Last updated on Feb 17, 2026

Get the free pdffiller

Show details

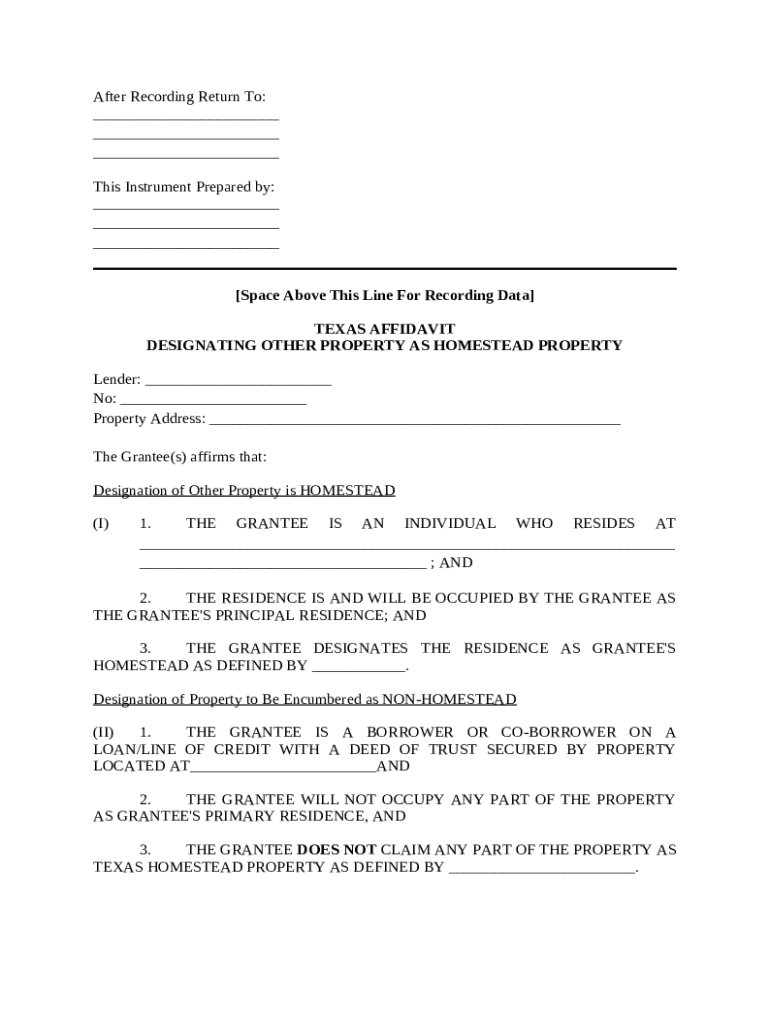

This affidavit is used to designate another property as legal Homestead Property as defined by Texas Law and list the location of non-homestead property.

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is tax affidavit designation oformr

A tax affidavit designation of form is a legal document used to establish the tax status or exemption of an individual or entity for tax purposes.

pdfFiller scores top ratings on review platforms

I enjoy the simplicity of it all!!

Pleased.

I found it helpful, but hard to find the print menu.

Great site for legal forms needed.

Sometimes I get lost or confused about how to save a document I have just uploaded as a pdf file, but then I find the "Save As" button.

very helpful and easy to navigate

Who needs pdffiller template?

Explore how professionals across industries use pdfFiller.

Tax affidavit designation of homestead property guide

Filling out the tax affidavit designation of homestead property form ensures your property gains certain tax benefits, such as exemptions. This guide will walk you through the essential components and instructions for completing this important document.

What is a tax affidavit designation?

A tax affidavit is a legal document that allows homeowners to designate their property as homestead property, which can offer tax savings. Homestead property is typically considered your primary residence, and designating it as such protects it from certain creditors and grants you a property tax exemption.

-

A tax affidavit serves as a formal declaration that specific property meets the requirements to be classified as homestead, ensuring eligibility for tax benefits.

-

Designating your property as homestead can significantly reduce your property tax liability and extend certain legal protections.

-

Homestead properties typically enjoy favorable tax treatment and additional protections under the law, while non-homestead properties do not.

Who needs to file a tax affidavit?

Certain categories of individuals must file a tax affidavit to properly designate their properties. Understanding these requirements is crucial for compliance and maximizing tax benefits.

-

Homeowners who live in their property full-time are typically required to file a tax affidavit for homestead designation.

-

Individuals who have taken out loans using their home as collateral may also need to file to ensure that their property remains protected.

-

In Texas, specific legal guidelines dictate who is eligible and mandated to file a tax affidavit for homestead designation, protecting homeowners' rights.

What are the key components of the affidavit form?

The tax affidavit form consists of several essential sections that must be accurately filled out to ensure proper processing.

-

This section determines where the form should be returned after processing and is critical for timely notifications.

-

This portion includes the information of the individual filling out the affidavit, which must be complete and accurate.

-

This area is designated for the clerk to record the information related to the affidavit’s filing.

-

If applicable, the lender's details must be included to clarify any financial claims over the property.

-

This section requires the designated homeowner to affirm their intent and eligibility for homestead designation.

How do you fill out the affidavit: step-by-step?

Filling out the tax affidavit can seem daunting, but by breaking it down step by step, it becomes manageable.

-

Begin by including the full name and address of the property owner in the grantee section.

-

Follow the specific instructions to indicate that the property is your primary residence.

-

In cases where the property is not a primary residence, ensure to follow the guidelines for accurate designation.

-

Complete the document with necessary signatures and have it notarized to authenticate the affidavit.

What are common mistakes to avoid?

Some common pitfalls can lead to delays or rejections when submitting your affidavit. Being aware of these can help streamline the process.

-

Always verify that each section is filled out completely and that all required signatures are provided.

-

Ensure all details regarding the grantee’s information are accurate to avoid complications.

-

Remember to file the completed affidavit with your local tax authority to ensure it is officially recognized.

How to manage your affidavit after submission?

Once you submit your tax affidavit, it's essential to manage it appropriately to ensure everything stays on track.

-

Keep a record of the submission date and follow up with the local tax authority to confirm receipt.

-

Be proactive about updating your affidavit if there are any changes to your property status or ownership.

-

Stay informed about any local deadlines or requirements to keep your status current and valid.

What resources are available for further assistance?

There are various resources you can access for additional assistance with the tax affidavit designation process.

-

Reach out directly to your local tax office for questions or clarifications regarding your affidavit.

-

Utilize pdfFiller's comprehensive tools for managing and editing your tax affidavit, ensuring you have access to every necessary feature.

-

Explore available resources online to gather common information regarding tax affidavit filing procedures.

How to fill out the pdffiller template

-

1.Access the PDFfiller website and log in to your account or create a new account if you don't have one.

-

2.Search for 'tax affidavit designation oformr' in the template library.

-

3.Select the correct form from the search results to open it for editing.

-

4.Carefully read through the instructions provided with the form to ensure understanding of requirements.

-

5.Begin filling out the form by entering your personal information such as name, address, and tax identification number in the designated fields.

-

6.Complete any necessary sections that pertain to your tax status or exemptions, ensuring all required data is provided.

-

7.Review each section for accuracy, checking for any errors or missing information before proceeding.

-

8.Once all required fields are filled, use the PDFfiller tools to electronically sign the document if needed.

-

9.Finally, save the completed form and download it as a PDF or send it directly to the intended recipient through PDFfiller's platform.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.