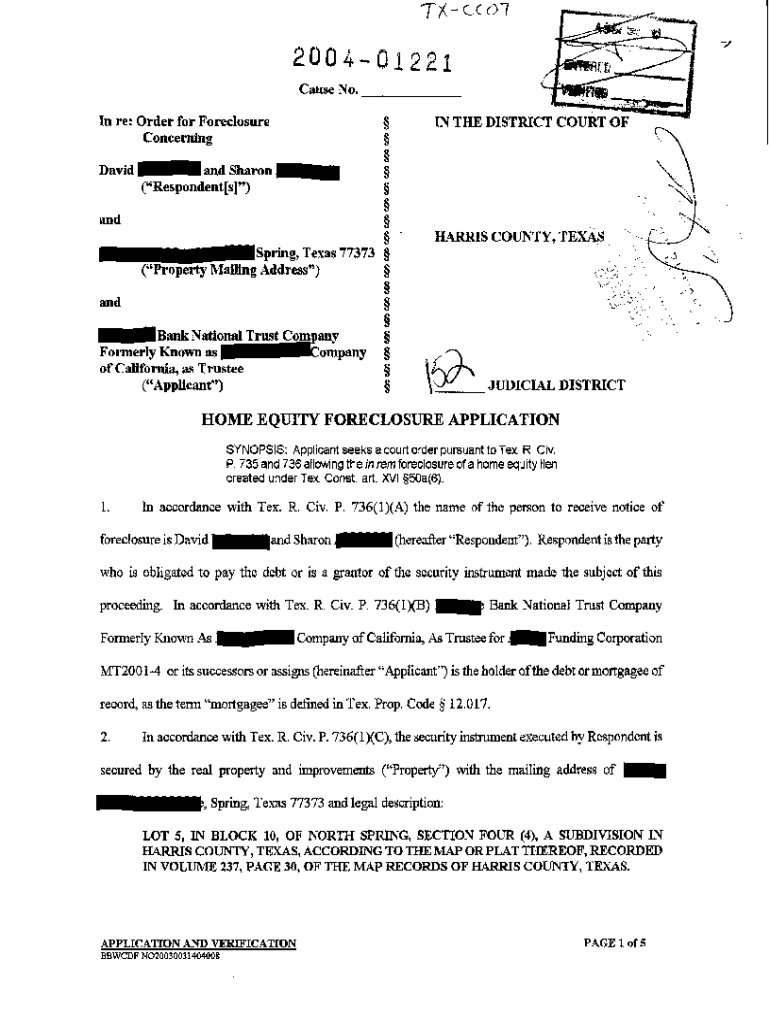

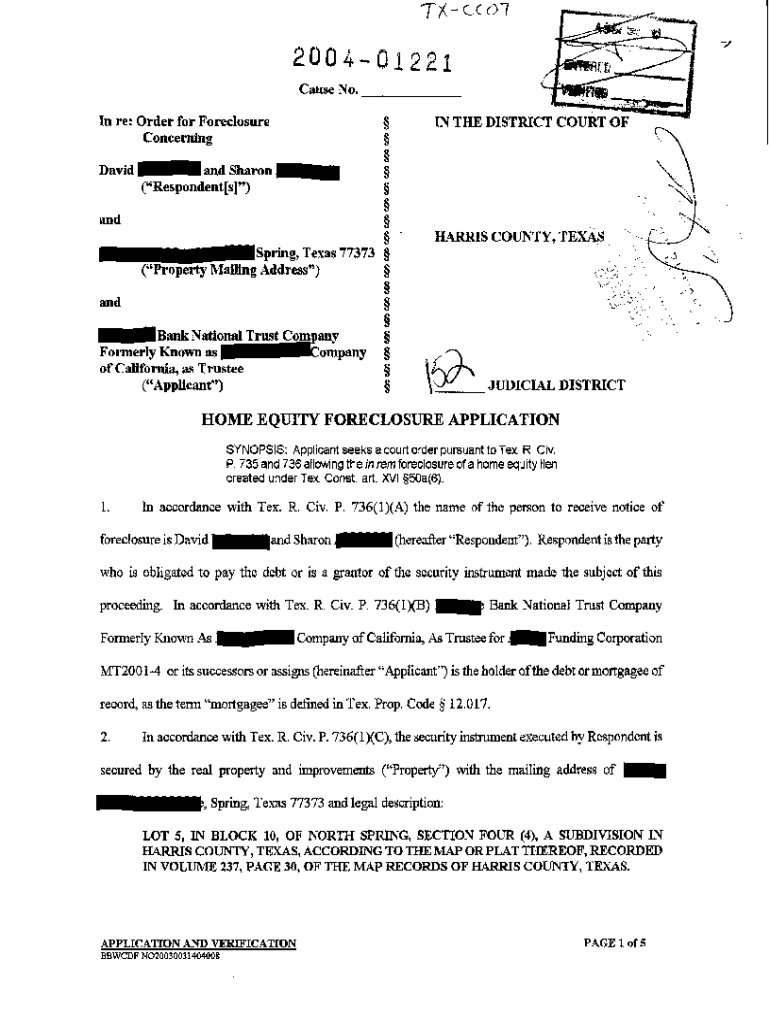

Get the free A01 Home Equity Foreclosure Application

Show details

A01 Home Equity Foreclosure Application

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is a01 home equity foreclosure

A01 home equity foreclosure is a document related to the legal process of reclaiming a property due to the non-payment of home equity loans.

pdfFiller scores top ratings on review platforms

easy to use and very much happy to have found this out! thank you

seamless log in and easy to use formatting

easy to navigate and a great asset to my business!

