Get the free Deed of Trust With Future Advance

Show details

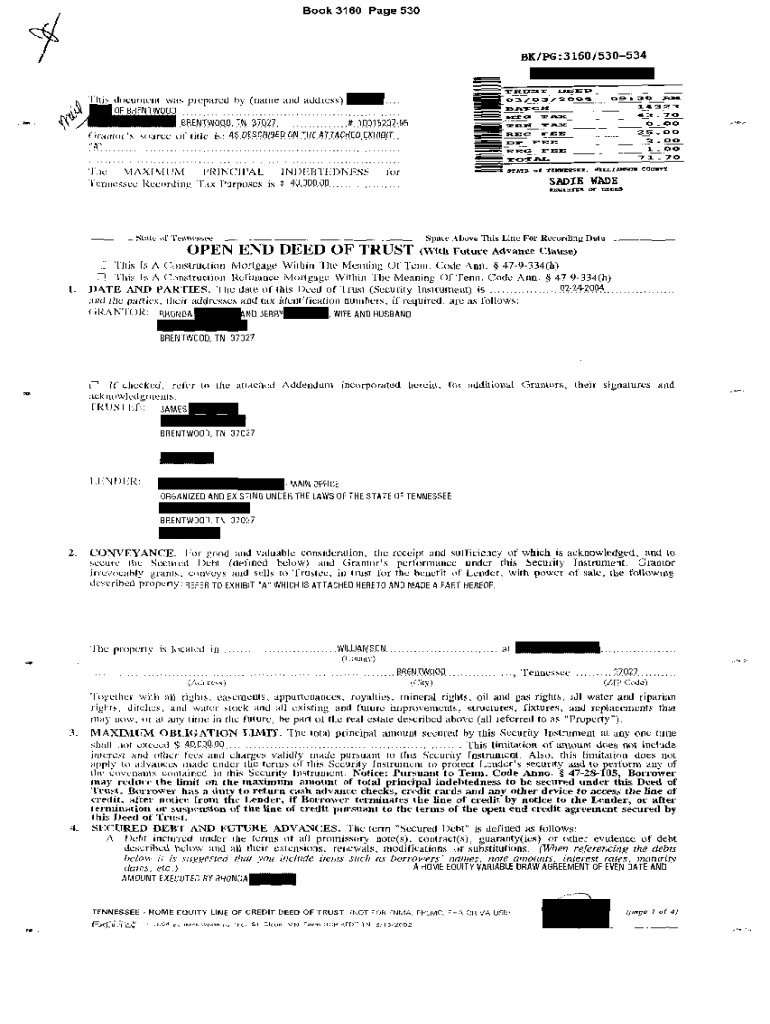

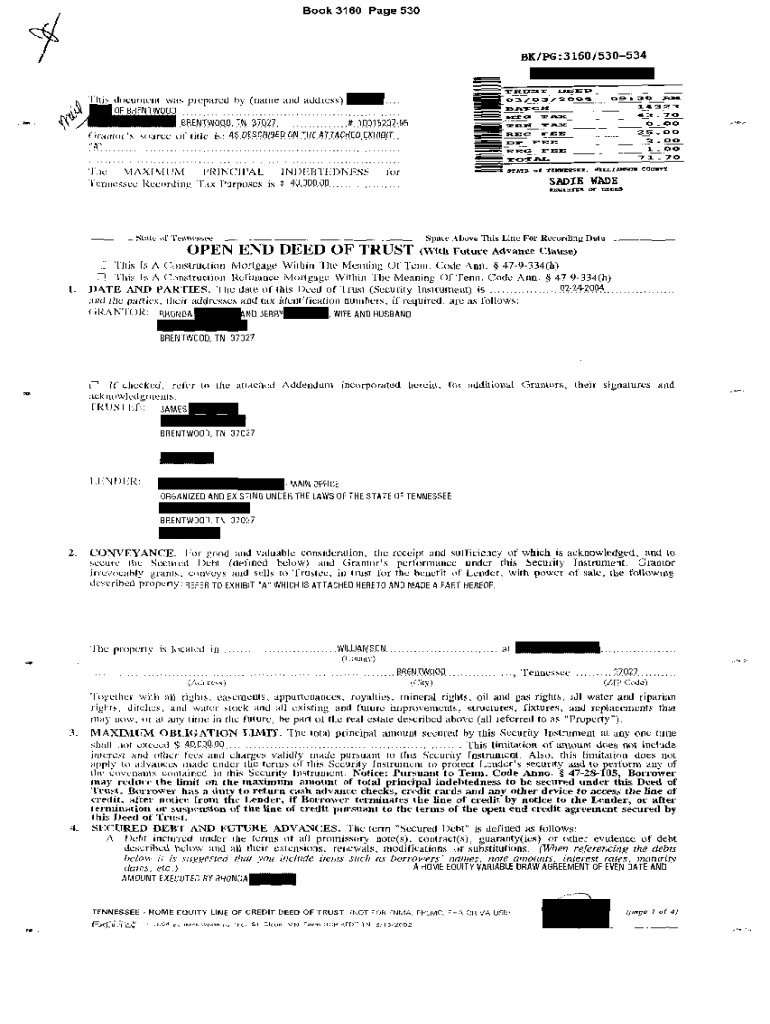

Deed of Trust With Future Advance

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is deed of trust with

A deed of trust with is a legal document that secures a loan by transferring the title in real estate to a trustee until the loan obligation is fulfilled.

