Get the free Revocable Living Trust for Pets template

Show details

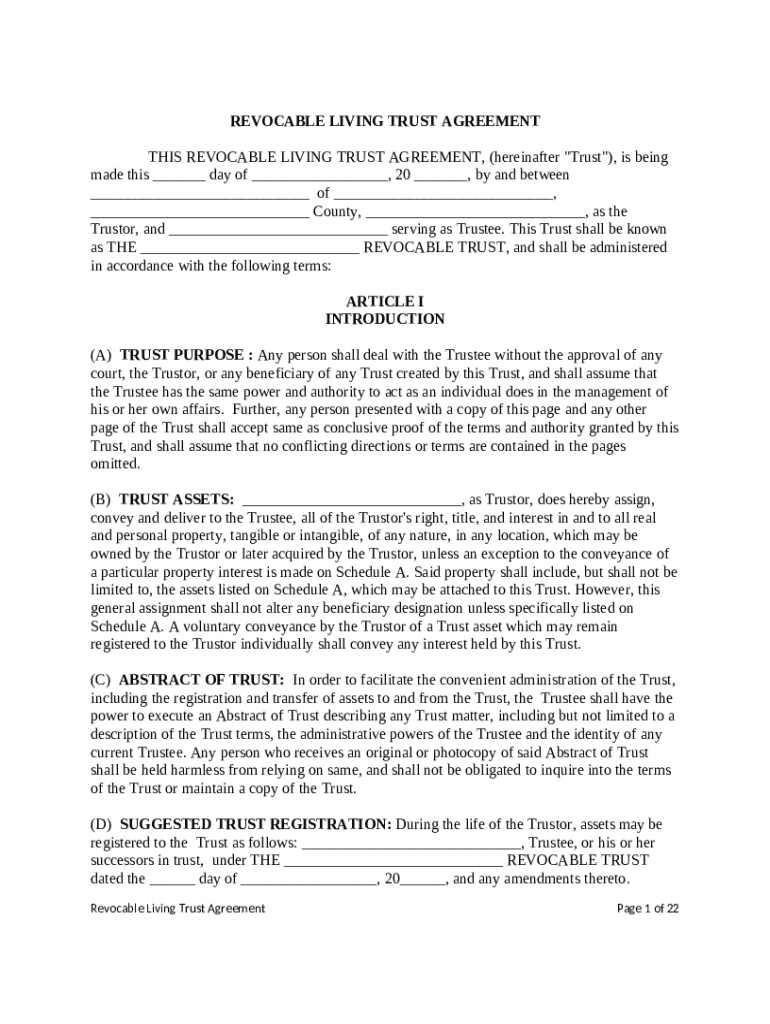

Trustor and trustee enter into an agreement to create a revocable living trust. The purpose of the creation of the trust is to provide for the convenient administration of the assets of the trust

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is revocable living trust for

A revocable living trust is a legal document that allows an individual to place assets into a trust during their lifetime, with the option to modify or dissolve it, providing benefits like avoiding probate and managing asset distribution after death.

pdfFiller scores top ratings on review platforms

So fast and easy to use.

Great Product great intro offer ,very…

Great Product great intro offer ,very user friendly

I love this app as a small business and…

I love this app as a small business and the hard situation that we are living with this pandemic, make my job much easier..

EXCELLENT PLATFORM.

User friendly application

Easy to use with lots of options

Easy to use with lots of options. Worth the $$ just to make it easier to modify documents, since everything is digital/email these days.

Who needs revocable living trust for?

Explore how professionals across industries use pdfFiller.

Comprehensive guide to creating a revocable living trust

Creating a revocable living trust is an essential step in effective estate planning. This guide provides clear insights into the process and benefits of establishing a revocable living trust, focusing on the specifics of filling out a revocable living trust form.

What is a revocable living trust?

A revocable living trust is a legal document that allows an individual (the Trustor) to transfer assets into a trust during their lifetime, while retaining the ability to modify or revoke the trust at any time.

This arrangement helps in avoiding probate, simplifies the management of assets, and can ensure privacy regarding the distribution of one’s estate.

-

The primary purpose is to manage assets efficiently during one's life and to provide for their distribution after they pass away.

-

Unlike irrevocable trusts, revocable trusts allow the Trustor to change the terms or dissolve the trust.

