Get the free Operating Budget template

Show details

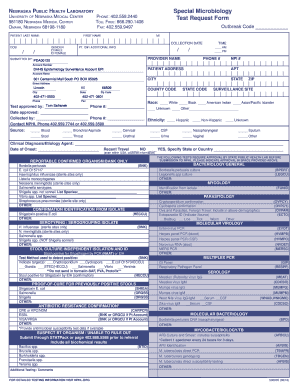

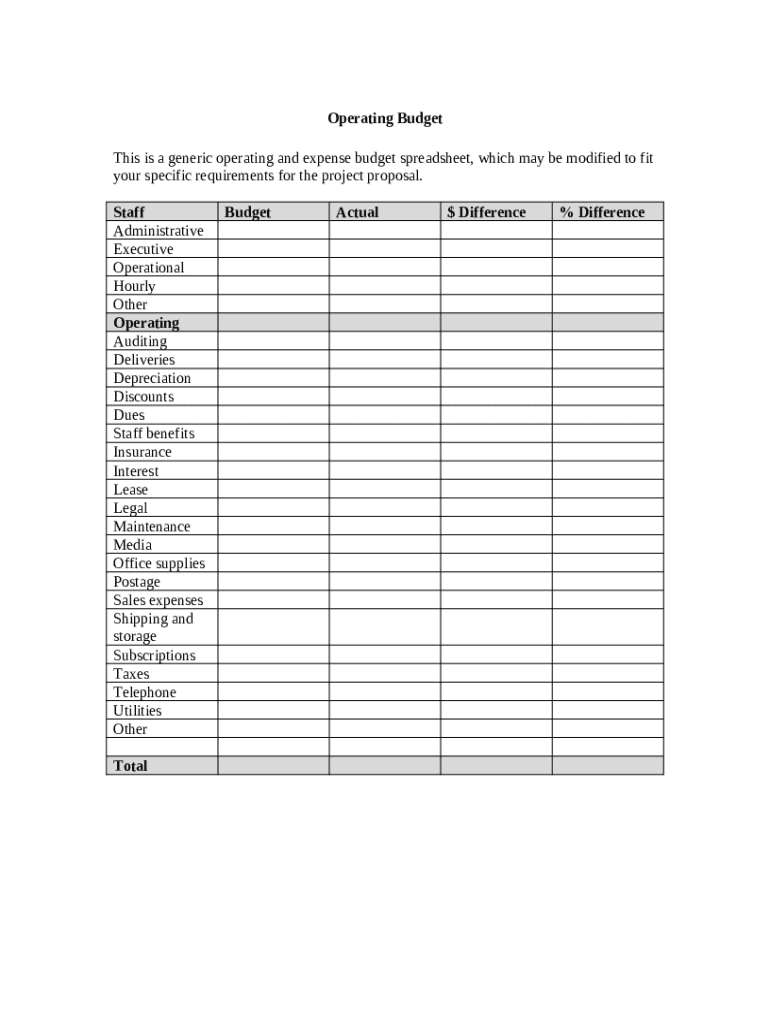

Operating Budget

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is operating budget

An operating budget is a financial plan that outlines expected income and expenses over a specific period, typically a year, to guide the day-to-day operations of an organization.

pdfFiller scores top ratings on review platforms

Minor problems caused by me not being…

Minor problems caused by me not being totally familiar with the program

Had to fill in dates byhand

best of all pdf editing app

good

good love it!

es practico y muy fácil e aplicar, cuando tengo que hacer algunas modificaciones en los textos.

It was frustrating at the beginning. I don't know how to rename a document. I will try and read the manual within the next week. I will attend the webinar.

Who needs operating budget template?

Explore how professionals across industries use pdfFiller.

Comprehensive Guide to Operating Budget Forms on pdfFiller

How does an operating budget impact financial planning?

An operating budget is essential for financial health, providing a roadmap for managing costs and revenues. It helps organizations allocate resources effectively, ensuring that funds are directed towards priority areas. Neglecting this budget can lead to overspending, reduced profitability, and may even jeopardize operational sustainability.

-

It serves as a financial blueprint for an organization over a defined period, usually annually.

-

An operating budget guides decisions, helping managers assess whether the organization is on track.

