Get the free Non- Homestead Affidavit and Designation of Homestead template

Show details

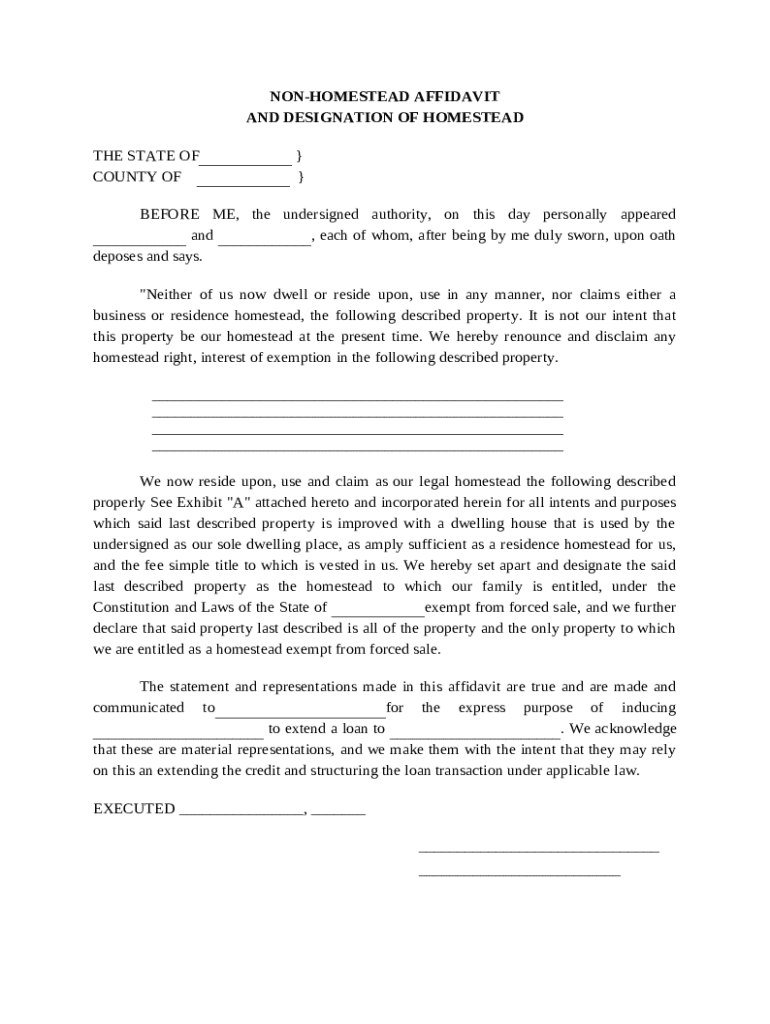

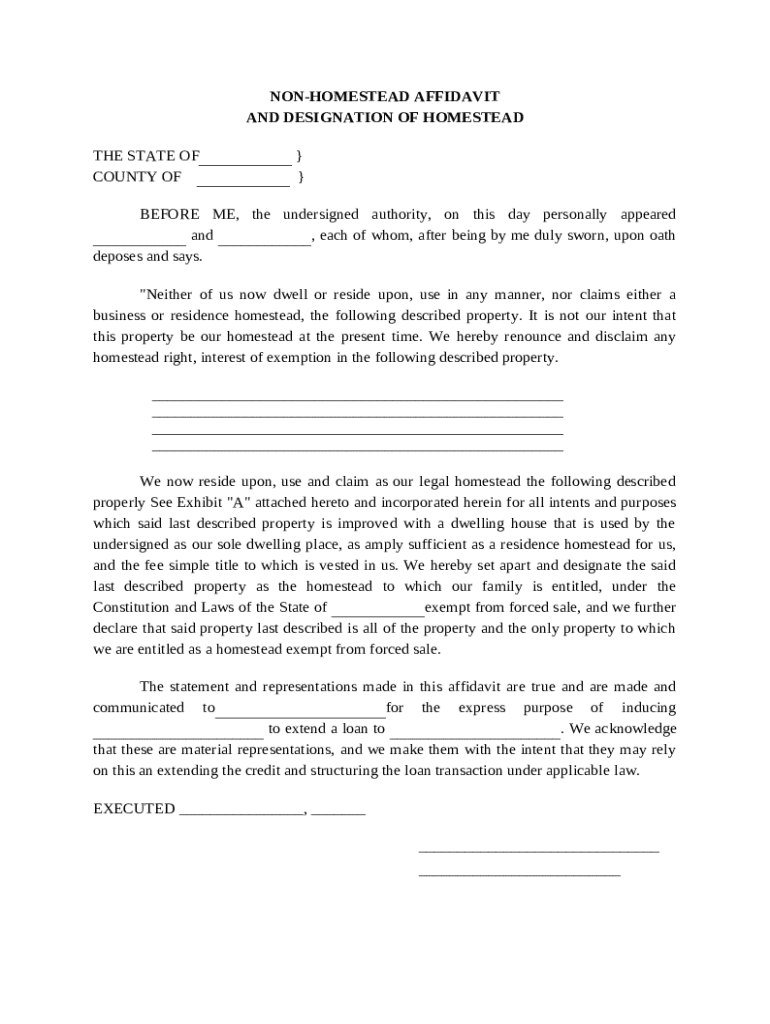

This affidavit is used to notify a change in location of legal Homestead Property.