-

Many opt for revocable trusts to maintain control over their assets while planning for future uncertainties.

What are the advantages of establishing a revocable living trust?

-

Revocable living trusts streamline estate administration, enabling beneficiaries to access their inheritance without prolonged court processes.

-

The Trustor can modify or revoke the trust whenever needed, offering peace of mind as personal circumstances change.

-

Trusts are not made public, thus keeping the assets and terms of the trust confidential from public scrutiny.

What potential drawbacks should you consider?

-

Setting up a revocable living trust can incur legal fees, which might be a consideration for those with limited resources.

-

Assets in a revocable trust are not typically sheltered from creditors since the Trustor maintains control over them.

-

Transferring assets into a trust may have certain tax consequences, which should be evaluated with a tax professional.

When should you consider using a revocable living trust?

-

Marriage, having children, or purchasing a home are significant moments that may warrant the establishment of a trust.

-

Factors like complicated family dynamics or significant assets can make a revocable trust an ideal choice.

-

If you have substantial investments or family businesses, a revocable living trust can help manage those complexities.

What steps are involved in setting up your revocable living trust?

-

Selecting a trustworthy individual or institution is crucial as the trustee manages trust assets and carries out your instructions.

-

You need to identify and catalog the assets you want to include in the trust, ensuring to account for all valuable properties.

-

The trust document should outline the terms, beneficiaries, and responsibilities, and can be structured with legal assistance.

-

Finalize the trust by signing the document in the presence of a notary public, which ensures its legal standing.

How do state-specific laws affect revocable living trusts?

Each state has different regulations that can influence how a revocable living trust is created and executed.

-

Provisions for setting up and managing trusts may vary widely based on local legislative differences.

-

Understanding your state's requirements can help you avoid legal pitfalls and ensure your trust complies with the law.

-

Law libraries, state websites, and legal professionals can provide insights into your state's specific requirements.

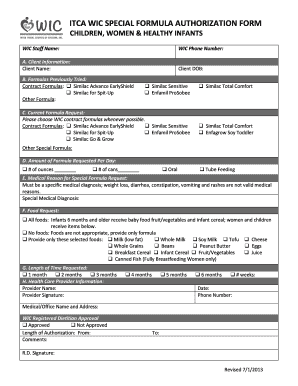

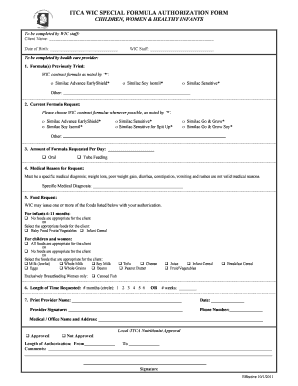

What does a sample revocable living trust template include?

A sample template for a revocable living trust should cover all essential clauses and provisions needed to establish a functional trust.

-

Templates typically require the Trustor's details, trustee appointments, beneficiary names, and asset descriptions.

-

Important provisions such as revocation terms, trustee duties, and distribution instructions are crucial for clarity.

-

Using online platforms like pdfFiller can help you tailor the document to meet your unique needs effectively.

Who are the key parties involved in a revocable living trust?

-

The Trustor establishes the trust, transferring assets and setting the terms while alive.

-

The appointed trustee manages the trust assets and ensures distributions to beneficiaries as per the outlined instructions.

-

Individuals or entities designated to receive benefits from trust assets and must understand their rights and terms under the trust.

How to fill out the revocable living trust for

-

1.Start by obtaining a blank revocable living trust form from pdfFiller.

-

2.Open the form in pdfFiller and familiarize yourself with the sections.

-

3.Begin with your personal information: fill in your name, address, and date.

-

4.Next, specify the trustee(s) who will manage the trust; typically, this is the creator of the trust.

-

5.List the beneficiaries who will receive assets from the trust and detail what they will receive.

-

6.Identify the assets you wish to place in the trust, such as real estate, bank accounts, or investments.

-

7.Include any specific instructions or restrictions for asset distribution.

-

8.Review the document for accuracy and completeness, ensuring all information is properly filled.

-

9.Once satisfied, save the document to your pdfFiller account and proceed to sign it.

-

10.Consider having the trust witnessed or notarized, depending on your state’s requirements.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.