-

Failure to adhere to a budget can result in financial distress and hinder operational goals.

What are the key components of an operating budget?

An effective operating budget encompasses several key components that contribute to a comprehensive financial overview. By systematically breaking down categories such as administrative, operational, and executive expenses, organizations can gain clearer insights into their financial standing.

-

These may include Administrative, Operational, and specific categories for various roles within the organization.

-

Elements like auditing fees, deliveries, and depreciation need careful consideration in the budgeting process.

-

It is critical to compare budgeted amounts against actual spending to understand financial performance.

How to create an effective operating budget?

Filling out an operating budget form effectively can dramatically improve your financial management. Start by gathering data on income sources and estimated expenses, then follow a structured approach to complete your budget.

-

Begin with a clear listing of all anticipated income and expenses, ensuring accuracy at every stage.

-

Utilize historical data and forecasts to ensure your estimates are realistic and achievable.

-

Consider using pdfFiller for creating and managing your budget forms easily.

What interactive budgeting tools does pdfFiller offer?

pdfFiller provides a suite of features that enhance budget creation and management, allowing for streamlined editing and eSigning of budget forms. Collaboration options allow teams to work together efficiently, making the process faster and more effective.

-

Utilize pdfFiller’s intuitive tools for seamless PDF editing and secure electronic signatures.

-

Team members can collaborate in real-time, enhancing communication and efficiency.

-

Access pre-built templates tailored to various industries, simplifying the budgeting process.

How are expense categories structured?

Identifying and organizing expense categories is crucial for managing an operating budget effectively. Key categories may include staff salaries, utility bills, and office supplies, and businesses can customize these categories based on their specific needs.

-

Expenditures related to payroll should be one of the largest budget considerations.

-

Regular utility payments must be anticipated accurately to avoid budget shortfalls.

-

Tracking office supplies ensures that essential items are always available without overspending.

How to use the operating budget template from pdfFiller?

The operating budget template provided by pdfFiller is a versatile resource that simplifies the budgeting process. Downloading and customizing the template can save time while enabling precise tracking of budgeted amounts versus actual expenses.

-

Easily download the template directly from pdfFiller’s library.

-

Follow a clear walkthrough to input budgeted figures, actual spending, and differences.

-

Frequent revisions to budget entries can significantly improve financial oversight.

What does operating budget performance analysis entail?

Analyzing an operating budget's performance involves comparing budgeted figures to actual expenses. This comparison helps identify discrepancies and areas that require attention.

-

Identifying variances is crucial for understanding business performance and making informed decisions.

-

Interpreting the dollar and percentage differences allows for targeted adjustments in future budgets.

What are common mistakes to avoid in budgeting?

Many organizations fall into common traps while preparing their budgets. By being aware of potential pitfalls, you can take proactive steps to create a more accurate and functional budget moving forward.

-

Underestimating costs or overestimating revenues can throw a budget off balance.

-

Failure to regularly review the budget against actual spending can lead to costly mistakes.

-

Budgeting without accounting for unexpected expenses can jeopardize overall financial health.

How to customize your operating budget strategy by industry?

Different industries have unique challenges and requirements, and it's essential to customize your operating budget accordingly. By examining examples from sectors such as nonprofits, small businesses, and restaurants, you can design a budget that meets specific operational needs.

-

Tailoring your budget to specific industries can enhance relevance and compliance.

-

Be aware of compliance requirements that affect budgeting in different locales.

-

Leveraging sector-specific strategies can result in more robust budgeting practices.

How to fill out the operating budget template

-

1.Open pdfFiller and upload your operating budget template.

-

2.Start by filling in the header with your organization's name and the budget period.

-

3.In the income section, list all expected revenue sources, ensuring you specify amounts for each category.

-

4.Proceed to the expenses section and categorize all anticipated costs, including fixed and variable expenses.

-

5.Ensure to include all line items such as salaries, utilities, and supplies with accurate projections.

-

6.Review each entry for accuracy and completeness before finalizing.

-

7.Use any available budget notes section for additional explanations or assumptions.

-

8.Once completed, save the document using an appropriate file name for your records.

-

9.Finally, share or print the operating budget document as needed for stakeholders.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.