Get the free Invoice Template for Accountant template

Show details

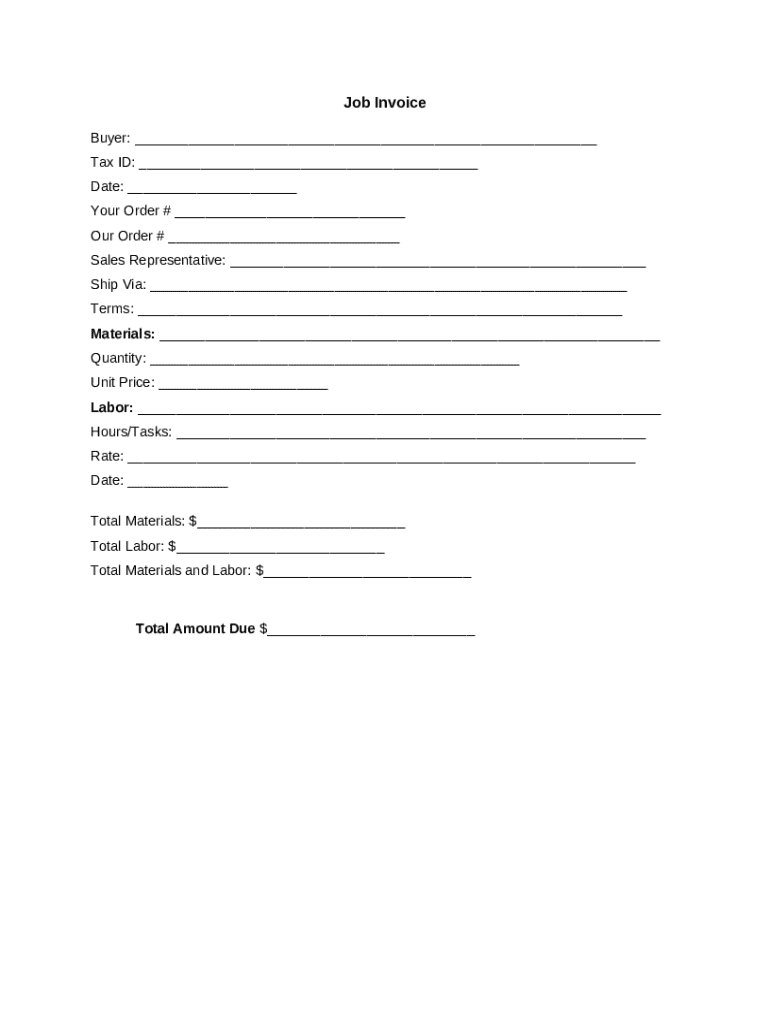

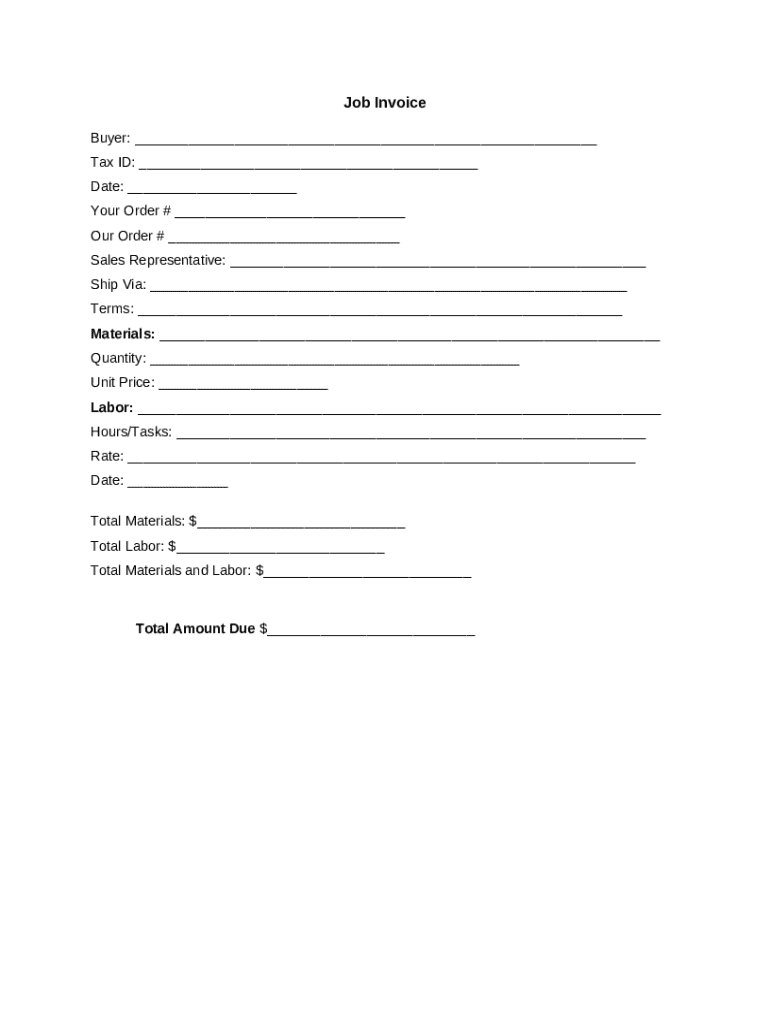

An invoice is a detailed list of goods shipped or services rendered, with an account of all costs - an itemized bill. A job invoice is an invoice detailing work that has been done.

