Get the free Direct Deposit for Employees template

Show details

Direct deposit is a process where someone who is going to be paid on a recurring basis, such as an employee, or a recipient of a government entitlement or benefit program such as social security,

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is direct deposit form for

A direct deposit form is a document used to authorize the electronic transfer of funds directly into a bank account.

pdfFiller scores top ratings on review platforms

My first time using

My first time using, it taken a few minutes to learn, but afterwards it is very easy.

Amazing app

I would like to be able to edit pdf forms

great prduct

great!

It is useful. Only thing I would like is for it to figure out what font I had on the document BEFORE I edit it. I have contract templates that I use that I have to edit sometimes and finding the font that will match that size and actual type is very difficult. i usually end up just dealing with whichever one I find. If there is a way to do that, please let me know via email.

Who needs direct deposit for employees?

Explore how professionals across industries use pdfFiller.

Comprehensive Guide to Direct Deposit Form on pdfFiller

Filling out a direct deposit form ensures your paycheck goes directly into your bank account, eliminating the need for physical checks. In this comprehensive guide, we will cover everything you need to know about the direct deposit form, from understanding how it works to filling it out accurately on pdfFiller.

What is direct deposit and what are its advantages?

Direct deposit is an electronic transfer of funds from an employer directly into an employee's bank account. It offers numerous advantages, such as convenience, speed, and enhanced security.

-

Employees no longer need to visit the bank to deposit checks, as funds are transferred automatically.

-

Payments are received quicker than traditional checks, often on the same day.

-

Direct deposits reduce the risk of checks being lost or stolen.

For employers, offering direct deposit can lower administrative costs associated with printing and distributing checks, while also enhancing employee satisfaction.

What personal information do you need to prepare?

Before you fill out the direct deposit agreement, gather essential personal information. This ensures that the form is completed accurately and without delays.

-

Your legal name as it appears on your bank account.

-

Your current residential address.

-

To ensure proper identification for tax purposes.

Gathering your bank details, including routing and account numbers, is crucial for setting up your direct deposit correctly.