pdfFiller scores top ratings on review platforms

It is easier to share via fax, email signed documents. Thanks

We have a very small non profit organization for women and having access to work with PDF documents via PDFfiller saves us time and provides us a sense of confidence each day.

its been great so far thank you very much it's been a savo

I have really liked PDFfiller. It works well for me to prepare plea bargain documents and other documents for my clients.

It has been a little difficult at times but I am computer illiterate so if I can do it or manage to figure it out I think it’s safe to say anyone’s name. I ha it has been a little difficult at times but I am computer illiterate so if I can do it or manage to figure it out I think it’s safe to say anyone’s name. I Got a few other features would be nice. Texutered, patterns of the paper texture already patterns of the paper also cut and paste; As well as Cut n pastes features.

I really enjoy using it. it makes everything i am doing a lot easier. it is not hard to use. would love to learn more. Thanks

Who needs deed of trust with?

Explore how professionals across industries use pdfFiller.

How to fill out a deed of trust with form form effectively

Understanding the deed of trust

A deed of trust is a legal document that secures a loan on a property. In property financing, it involves three parties: the trustor (borrower), the trustee (neutral third party), and the beneficiary (lender). The deed outlines the terms under which the loan is secured against the property, and it carries significant legal implications regarding the ownership and financing responsibilities.

Essential components of a deed of trust

To complete a deed of trust, specific information must be included. This typically comprises property details, borrower information, and lender details.

-

This includes the physical address and legal description of the property.

-

The full legal name(s) of the borrower(s) must be clearly stated.

-

The lender's name and contact information should be documented for clarity.

Additionally, typical legal phrasing within the deed is critical for its enforceability. Clauses that protect the lender's interests must also be well-articulated, for example, foreclosure rights and default consequences.

Step-by-step instructions for filling out a deed of trust

Filling out a deed of trust requires careful attention. Begin with the headings and subheadings that guide the flow of information within the form.

-

Enter the property description accurately to avoid disputes later on.

-

Clearly identify all parties involved: the borrower and lender.

-

Review for common mistakes, such as typos or incomplete fields, which can delay the process.

Preparing related documents

In addition to the deed of trust, other documentation is essential, such as the Promissory Note. The Promissory Note outlines the borrower's promise to repay the loan and complements the deed.

-

Outlines loan terms, payment schedules, and conditions.

-

Consider collecting any appraisals or insurance documentation.

Templates and links to fillable forms can often be found on platforms like pdfFiller, making the process more streamlined.

Notarizing and signing the deed of trust

Getting the deed notarized is a crucial step to validate the document legally. Notarization requires that all parties involved are present during the execution.

-

Schedule an appointment at a local notary office or use mobile notary services.

-

pdfFiller can simplify the signing process, allowing for secure electronic signatures.

Recording the deed of trust

Once the deed is signed, it must be recorded at the County Recorder’s Office. This action provides public notice of the lender's secured interest in the property.

-

Submit the signed deed and pay required fees at the local recorder's office.

-

Fees may vary by jurisdiction; familiarize yourself with local guidelines.

Managing and storing the final recorded documents with pdfFiller ensures security and accessibility for future reference.

Post-signing considerations

After recording the deed of trust, several outcomes occur regarding ownership and financing. For instance, the lender holds a secured claim against the property.

-

Understand the possible scenarios leading to defaults, which may lead to foreclosure.

-

Using pdfFiller can assist in document management concerning monthly payments and related documentation.

It's important for borrowers to monitor any impacts on their ownership status and regular payments to avoid complications.

How to fill out the deed of trust with

-

1.Access the deed of trust form online or through pdfFiller and open it.

-

2.Begin by entering the date at the top of the document. This is usually the date when the agreement is made.

-

3.Fill in the names and addresses of the borrower (trustor) and lender (beneficiary) accurately in the designated fields.

-

4.Provide the legal description of the property being secured, ensuring it matches the official records to avoid discrepancies.

-

5.Enter the loan amount in the specified field, which represents the total amount borrowed.

-

6.Specify the terms of the loan, including interest rate and repayment schedule, ensuring clarity and precision.

-

7.Identify the trustee - typically a neutral third party - by providing their name and contact information.

-

8.Sign and date the document where indicated. The borrower and lender should both sign to validate the agreement.

-

9.If required, have the document notarized by a licensed notary public to ensure legal compliance.

-

10.Review the entire document for accuracy before submitting or recording it with the appropriate government office.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.