Only had problems with the software once during a client appointment.

One issue...the checks in the check boxes in my form disappear when downloaded or printed.

After a bit tinkering around it works very well.

Who needs a01 home equity foreclosure?

Explore how professionals across industries use pdfFiller.

A comprehensive guide to the A01 home equity foreclosure form

How to understand home equity and foreclosure forms

Home equity represents the portion of your property that you truly own, which can be utilized for securing loans or as a financial escape during hardships like foreclosure. Understanding the intricacies of home equity and the purpose of foreclosure forms is crucial for homeowners facing financial difficulties.

-

Home equity equals your home's market value minus any existing mortgage debt, providing potential financial leverage.

-

Foreclosure forms are essential in communicating the homeowner's intent to the lender and in legal proceedings when unable to meet mortgage obligations.

-

Understanding terms like 'HELOC' (Home Equity Line of Credit) and 'foreclosure' itself is vital for navigating the financial landscape effectively.

How to unlock your home equity without refinancing?

Unlocking home equity without resorting to refinancing can be an optimal strategy, especially for those seeking immediate cash flow. This method allows homeowners to leverage their property's value while maintaining existing mortgage terms.

-

Assess your current equity, explore options like home equity loans or lines of credit, and consider consulting a financial advisor before proceeding.

-

The benefits include accessing funds for emergencies or investments, while risks involve potential over-leveraging and changes to your financial standing.

-

Consider options such as cash-out refinances, HELOCs, or personal loans tailored for homeowners.

What does the home equity process entail?

Navigating the home equity process involves evaluating your current assets and preparing necessary documentation. This proactive approach can ensure you're well-equipped should you need to access these funds.

-

Review your mortgage balance and home market value to gauge how much equity you can tap into.

-

Utilize online calculators to determine your available equity, helping you make informed financial decisions.

-

Gather recent tax returns, pay stubs, and any existing loan paperwork to ease the application process.

Why do homeowners choose to unlock their equity?

Homeowners are often motivated to unlock their equity due to financial needs or investment opportunities. Understanding these motivations can assist others in making their decisions.

-

Home repairs, medical expenses, and educational costs are frequent reasons homeowners decide to tap into their equity.

-

Many individuals have successfully leveraged their home equity to transform their financial situations, highlighting its potential.

-

Unlocking equity can alter monthly obligations, necessitating careful consideration of long-term cash flow.

What are the initial steps to fill out the foreclosure form?

Filling out the foreclosure form requires attention to detail to ensure compliance and avoid delays. Knowing what information is needed ahead of time will ease the process.

-

Gather your property details, loan information, and personal identification to fill out the foreclosure form effectively.

-

Utilize pdfFiller’s online tools to edit and complete the foreclosure form, enhancing ease of use.

-

Ensure you have all required documentation, such as proof of income, to support your submission.

How to practically use home equity once approved?

Once you've successfully accessed your home equity, knowing how to deploy these funds wisely can impact your financial future positively. From debt reduction to investment opportunities, the choices are significant.

-

Using home equity to pay off high-interest debts can lead to better financial management and decreased monthly payments.

-

Investing in smart renovations can enhance property value, providing returns on your home equity in the long run.

-

Launching a business venture with home equity can leverage personal assets, though it comes with inherent risks.

What is important to know about the A01 home equity foreclosure form?

The A01 home equity foreclosure form encompasses specific fields that require accurate information for effective processing. Understanding the details of this form can streamline your application.

-

Each field requires precise entry, including mortgage details and personal information, to validate your claim.

-

The pdfFiller platform allows effortless editing and electronic signing of forms, ensuring a smooth experience.

-

Ensuring compliance with your local laws regarding foreclosure can save time and potential legal issues.

How to fill out the a01 home equity foreclosure

-

1.Open pdfFiller and upload the A01 home equity foreclosure document.

-

2.Review the document for any pre-filled information or sections needing input.

-

3.Begin filling in your name, address, and other identifying information in the appropriate fields.

-

4.Provide details about the loan including the lender's name, loan amount, and payment history.

-

5.Detail the circumstances leading to the foreclosure, including dates and payment issues.

-

6.Sign and date the document in the designated area, ensuring that your signature matches the one on your identification.

-

7.If required, include any supporting documents, such as proof of income or correspondence with your lender.

-

8.Review the entire document for accuracy and completeness before submission.

-

9.Save the completed document to your pdfFiller account or download it for your records.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.