Last updated on Feb 17, 2026

Get the free pdffiller

Show details

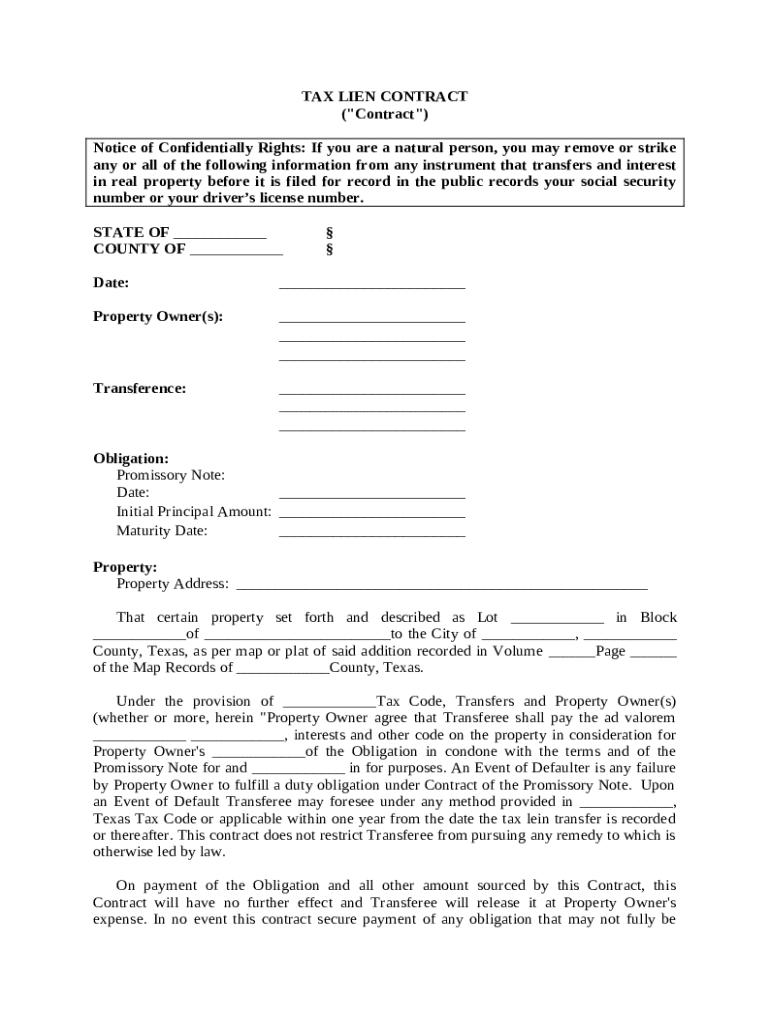

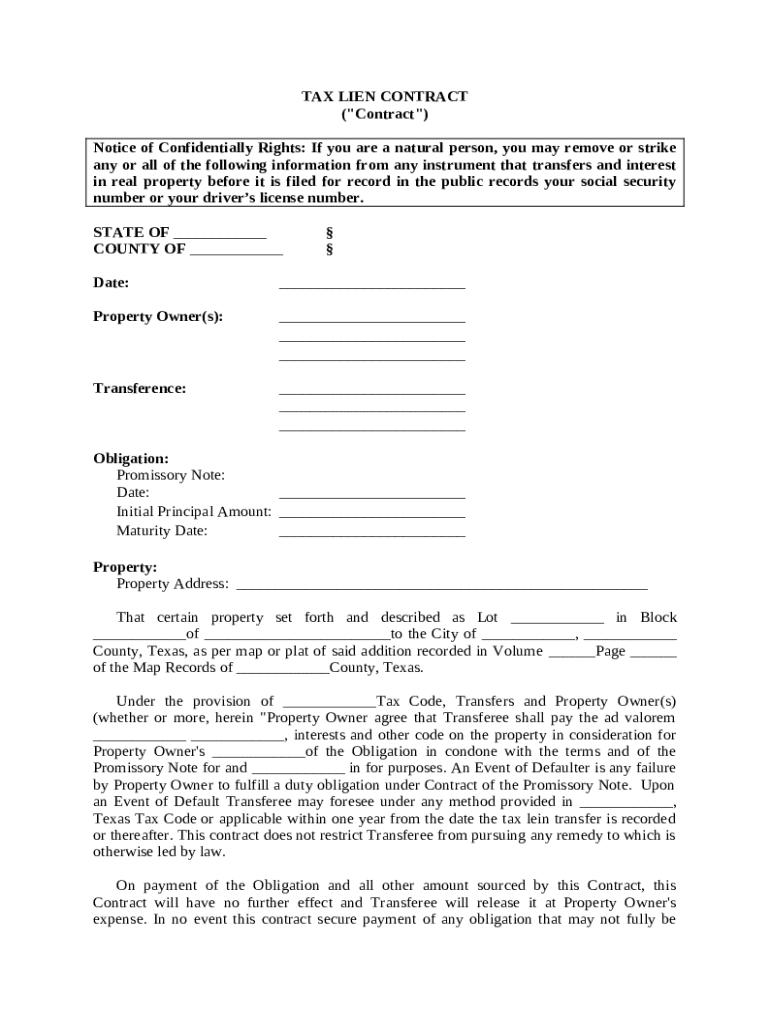

This Lien document state Property Owner agrees that Transferee shall pay Ad valorem taxes, interests and other codes within terms of Promissory Note.

