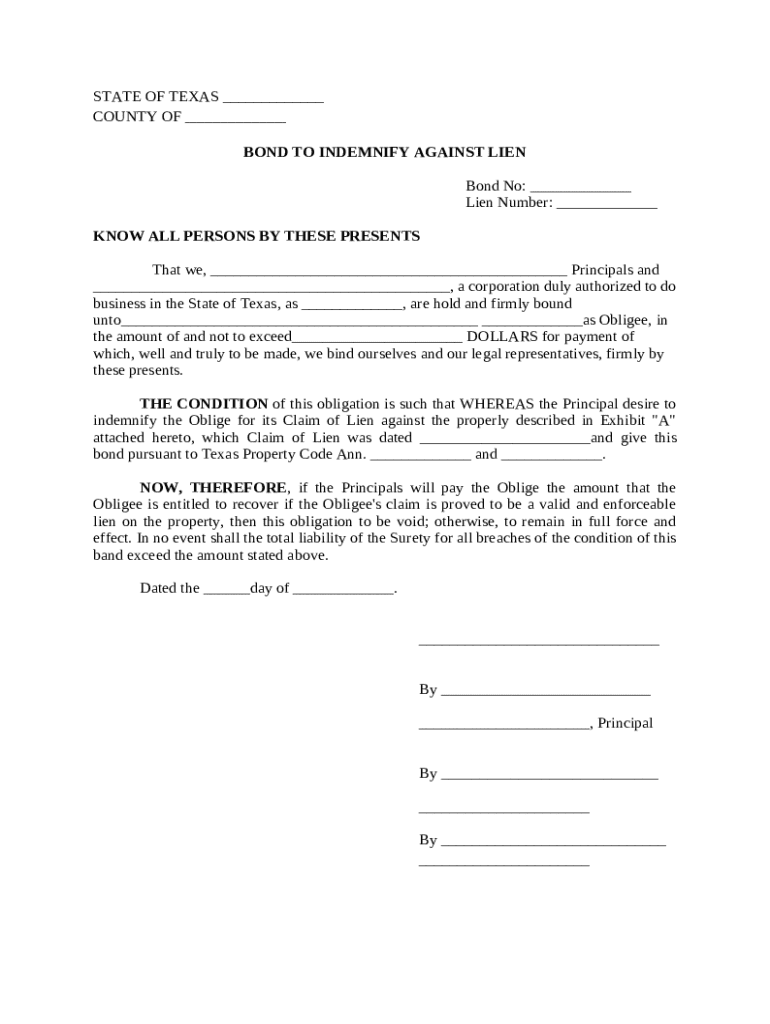

Get the free Bond to Indemnify Against Lien template

Show details

This Bond is where Principal is willing to pay for a valid claim to release lien on property.

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is bond to indemnify against

A bond to indemnify against is a financial agreement in which one party agrees to compensate another for any losses or damages incurred.

pdfFiller scores top ratings on review platforms

Wow

I'm really not a pro in the legal stuff and I it's nice to find what your looking for.

Thank you

God Bless You.

First experience was perfect. I'm having difficulty finding the current version of the form I need; specifically, the 2014 Revision of the Standard Agreement for the sale of real estate/Pennsylvania.

I just signed up and the process seems easy enough. I look forward to doing business with you.

Super easy to use. Did what I needed without much effort.

They were polite and courteous when I was tired and grouchy. Great site, better than Ad**be!

ITS PRETTY GREAT, THERE ARE A FEW FEATURES I WOULD LIKE, INCLUDING AN ONLINE MANUAL AND THE ABILITY TO MOVE TEXT BOXES ONCE THEY ARE FILLED OUT. THERE COULD ALSO BE AN ABILITY TO PAY PER FORM AS I PROBABLY WON'T BE FILLING OUT PDFS FREQUENTLY ENOUGH TO JUSTIFY MONTHLY PAYMENTS.

Who needs bond to indemnify against?

Explore how professionals across industries use pdfFiller.

Comprehensive Guide to Bond to Indemnify Against Lien

How to fill out a bond to indemnify against lien form

Filling out a bond to indemnify against lien form involves carefully providing essential details to ensure its validity. This guide will walk you through the definitions, components, and steps necessary for successfully completing the document, essential for protecting property interests in Texas.

Understanding bond to indemnify against liens

A bond to indemnify against liens serves as a financial guarantee protecting a property owner and stakeholders from potential claims. These bonds are particularly crucial in the Texas real estate context where liens may arise from unpaid debts associated with property improvements.

-

The primary purpose of a bond to indemnify against liens is to guarantee that the property owner compensates any claims that may arise from unpaid debts due to contractors or suppliers.

-

In Texas, where property development is rampant, these bonds are vital in safeguarding owners against unforeseen financial obligations.

-

The principal (usually the property owner) and the obligee (the party requiring the bond, such as a contractor) are the two main parties involved in these agreements.

What are the key components of a bond to indemnify?

Understanding the components of a bond to indemnify is crucial for ensuring all necessary information is provided. Key elements include the bond number, lien number, and obligations of the parties involved.

-

This unique identifier helps track the bond and is critical when submitting claims or inquiries.

-

This number is linked to the specific property and helps enforce rights associated with lien claims.

-

This defines the specific conditions under which the bond is valid and the circumstances under which a claim can be made.

