Last updated on Feb 17, 2026

Get the free pdffiller

Show details

Audited FY Financial Statement

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is audited fy financial statement

An audited FY financial statement is a formal record of the financial activities of an organization for a specific fiscal year, which has been reviewed and confirmed by an external auditor for accuracy and compliance.

pdfFiller scores top ratings on review platforms

Easy to navigate and use and a good way of finding documents again.

I love it. No scanners, Printers. Everything on line!!

Awesome program I can get a lot of things done finally

Would like financial forms easier to fill out, with numbers lining up. Too much time spent trying to do that manually

Makes editing & signing pdfs that can't be converted to Word or Excel quick & easy

Wonderful product. Easy to use, fairly priced.

Who needs pdffiller template?

Explore how professionals across industries use pdfFiller.

Ultimate Guide to Audited FY Financial Statements on pdfFiller

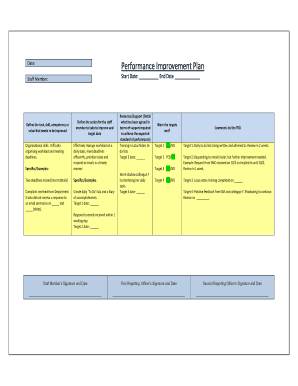

How to fill out an audited FY financial statement form

Filling out an audited FY financial statement form requires you to gather relevant financial documents, understand the accounting principles applicable in your case, and utilize tools like pdfFiller for streamlined edits and signatures. Start by collecting your balance sheet, income statement, and notes for clarity before inputting the data into the appropriate sections of the form.