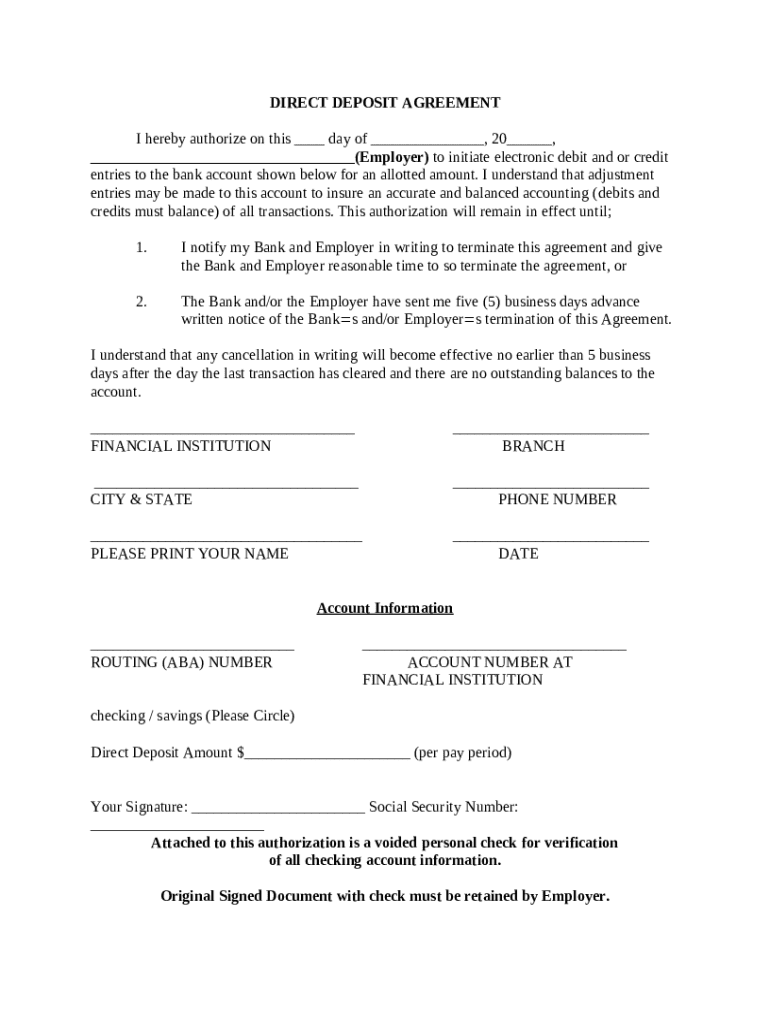

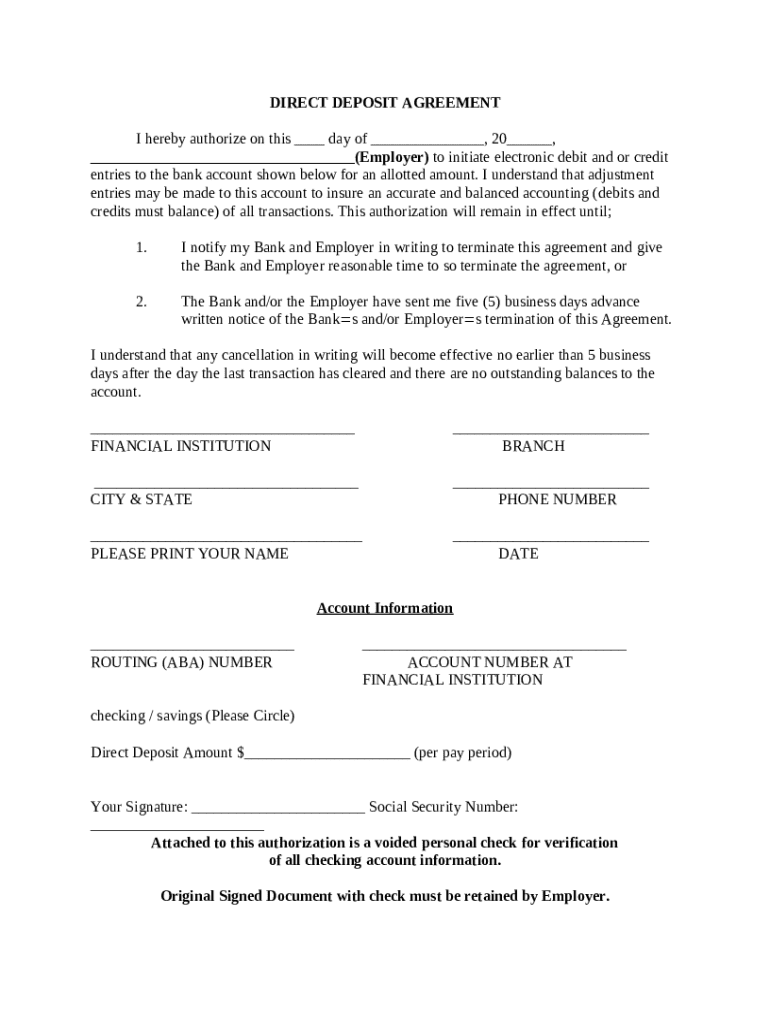

How do you fill out the direct deposit agreement?

To fill out the direct deposit agreement, follow a series of simple steps to ensure that all information is captured accurately.

-

Indicate when you are submitting this form.

-

Provide the name and address of your employer.

-

Input your bank's routing number and your account number.

-

Indicate how much you wish to deposit per pay period, if applicable.

How to edit and finalize your document on pdfFiller?

pdfFiller offers a user-friendly platform to edit your direct deposit agreement. Utilize its comprehensive editing tools to make necessary adjustments.

-

Use pdfFiller’s features to edit the document's text and layout.

-

Complete the form by adding your electronic signature.

-

Share the document for review and approval to ensure that all details are correct.

How do you submit your direct deposit agreement?

Once your direct deposit agreement is complete, the next step is to submit it to your employer. Following best practices can ensure smooth processing.

-

A voided check or a bank letter may be required to confirm your banking details.

-

Choose a secure way to submit the form, like encrypted email or a secure company portal.

-

Always ensure your personal and banking information remains confidential.

What to do when adjusting or revoking direct deposit setup?

Life changes often necessitate adjustments to your direct deposit setup. Knowing how to make these changes is essential.

-

Inform your employer promptly about any necessary changes to your banking information.

-

Follow the established protocol for revoking your direct deposit authorization, which varies by employer.

-

Be aware that processing changes can take several pay cycles, so plan accordingly.

How to fill out the direct deposit for employees

-

1.Obtain the direct deposit form from your employer's HR department or download it from PDF Filler.

-

2.Open the form in PDF Filler and locate the sections that need to be filled out.

-

3.Begin with your personal information, including your full name, address, and contact details.

-

4.Fill out your bank account information, including the bank's name, routing number, and your account number accurately.

-

5.Choose whether you want the deposit to go into a checking or savings account.

-

6.Review the completed sections to ensure there are no mistakes.

-

7.Sign and date the form where required to authorize the direct deposit.

-

8.Save the filled form and submit it according to your organization's submission guidelines, which may include emailing or handing it in person.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.