-

Information about their roles and responsibilities ensures clarity in the agreement.

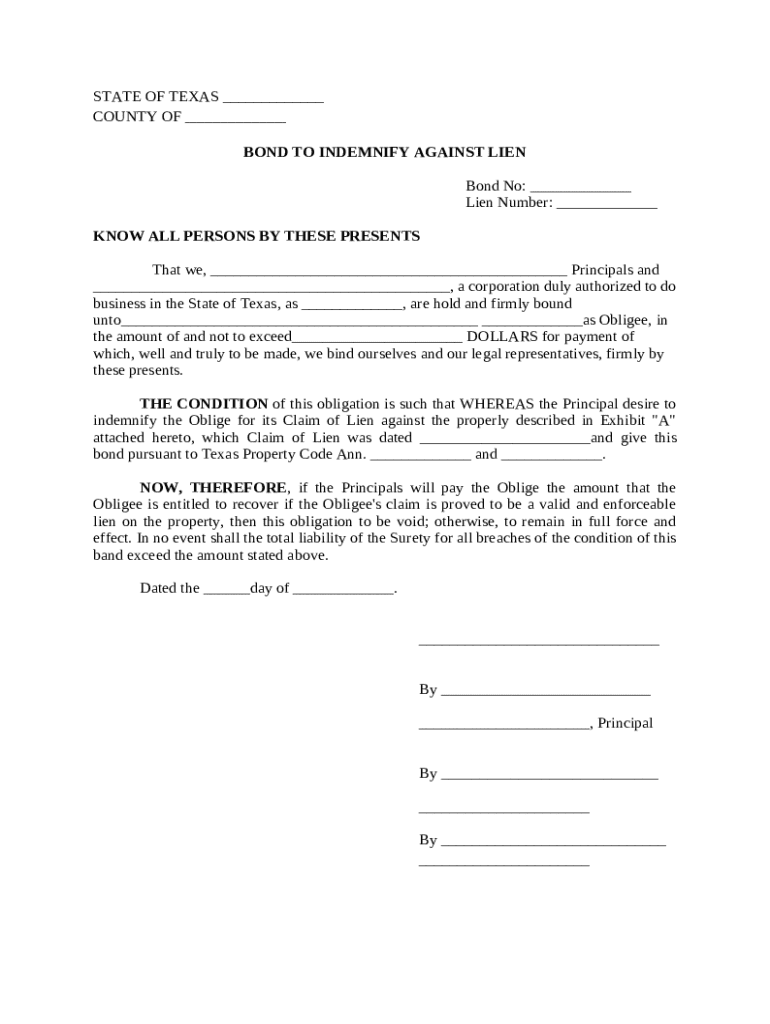

How do you fill out the bond to indemnify form?

Completing the bond form correctly is essential for legal protection and compliance. Here’s how to fill it out step-by-step.

-

Begin with the bond title and date, followed by entering the bond number and lien number accurately.

-

Ensure the bond no, lien number, and complete details about the obligee and principal are filled in.

-

Avoid leaving any required fields blank as this can invalidate the bond or delay its processing.

What legal considerations are there in bonding and indemnity?

Legal frameworks play a vital role in the effectiveness of indemnity bonds. Familiarizing oneself with these regulations is crucial.

-

Understanding the laws governing indemnity bonds can help prevent legal issues and ensure compliance.

-

These frameworks outline how claims can be made and the obligations of each party under Texas law.

-

Failing to meet the bond conditions can lead to legal repercussions, including denial of claims.

How does a bond to indemnify work in real-world applications?

In real scenarios, bonds to indemnify have proven their significance in protecting stakeholders and resolving disputes.

-

Various instances demonstrate how these bonds have protected property interests in cases of unpaid debts.

-

Bonds protect parties when a contractor defaults or when claims arise from disputes over payment.

-

Numerous disputes have been effectively resolved by invoking indemnity bonds, safeguarding property owners' investments.

Managing your bond: Tips and tools

Proper management of indemnity bonds is crucial for ongoing compliance and easy access.

-

Utilize pdfFiller to create, edit, and electronically sign your bond forms seamlessly.

-

Leverage team collaboration features and cloud solutions to streamline document management.

-

Execute regular tracking and filing of documents to ensure compliance with state regulations.

How can you ensure compliance and avoid liabilities?

Keeping your bond information accurate and updated is key to protecting against future claims.

-

Frequently review and update bond information as business circumstances change.

-

Regularly verify compliance with local laws and regulations to avoid unnecessary liabilities.

-

Maintain organized records to safeguard against disputes and ensure clarity in obligations.

How to fill out the bond to indemnify against

-

1.Access pdfFiller and search for 'bond to indemnify against' form.

-

2.Select the appropriate template from the available options.

-

3.Begin filling in your information in the designated fields, starting with the principal's name and contact details.

-

4.Provide the surety's details and ensure accurate spelling of names and addresses.

-

5.Fill out the indemnity clause clearly, stating the scope of indemnification and any specific situations covered.

-

6.Include the date of the agreement and any relevant contract or project details.

-

7.Sign the document electronically using pdfFiller’s signature tool, ensuring it matches your official signature.

-

8.Review all entered information for accuracy before finalizing the document.

-

9.Save and download the completed bond to indemnify against for your records, or share it directly from pdfFiller.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.