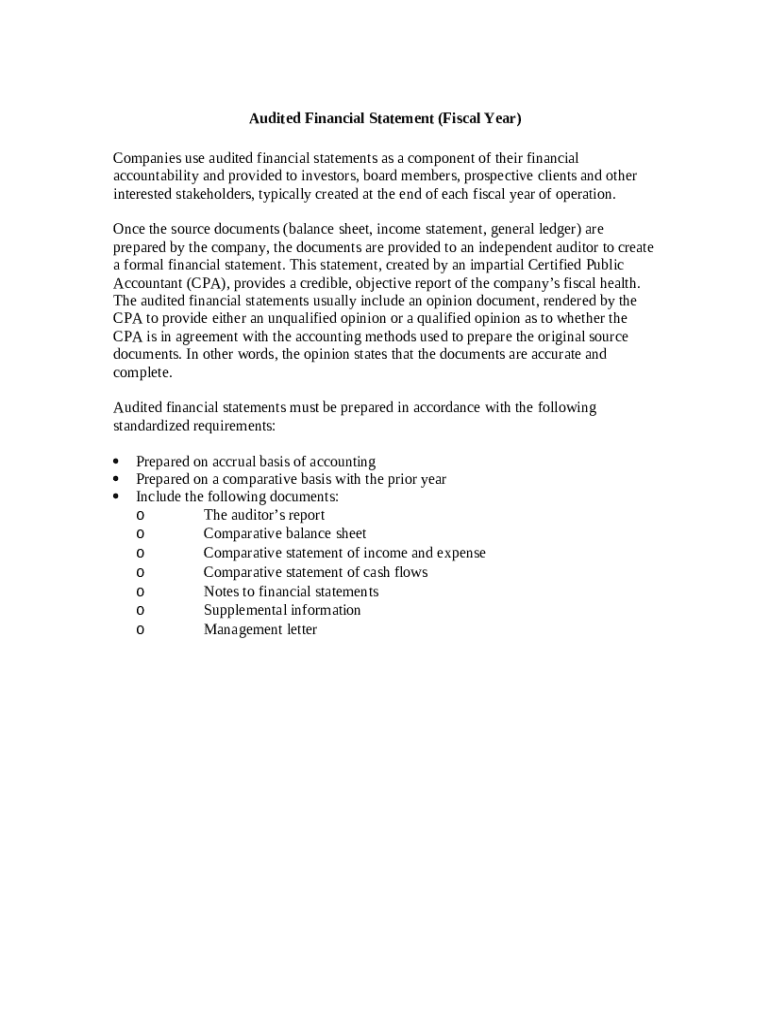

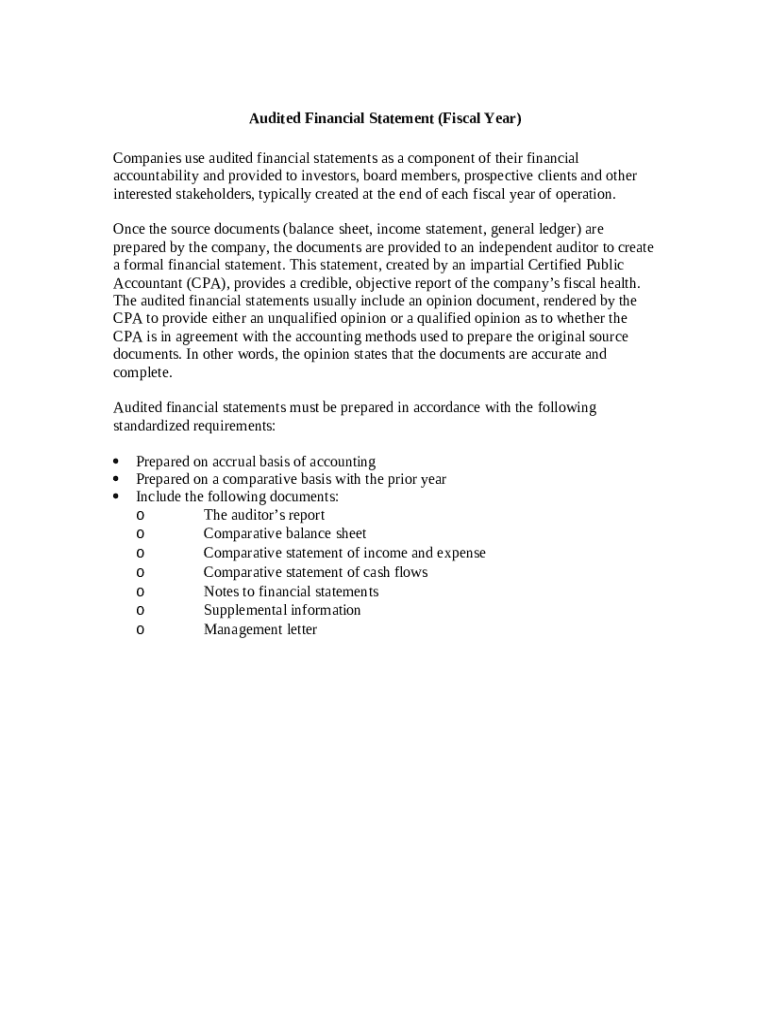

What are audited financial statements?

Audited financial statements are official records that have been examined by a certified public accountant (CPA), ensuring they accurately depict a company's financial position. These statements include key documents such as the balance sheet, income statement, and cash flow statement, playing a vital role in providing assurance to stakeholders regarding financial accountability.

Why are audited financial statements important for stakeholders?

For stakeholders such as investors, board members, and clients, audited financial statements are crucial as they reflect the financial health of an organization. They help in making informed decisions about investments, assessing risks, and understanding corporate governance compliance, thus promoting trust and transparency.

How do CPAs conduct audits and what are their opinions?

Certified Public Accountants (CPAs) conduct audits through a systematic evaluation of financial documents, testing internal controls and verifying data accuracy. Their findings culminate in an auditor's opinion which can be categorized as unqualified—indicating no significant issues—or qualified, highlighting areas where the financial statements may not fully comply with accounting standards.

What essential documents are needed for an audit?

To prepare for an audit, essential documents such as the balance sheet, income statement, and general ledger must be collected. These documents provide the necessary data to create a comprehensive financial picture and comply with standard preparation guidelines.

What components make up an audited financial statement?

An audited financial statement typically includes several key components: the auditor's report detailing the findings, comparative financial documents from previous years, and the main financial statements. This breakdown ensures clarity and demonstrates that the organization adheres to accounting standards set forth by regulatory bodies.

What are the standardized preparation requirements for audited statements?

Preparation requirements vary between accrual basis and cash basis accounting, with finance professionals needing to choose the method that best aligns with their business model. Moreover, comparative basis preparation requires organizations to present current year results alongside previous years for context.

What key financial documents are included in audited statements?

Key financial documents in audited statements include the auditor's report, income and expense statements, and cash flow statements. It is also essential to provide notes and supplemental information, as they lend valuable insights that aid in understanding the organization's overall financial performance.

How does pdfFiller assist in managing audited FY financial statements?

pdfFiller empowers users to seamlessly fill out, edit, sign, and manage forms with its cloud-based solutions. The platform simplifies the process of document management, allowing users to access their forms from anywhere, thereby enhancing efficiency and reducing errors in filling out audited financial statement forms.

How to navigate relevant forms using pdfFiller?

Navigating pdfFiller and accessing relevant forms such as Form 582 and Form 1001 is made easy through an intuitive user interface. Users can quickly locate templates, and the platform offers tips for efficient usage, ensuring a smooth form-filling experience.

What compliance standards must be considered?

Compliance standards vary by region and industry, and organizations must familiarize themselves with these requirements to prepare accurate audited financial statements. Non-compliance can lead to legal ramifications and impact the organization's reputation, making adherence essential.

How to fill out the pdffiller template

-

1.Obtain the PDF version of the audited FY financial statement template from your chosen source.

-

2.Open the PDF file using pdfFiller for editing.

-

3.Begin by entering the company name and address at the top of the document.

-

4.Fill in the fiscal year covered by the statement in the designated field.

-

5.Proceed to input financial figures such as revenues, expenses, and assets in their respective sections, ensuring numbers are accurate and reflect the audited report.

-

6.Include any necessary footnotes or supplementary details that clarify your financial data.

-

7.Review all entered information for completeness and accuracy before finalizing.

-

8.Utilize the 'Save' or 'Download' options on pdfFiller to save the completed document, and if needed, print it directly from the platform.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.