Get the free Direct Deposit for Employer template

Show details

Direct deposit is a process where someone who is going to be paid on a recurring basis, such as an employee, or a recipient of a government entitlement or benefit program such as social security,

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is direct deposit form for

A direct deposit form is a document that authorizes an employer or organization to deposit funds directly into an individual's bank account.

pdfFiller scores top ratings on review platforms

having trouble getting it to print the whole form... it's only printing the content even when I choose "print original"

Had some trouble with billing and the customer service was right on it and took care of the problem. Software is good and being able to access various pre-made docs is very nice.

This program has made converting locked PDF files more manageable.

this program is the answer to all who work with osha 300 log; thank you so much. Mahalo, and Aloha.

Kalani Whitford / Safety Officer

National Fire Protection Inc.

Excellent format. Easy to follow. Good results.

I'm able to get a ton of things done that I could never before.

Who needs direct deposit for employer?

Explore how professionals across industries use pdfFiller.

A comprehensive guide to completing your direct deposit form

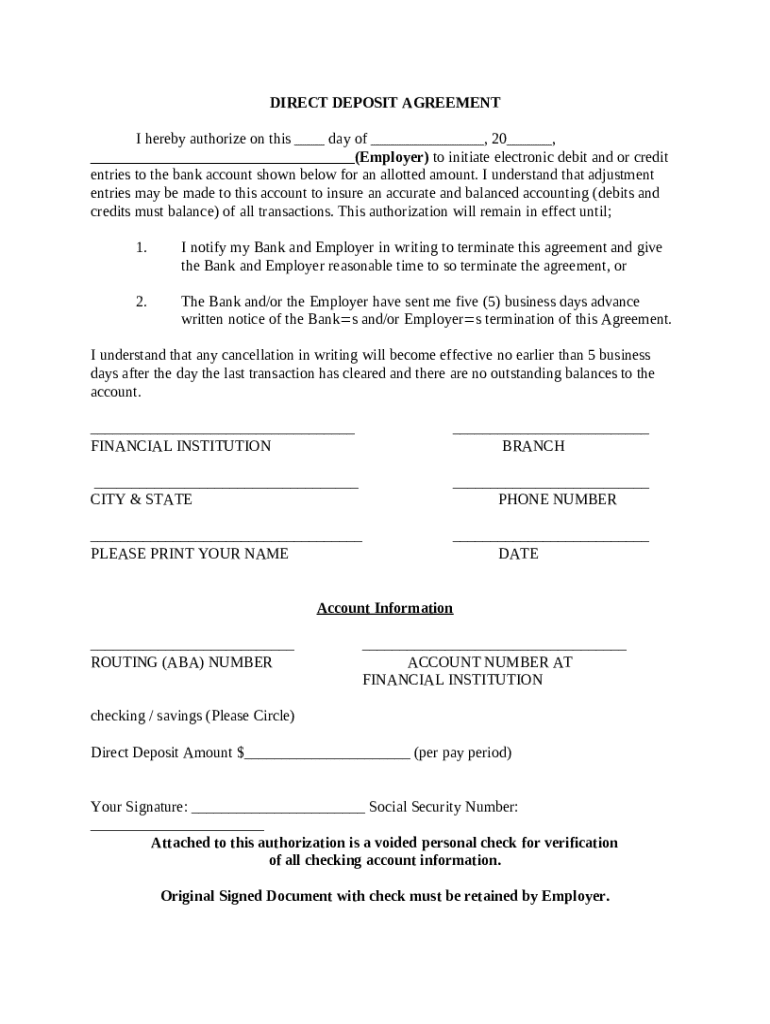

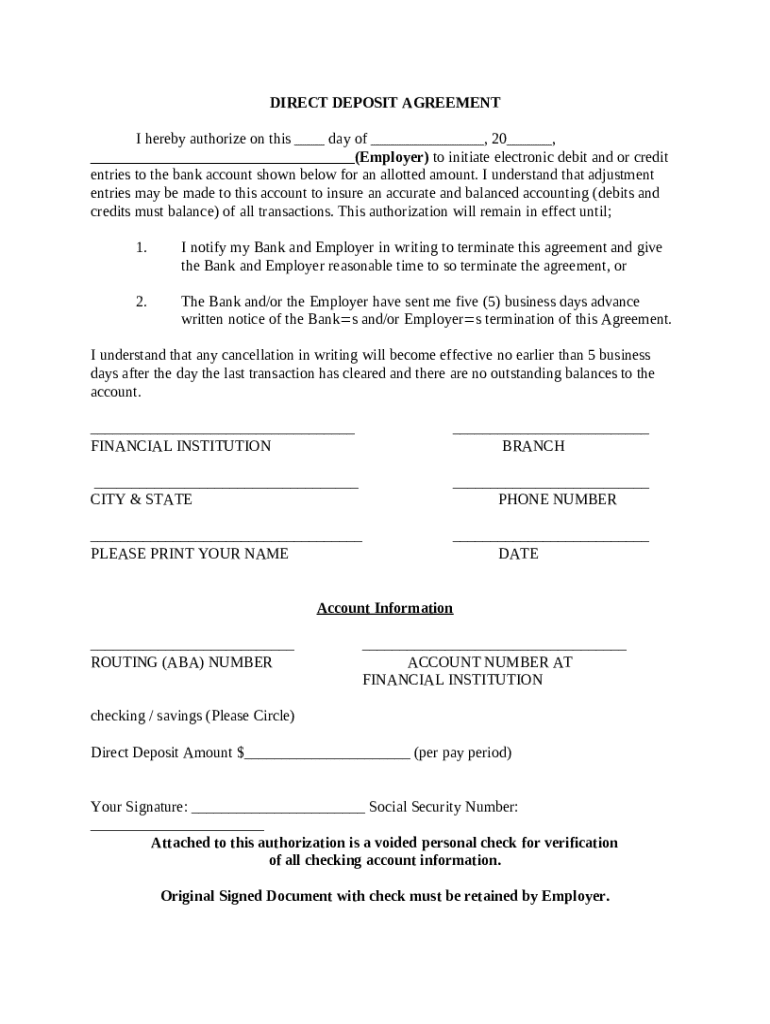

What is a direct deposit agreement?

A direct deposit agreement is a legal document that authorizes the transfer of funds directly into your bank account. Its purpose is to facilitate the efficient payment of salaries and other recurring payments without the need for checks. Completing a direct deposit form correctly is crucial to ensure timely and accurate deposits.

Why is completing a direct deposit form important?

Properly filling out your direct deposit form can save you time and hassle. Direct deposit streamlines the payroll process, reduces the possibility of lost or stolen checks, and ensures funds are available immediately on payday.

What are the benefits of using direct deposit for salary payments?

-

Funds are deposited directly into your account, eliminating trips to the bank.

-

Direct deposits reduce the risk of theft or loss associated with paper checks.

-

Your salary is deposited on the designated payday, ensuring you have access to your money as planned.

What are the essential components of the direct deposit form?

