Get the free Correction of Invoice template

Show details

An invoice is a document or electronic statement stating the items sold and the amount payable. It is also called a bill.

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is correction of invoice

A correction of invoice is a document used to amend errors or inaccuracies in an issued invoice.

pdfFiller scores top ratings on review platforms

Excellent. I would like to learn all the tricks.

its fine

Its easy and does all I need.

Very simple instructions. Easy to navigate. Good Resource for Business.

Very pleasant

Hard to get started but help from pdfiller, google and youtube got me going.

Who needs correction of invoice template?

Explore how professionals across industries use pdfFiller.

Guide to correcting invoices on pdfFiller

How to handle invoice corrections effectively?

Correcting an invoice is crucial for maintaining accurate financial records. In this guide, we will explore the processes involved in the correction of invoice forms on pdfFiller, a powerful platform that allows users to edit and manage documents easily.

-

Timely invoice corrections can help prevent delayed payments, maintain client trust, and avoid potential disputes.

-

With pdfFiller, users can quickly edit invoices using its extensive editing tools, ensuring all information is updated in real-time.

Why is it necessary to correct invoices?

Invoices often contain errors due to various reasons like data entry mistakes or misunderstanding of services rendered. Not addressing these discrepancies can lead to confusion, trust issues with clients, and financial complications.

-

Mistakes can occur in product descriptions, quantities, and pricing, which can result in undercharging or overcharging clients.

-

Failure to correct invoices can result in late payments, loss of customer confidence, and potential legal ramifications.

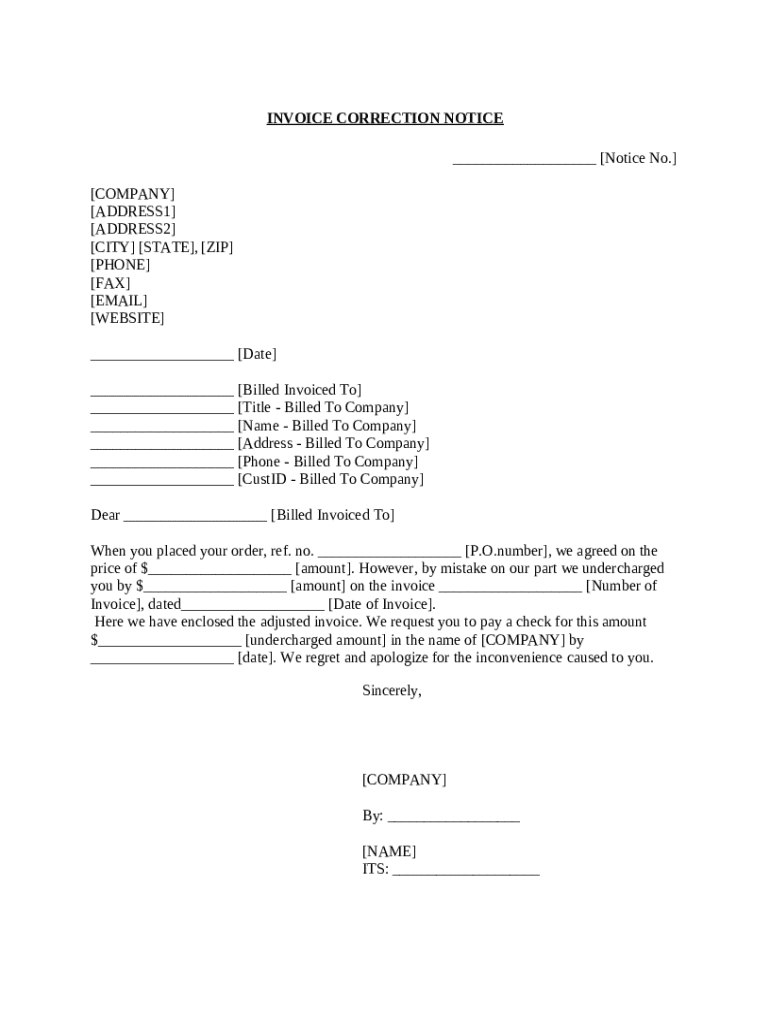

What should be included in an invoice correction notice?

An invoice correction notice must communicate changes clearly to prevent further confusion. Important elements include the original invoice details, specific corrections made, and updated payment information.

-

These include original invoice number, date of correction, and a detailed explanation of the changes made.

-

A well-crafted correction notice enhances transparency and aids in maintaining professional relationships between businesses and clients.

How do you create a step-by-step invoice correction notice?

Creating a correction notice requires attention to detail. Here’s a structured process for filling it out effectively.

-

Include your company details, such as the name, address, and contact information, along with the notice number.

-

Clearly state the information about the billed company to avoid miscommunication.

-

Explain what error was corrected on the previous invoice, providing as much clarity as possible.

-

Ensure that the corrected amounts and due dates are accurate to facilitate seamless transactions.

How to correct invoices before issuance?

Preventing errors before invoices are issued can save time and reduce issues later on. It's essential to establish a systematic review process.

-

Establishing a checklist can help ensure no crucial information is missed in the invoice.

-

pdfFiller offers tools to revisit and edit invoices before final submission, enhancing accuracy.

What are the steps for correcting issued invoices?

If an invoice has been sent, the correction process demands careful handling to avoid confusion. Understanding the amendment process is vital.

-

Recognize that corrective actions may involve notifying the client and providing clear explanations.

-

Leverage pdfFiller's seamless updating features that allow corrections without starting from scratch.

What legal considerations should be kept in mind during invoice corrections?

Understanding legal implications related to invoice corrections is necessary for compliance and avoiding potential disputes.

-

Ensure that the corrections do not violate any invoicing regulations in your region.

-

Consult legal experts or resources to stay updated on best practices pertinent to your business area.

When and how should proforma invoices be corrected?

Proforma invoices serve as preliminary bills and may require corrections under certain circumstances. Understanding this is crucial.

-

Corrections may be necessary if terms change or errors are found prior to finalizing the sale.

-

With pdfFiller’s user-friendly tools, users can efficiently adjust proforma invoices as needed.

What additional resources are available for invoice corrections?

Many resources are available for people looking to enhance their invoice management process. pdfFiller provides various templates and guides that help users through the correction process.

-

pdfFiller offers numerous templates to simplify creating and correcting invoices without hassle.

-

Visit pdfFiller to explore comprehensive guides that help streamline your invoicing and correction processes.

How to fill out the correction of invoice template

-

1.Open the invoice correction template using pdfFiller.

-

2.Enter the original invoice number that needs correction in the designated field.

-

3.Clearly indicate the date of the original invoice to provide context.

-

4.List the items or services that require correction, detailing the changes necessary.

-

5.Include a brief explanation for each correction to clarify the reason behind the amendment.

-

6.Input the correct amounts and ensure they match the adjustments made.

-

7.Add contact information for the issuing party to facilitate communication.

-

8.Review the entire document for accuracy, ensuring all changes are accurately reflected.

-

9.Save the completed correction of invoice and export it in the desired format.

-

10.Distribute the corrected invoice to all relevant parties for their records.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.