Get the free Direct Deposit for IRS template

Show details

Direct deposit is a process where someone who is going to be paid on a recurring basis, such as an employee, or a recipient of a government entitlement or benefit program such as social security,

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is direct deposit form for

A direct deposit form is a document that allows employees or individuals to authorize the electronic transfer of their paycheck or other funds directly into their bank account.

pdfFiller scores top ratings on review platforms

VERY GOOD SERVICE

so far good pdf

so far good pdf. i was able to share the info with others. saved me so much time.

i've been using this service for years

i've been using this service for years. I'm happy with all the new improvements. Especially the month to month service fee.This service is excellent!- Thank you!

good

goodi really like it, super easy and simple

Love the ease of use.

THIS IS A GREAT APP TO USE FOR ALL OF…

THIS IS A GREAT APP TO USE FOR ALL OF YOUR BUSINESS NEEDS... VERY EASY TO USE AND HANDS ON

Who needs direct deposit for irs?

Explore how professionals across industries use pdfFiller.

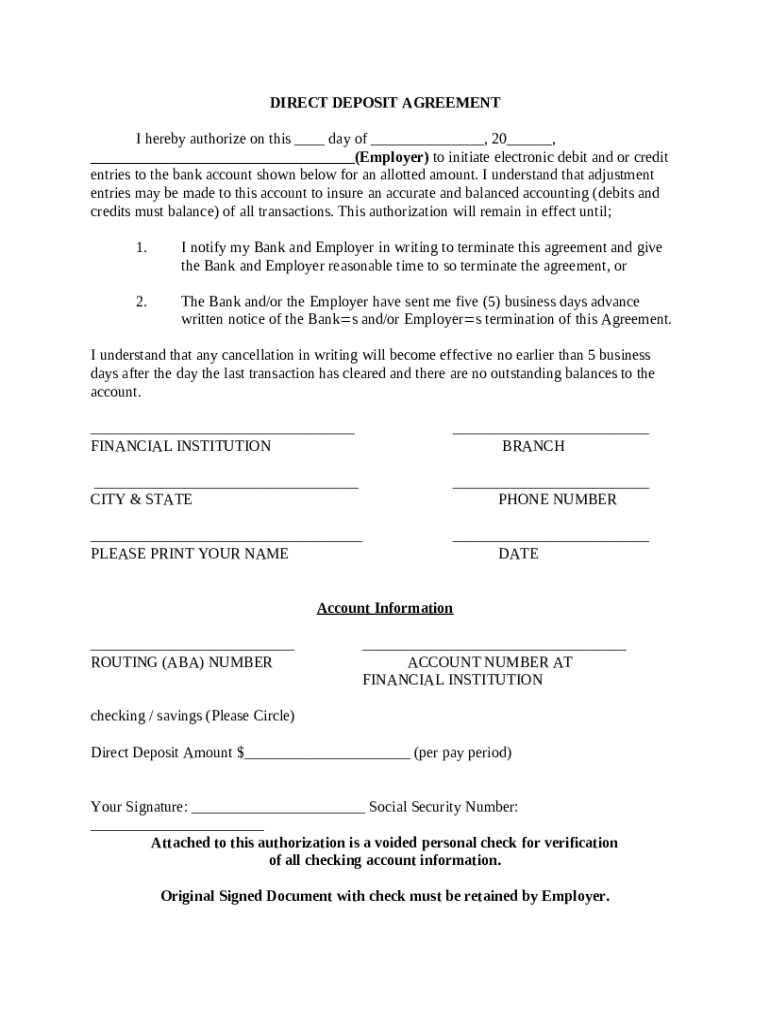

Comprehensive Guide to Completing the Direct Deposit Form

Filling out a direct deposit form is straightforward but requires careful attention to detail. This guide will provide essential instructions on how to complete the form accurately, ensuring you enjoy the convenience of direct deposits.

