Get the free Collateral Decision, Request for Prep. Of Loan Documents template

Show details

Collateral decision, request for prep. of loan documents

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is collateral decision request for

A collateral decision request for is a formal document used to seek approval for the use of collateral in financial transactions.

pdfFiller scores top ratings on review platforms

It's been great! looking forward to learning more after the holidays.

excellent for business. saves time and easy to use.

Right now, I'm having problems accessing my file, but previously, it was working fine.

I find the ui very east to understand, and very function-able. just what i was looking for.

This is a great tool! It allows me to get all of our business documents into an online document repository. It is going to save us time, money, paper, and the planet!

I love it for my business. It makes it so much easier to have a completely paperless office. We can just scan things into the computer and edit them or use as a document on PDFfiller.

Who needs collateral decision request for?

Explore how professionals across industries use pdfFiller.

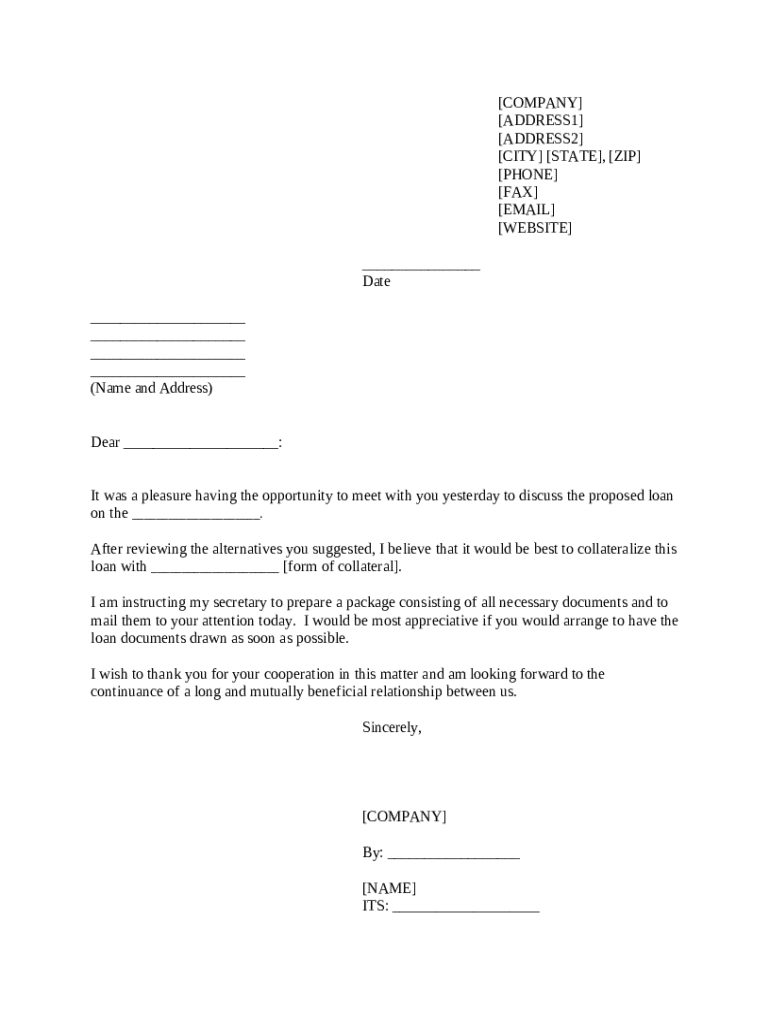

Understanding the Collateral Decision Request Process

A collateral decision request for form form is essential when seeking a loan that requires collateral. It is vital to understand how to properly complete this form, as it plays a crucial role in your loan approval process.

This guide provides step-by-step instructions to help you submit a successful collateral decision request, ensuring you gather all necessary information and fill out the request accurately.

What are collateral decision requests?

A collateral decision request is a formal application submitted to lenders, detailing the collateral a borrower plans to offer as security for a loan. Collateral can include assets such as property, vehicles, or equipment. This request is vital because it helps the lender assess the risk associated with the loan.

Why is collateral important in loan agreements?

Collateral serves as a safety net for lenders, ensuring that they can recover their funds if a borrower defaults on the loan. By securing a loan with collateral, borrowers may also benefit from lower interest rates and improved loan terms. Understanding its significance helps streamline the collateral decision process.

What to expect during the collateral decision process?

Once you submit your collateral decision request, expect the lender to evaluate the information provided, including the value of the collateral and your creditworthiness. This assessment may take several days. Be prepared for potential follow-up questions to clarify details.

What are the key components of a collateral decision request?

-

Include your company's name, address, phone number, and email.

-

Describe the collateral you plan to offer, including its market value and condition.

-

Provide details about the loan such as the amount requested and the purpose.

How to complete the collateral decision request form?

To fill out your collateral decision request form accurately, start with your company's information. Follow up by adequately describing the proposed loan and the form of collateral you're offering.

-

Enter your company’s legal name and contact details.

-

Clearly articulate the loan amount and its intended use.

-

Don't forget to sign and date the form to validate it.

-

Once completed, review and submit the form to your lender.

What tips can enhance communication when requesting collateral?

-

Use straightforward language to avoid misunderstandings.

-

Maintain a formal tone to reflect the seriousness of your request.

-

Communicate any time constraints you may have.

-

Thank the lender for their consideration.

What documents are typically required for loan preparation?

When preparing for a loan, various documents are required to substantiate your collateral and financial standing. Common documents include financial statements, tax returns, and proof of collateral ownership. Gathering these in advance can expedite the approval process.

How to manage collateral decision requests effectively?

-

Develop a checklist of all necessary documents to ensure nothing is overlooked.

-

Tools like pdfFiller can streamline the process by allowing edits and e-signature features.

-

Follow up regularly to stay informed about the request's progress.

How can pdfFiller enhance your collateral management experience?

pdfFiller provides powerful features for managing your collateral request forms. Users can easily edit PDFs, add necessary information, and employ e-signatures for speedy authentication. Collaboration is simplified through its cloud-based platform, making it easier for team members to contribute to collateral decisions.

What should you do to finalize your collateral decision request?

-

Review all information to ensure it is correct and complete.

-

Submit the completed request promptly to avoid delays.

-

Be proactive in following up with the lender if you do not receive feedback within the expected timeframe.

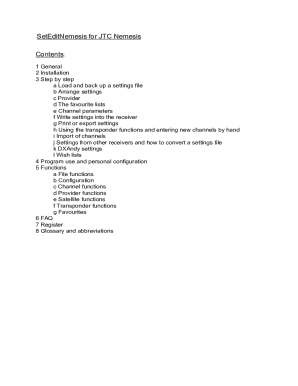

How to fill out the collateral decision request for

-

1.Open the pdfFiller platform and log in to your account.

-

2.Upload the collateral decision request form if not already available in your documents.

-

3.Begin filling in the required fields, starting with your contact information at the top of the form.

-

4.Provide details about the collateral involved, including type, value, and any relevant descriptions.

-

5.Fill in the borrower’s information accurately, including their name, address, and identification details.

-

6.Specify the purpose of the collateral and any associated loan details.

-

7.Review the terms and conditions related to the collateral agreement to ensure compliance with policies.

-

8.If needed, attach any supplementary documents that support your request for collateral approval.

-

9.Once all fields are completed, review the form for accuracy and completeness before submission.

-

10.Click the 'Submit' button to send your completed collateral decision request for approval.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.