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is non- homestead affidavit and

A non-homestead affidavit is a legal document used to declare that a property is not the owner's primary residence for tax purposes.

pdfFiller scores top ratings on review platforms

great program. great service. great features. great results.

Too premature to describe.

VERY EASY TO USE

Still to early to tell. Until now, all I can say is that the text types could adjust more to the real ones and it could have an option to copy-paste fields through the document. Moving boxes is not that easy, either. Bur overrall it's been great.

mnbm

I was guided to the site. I did find it very easy to complete my document. I would like to check the site out at a later time.

Who needs non- homestead affidavit and?

Explore how professionals across industries use pdfFiller.

Navigating the Non-Homestead Affidavit and Designation Process with pdfFiller

Filling out a non-homestead affidavit and form can seem daunting, but with the right guidance and tools, the process becomes manageable. This guide aims to provide comprehensive instructions and tips for completing this important legal document.

What is a non-homestead affidavit?

A non-homestead affidavit is a legal document used to declare that a property does not qualify for homestead exemptions. Its purpose is to formally notify tax authorities and prevent misapplication of tax benefits. Understanding its implications helps property owners navigate property laws effectively.

-

The non-homestead affidavit declares a property as non-homestead. This ensures accurate taxation and clarifies the property status.

-

Filing this document has legal consequences, including loss of homestead rights, so it is essential to fully understand its significance.

-

Homestead properties are eligible for certain exemptions, while non-homesteads do not qualify. Knowing this will guide your property decisions.

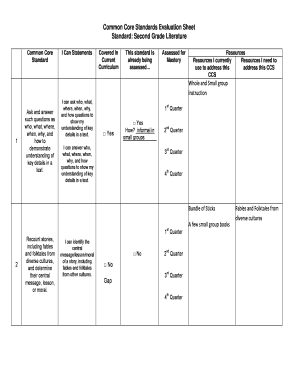

What are the key components of a non-homestead affidavit?

Every non-homestead affidavit must include specific components to be legally valid. These components ensure clarity in the affidavit's intent and purpose.

-

The affidavit must include the property owner's name, property address, and a clear declaration regarding the non-homestead status.

-

Specific legal language must be used to ensure compliance with laws and regulations governing non-homestead properties.

-

Precise property descriptions and legal references support the affidavit's validity, preventing future disputes.

How do you fill out a non-homestead affidavit?

Filling out the non-homestead affidavit is a straightforward process when utilizing platforms like pdfFiller.

-

Begin by navigating to pdfFiller and locate the non-homestead affidavit template. Fill in necessary fields based on your property details.

-

pdfFiller offers tools for easy editing and collaboration. Utilize these features to streamline form completion.

-

Be mindful of common errors such as incorrect property descriptions or missing signatures, as these can invalidate your form.

What are the signature and submission procedures?

Submitting a non-homestead affidavit requires attention to detail, especially regarding signatures and final submissions.

-

Ensure the affidavit is signed by the appropriate parties. Depending on local laws, notary services might be necessary.

-

Using pdfFiller enhances security when submitting the completed affidavit. Make sure to follow all defined procedures for submission.

-

pdfFiller provides options to track the submission status and ensure that your document is processed promptly.

What are your rights and obligations after filing?

Understanding your rights after filing a non-homestead affidavit is critical to managing your property interests.

-

Filing this affidavit means renouncing your homestead rights, which impacts any tax relief you may have previously been entitled to.

-

There are risks involved, such as increased tax liability or disputes regarding property rights that may arise.

-

The role of affidavits can become crucial during property disputes, making it essential to keep accurate records.

How do local laws affect your non-homestead affidavit?

Local laws significantly influence non-homestead affidavits, as different states may have varying requirements.

-

In Illinois, for instance, there are distinct guidelines to follow when filing non-homestead affidavits. It's crucial to review state laws before preparing your document.

-

Local regulations can dictate how non-homestead affidavits are perceived and processed, affecting your document's legal standing.

-

Familiarize yourself with local regulatory offices for assistance if you encounter issues or need clarification on specific requirements.

How can pdfFiller assist in document management?

pdfFiller offers extensive features to simplify the management of your non-homestead affidavit and related documents.

-

Users can collaborate with multiple individuals seamlessly, which is especially useful in property transactions involving several parties.

-

With cloud-based storage, all your documents are accessible from anywhere, ensuring you can manage your affidavits over time.

-

Implement best practices for organizing and accessing documents, such as creating folders dedicated to specific properties or transactions.

How to fill out the non- homestead affidavit and

-

1.Obtain the non-homestead affidavit form from your local tax assessor's office or download it from pdfFiller.

-

2.Open pdfFiller and upload the non-homestead affidavit form.

-

3.Begin filling out your personal details, including your name, address, and contact information in the designated fields.

-

4.Specify the property address that you are declaring as non-homestead.

-

5.Provide any required identification or documentation related to the property.

-

6.Review all the information entered for accuracy and completeness, ensuring that all sections are filled out as needed.

-

7.If applicable, sign and date the affidavit in the appropriate section.

-

8.Save the completed form within pdfFiller and check for any additional submission instructions specific to your locality.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

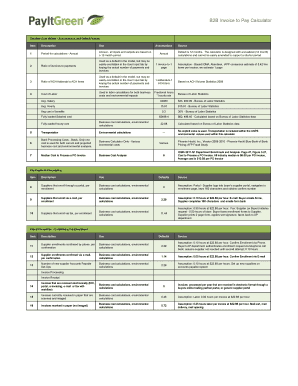

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.