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is invoice template for accountant

An invoice template for accountant is a standardized document used to request payment for goods or services rendered, formatted for ease of use by accountants.

pdfFiller scores top ratings on review platforms

Easy to use. Thanks, Team!

I have had great service and happy that it is easy to use.

Easy to use. Had to do minimum adjusting for my document but satisfied overall.

easy

good

amazing

Who needs invoice template for accountant?

Explore how professionals across industries use pdfFiller.

Long-read how-to guide on invoice template for accountant form

What is the importance of an invoice template?

An invoice template serves as a crucial tool in accounting, especially for accountants who require accuracy and professionalism in billing clients. A standardized invoice template helps avoid common errors, ensuring that all necessary information is included. Utilizing a consistent format not only enhances compliance with regulations but also streamlines the invoicing process, making it easier for clients to understand their billing.

What are the key components of an effective invoice template?

-

Include details such as Buyer, Tax ID, and Date to avoid any confusion.

-

Assign order numbers and designate sales representatives for tracking purposes.

-

Clearly state payment instructions and service terms.

-

Break down quantities, unit prices, and rates for clarity.

-

Accurately compute Total Materials, Total Labor, and Total Amount Due.

How do you create an invoice template step-by-step?

Creating an invoice template can be achieved efficiently by leveraging tools like pdfFiller, which offers user-friendly software. Start by selecting a suitable platform and consider existing templates as starting points. Customization options allow you to brand and personalize your invoices, enhancing professional appeal.

-

Select a platform like pdfFiller that suits your needs.

-

Using a template can save time and provide a base to modify.

-

Add your business logo to reinforce branding.

-

Ensure to fill out the invoice accurately with the client's information.

What are the instructions for filling out the job invoice?

Filling out the job invoice requires careful attention to detail. Be meticulous in entering the Buyer and Tax ID information, as inaccuracies can lead to delayed payments or misunderstandings. Effective calculation of labor and material totals is essential to ensure transparent billing.

-

Take special care when entering Buyer and Tax ID details.

-

Use formulas or software tools to avoid miscalculations.

-

Double-check all fields for completeness and accuracy.

-

Tools provided by pdfFiller can aid in accurate form completion.

How do you edit and customize your invoice template?

Editing and customizing your invoice template with pdfFiller allows for better personalization and utility. You can easily modify PDF invoices, incorporating collaborative features for team efficiency. Save custom templates for consistent use across your accounting tasks.

-

Use pdfFiller’s tools for quick modifications.

-

Utilize eSigning and sharing options to enhance team collaboration.

-

Store customizations for future invoices, ensuring time efficiency.

What are the compliance and best practices for invoice submission?

Compliance with legal obligations is paramount when submitting invoices. Understand the specific requirements in your region, and ensure that all information is accurate to mitigate potential disputes. Establish effective record-keeping practices to maintain transparency and professionalism.

-

Each region may have its own regulations surrounding invoice submissions.

-

Thoroughly check invoices to ensure accuracy.

-

Maintain organized records for all invoices to help with future audits.

What are common mistakes in using invoice templates, and how do you avoid them?

Common mistakes in using invoice templates can derail billing processes. It's crucial to avoid overlooking mandatory fields and ensure all calculations are verified. Regularly updating your templates can also prevent outdated information from being used.

-

Ensure all necessary information is filled in to avoid processing delays.

-

Recheck all sums to avoid disputes regarding payments.

-

Regularly revise templates to reflect current pricing and terms.

What are alternatives and additional resources?

Exploring other invoice templates can be beneficial for accountants in various industries. Additionally, consider using supplementary tools available on pdfFiller or recommend software that complements your invoicing needs.

-

Different industries may require specialized invoice formats.

-

Utilize various features offered by pdfFiller for comprehensive solutions.

-

Look for software that enhances invoice management capabilities.

How to fill out the invoice template for accountant

-

1.Open the invoice template in pdfFiller and ensure you have access to all necessary document tools.

-

2.Begin by entering your business name and contact information in the designated fields at the top of the invoice.

-

3.Next, add the client's name and contact details in the ‘Bill To’ section.

-

4.Specify the invoice date and a unique invoice number for tracking purposes.

-

5.List the products or services provided along with their descriptions, quantities, and individual prices in the itemized table.

-

6.Calculate and enter the subtotal, tax, and total amount due at the bottom of the invoice.

-

7.Include payment terms and methods, ensuring clients know how and when to pay.

-

8.Review all information for accuracy before saving or sending the invoice directly from pdfFiller.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.