-

Make sure to include your consent for the payments to be deposited directly into your account.

-

Provide accurate details about your employer and the bank receiving the deposits.

-

Understand the terms that govern adjustments or cancellations to your direct deposit arrangement.

How can you fill out your direct deposit form?

Filling out your direct deposit form requires careful attention to detail. Here’s a step-by-step guide to ensure accuracy.

-

Collect your bank account number and routing number.

-

Fill in your personal information accurately, including your name, address, and account details.

-

Double-check all entries for typos, especially numerical errors.

What interactive tools can help with your form experience on pdfFiller?

-

Use pdfFiller to edit the document for accuracy and clarity.

-

Sign your document digitally within the platform to streamline the process.

-

Work directly with your employer or financial institution on the form to ensure everything is correct.

What are best practices for submitting your direct deposit agreement?

-

Submit your completed form well in advance of the next pay cycle to avoid delays.

-

Keep a copy of the signed original document for your records.

-

Set reminders for any updates or cancellations you may need regarding your direct deposit.

What compliance and considerations should you be aware of in your region?

-

Familiarize yourself with local regulations governing direct deposit agreements.

-

Ensure your agreements comply with relevant state and federal laws.

-

Understand your rights in the direct deposit process to protect your interests.

How to fill out the direct deposit for employer

-

1.Obtain the direct deposit form from your employer or financial institution.

-

2.Open the form using pdfFiller or any preferred PDF editor.

-

3.Fill in your name as it appears on your bank account.

-

4.Enter your address, including city, state, and zip code.

-

5.Provide your bank account number where you wish to receive deposits.

-

6.Enter the bank's routing number, which can be found on your checks or bank statements.

-

7.Indicate whether this is a checking or savings account by checking the appropriate box.

-

8.Sign and date the form to authorize direct deposits.

-

9.Review all information for accuracy before submission.

-

10.Submit the completed form to your employer or financial institution as directed.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.