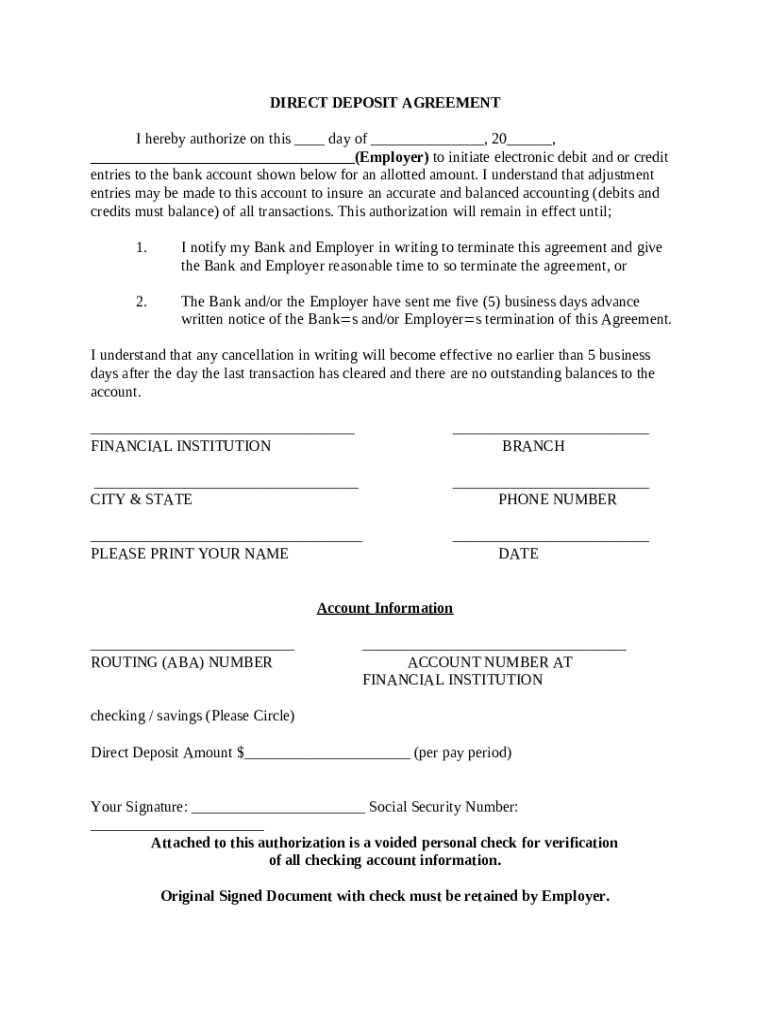

What is a direct deposit agreement?

A direct deposit agreement is a consent form allowing your employer to deposit your paycheck directly into your bank account. This arrangement is crucial as it simplifies payroll and secures timely payments.

Why is direct deposit important?

Direct deposit offers several advantages for both employers and employees. For employers, it reduces administrative costs and paper usage, while employees benefit from faster access to funds, often immediately on payday.

Common use cases for direct deposit

-

Employers use direct deposit for recurring salary payments, ensuring employees receive their wages without delay.

-

Many companies use direct deposit for bonuses, allowing a seamless distribution of additional earnings.

-

Direct deposits are also used to reimburse employees for work-related expenses swiftly.

What are the key components of the direct deposit form?

Filling out the direct deposit form correctly is essential to ensure that your funds are deposited without issues. Here are the primary components you need to know.

-

You must provide your consent, which often includes your name, address, and employee identification number.

-

This section requires your bank's routing number and your account number to direct deposits to the correct account.

-

Some forms may allow you to specify a percentage or fixed amount that goes into checking or savings accounts.

How do you fill out the direct deposit form?

Filling out the direct deposit form requires a step-by-step approach to avoid common errors.

-

Have your bank information, including routing numbers and account numbers, readily available.

-

Each form may have specific instructions, so read them carefully before completing it.

-

Before submitting, verify that all content is accurate to prevent misdirected payments.

What common mistakes should you avoid while filling out the form?

Avoiding common mistakes can save you time and headaches down the line. Ensure your details are correct and follow each step diligently.

-

Double-check these numbers as errors can lead to missing payments.

-

Most forms require your signature; failing to sign can delay processing.

-

If your bank details change, always provide an updated form to your employer.

How do you submit your direct deposit form?

Submitting your direct deposit form is a crucial last step to ensure you start receiving payments electronically.

-

Your employer may have specific submission guidelines—adhere to them for smooth processing.

-

You can typically submit via email, in-person, or through traditional mail. Consider the fastest method for your situation.

-

Keep records of your submission methods and timelines to address any potential delays.

What if you need to modify or terminate your direct deposit arrangement?

Life changes require that you adjust your direct deposit arrangements effectively.

-

Understand the circumstances under which you may cancel your direct deposit, such as ending employment.

-

Inform your employer and bank of your decision to avoid payment disruptions.

-

Allow adequate processing time for the cancellation to take effect and ensure no payments are missed.

How do you ensure compliance with financial regulations?

Understanding financial regulations is crucial to maintain compliance for direct deposit systems.

-

Know the laws governing direct deposits in your country to avoid penalties.

-

Be aware of any unique regulations depending on where you live or work.

-

Stay informed about typical issues related to direct deposits, including security concerns.

How can pdfFiller simplify the direct deposit process?

pdfFiller offers a streamlined solution for managing the direct deposit process, allowing users to edit, sign, and store documents in a cloud-based environment.

-

With pdfFiller, users can quickly edit their direct deposit forms and add digital signatures.

-

Teams can work together efficiently on submissions, enhancing productivity.

-

All documents are securely stored in the cloud, allowing for easy access and management from anywhere.

How do you verify your direct deposit setup?

Verifying your direct deposit setup ensures that your payments are processed correctly and on time.

-

Confirm with your bank that your account is set up to receive direct deposits.

-

Keep an eye on your payroll dates to ensure that funds are arriving as expected.

-

If payments are delayed or missing, contact both your bank and employer for quick resolution.

How to fill out the direct deposit for irs

-

1.Access the direct deposit form on pdfFiller.

-

2.Begin by entering your personal details at the top of the form, including your name, address, and contact information.

-

3.Locate the section for banking information and fill in your bank's name and address.

-

4.Enter your account number accurately, ensuring no digits are missed or added incorrectly.

-

5.Choose your account type (checking or savings) and mark the appropriate box.

-

6.If required, provide the bank’s routing number, which you can find on your checks or ask your bank for assistance.

-

7.Review all the information filled in to ensure accuracy, as mistakes can delay your payments.

-

8.Sign and date the form at the designated space, confirming your authorization for direct deposits.

-

9.Save your completed form as needed, and submit it to your employer or the organization handling your payments.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.