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is tax lien contract

A tax lien contract is a legal agreement outlining the terms under which a property tax lien is placed on a property due to unpaid taxes.

pdfFiller scores top ratings on review platforms

I love this program, it makes my job so much easie

I cannot believe how wonderful this website is!! I can edit any PDF, fill out forms, send from the website and they even have an option to mail it for me! Definitely exceeded my expectations and I've never seen any other website or app like this. I KNOW I will be renewing this every year, especially how affordable it is!

Awesome for edits. sharing and keeping records

Great application, very easy to work with, set up and work with PDF docs. I really like this application

App doesnt work the same as using it on a computer. On the computer is easy and simple. Ive tried the app and seems to cant work it like on the computer such as tap on it erase or add , high light , or erase. Im using apple iphone Thank you

I made several mistakes that your system corrected without me refilling the info Wonderful

Who needs pdffiller template?

Explore how professionals across industries use pdfFiller.

Comprehensive Guide on Tax Lien Contract Form on pdfFiller

Filling out a tax lien contract form is crucial for ensuring the proper and legal management of tax liens in real estate transactions. This guide will equip you with all the necessary information and tools to navigate the complexities of these contracts on pdfFiller.

What is a tax lien contract?

A tax lien contract is a legally binding agreement detailing the terms of a tax lien imposed on a property due to unpaid property taxes. Understanding tax lien contracts is essential for both property owners and investors, as they play a significant role in real estate transactions.

-

A tax lien contract is a formal document that describes the obligations of the taxpayer regarding unpaid taxes and allows the government to secure its interests against the property.

-

Tax liens can affect property sales and purchases, making it crucial for buyers to understand the existing liens before committing to a transaction.

-

Key components include the debtor's details, the amount owed, terms of payment, and consequences of default, all of which outline the responsibilities of the parties involved.

What personal information should be removed for confidentiality?

Protecting personal information is paramount when dealing with tax lien contracts. Sensitive data should be removed to prevent identity theft or unauthorized use of your information.

-

Ensure all personal identifiers such as Social Security numbers and addresses are omitted or redacted.

-

Use digital tools to black out sensitive information effectively, ensuring it is not visible in any downloaded or shared documents.

-

Familiarize yourself with legal protections against the unauthorized disclosure of your private information, which can vary by state.

How do fill out the tax lien contract form?

Filling out the tax lien contract form properly is crucial to ensuring enforceability. Each section must be completed accurately to represent the transaction appropriately.

-

Begin by entering the date and names of involved parties, followed by property details to establish clear agreements from the outset.

-

Make sure to include all pertinent information, including tax identification numbers and parcel numbers for the property.

-

Clearly state the initial amount owed and the maturity date, as this affects the timeline for payment obligations under the contract.

What are default events and remedies for breaches?

Understanding the events of default in a tax lien contract is critical as it can lead to serious legal consequences. Remedies are also available for defaulting parties.

-

Defaults typically occur when a payment is missed or conditions stipulated in the contract are violated.

-

Options may include payment plans or modifications of terms, but these should be documented clearly to avoid misunderstandings.

-

Failure to address defaults may lead to foreclosure proceedings or other legal actions to recover unpaid taxes.

What should know about the Texas Tax Code?

The Texas Tax Code provides specific guidelines and provisions for tax liens, making it essential for property owners and investors to familiarize themselves with these laws.

-

The Texas Tax Code outlines the procedures for imposing and enforcing tax liens, including redemption rights for property owners.

-

Several methods are available for filing tax liens, each with varying requirements and implications for property owners.

-

Understanding how Texas laws affect tax lien processes is crucial for compliance and avoiding unintentional violations.

What are additional filing tips and best practices?

Timely and accurate filing of a tax lien contract form helps prevent legal complications. Adhering to best practices will ensure a smoother process.

-

Errors such as inaccurate information or missed deadlines can lead to delays or legal issues in the tax lien process.

-

Utilize digital tools like pdfFiller for efficient document management and ensure compliance with all deadlines.

-

Filing methods can vary in processing times, so be aware of the timeline expectations to ensure prompt execution of contracts.

Where can find resources and assistance?

Accessing the right resources can significantly enhance your understanding and management of tax lien contracts.

-

Visit reputable websites, including government resources and legal counsel, to gather helpful information about tax lien contracts.

-

Reach out to local tax offices or legal professionals for direct assistance with specific tax lien issues.

-

Take advantage of pdfFiller’s cloud-based platform to edit, sign, and manage your tax lien contract forms efficiently.

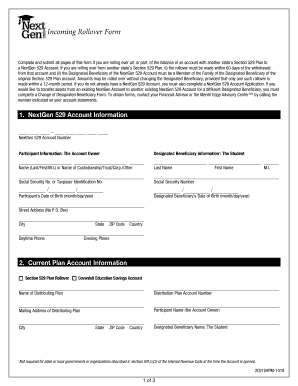

How to fill out the pdffiller template

-

1.Open the tax lien contract template on pdfFiller.

-

2.Read through the contract to understand the required information.

-

3.Begin filling in the property owner's details, including name and address.

-

4.Input the tax lien details, including the amount owed and the specific timeframe for payment.

-

5.Provide any required identification or tax identification numbers for the involved parties.

-

6.Include any special terms or conditions related to the lien if applicable.

-

7.Review all entered information for accuracy to prevent errors.

-

8.Sign the document electronically, if required, following the prompts on pdfFiller.

-

9.Save the completed document and download it if needed for your records.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.