Get the free Amendment To Ination template

Show details

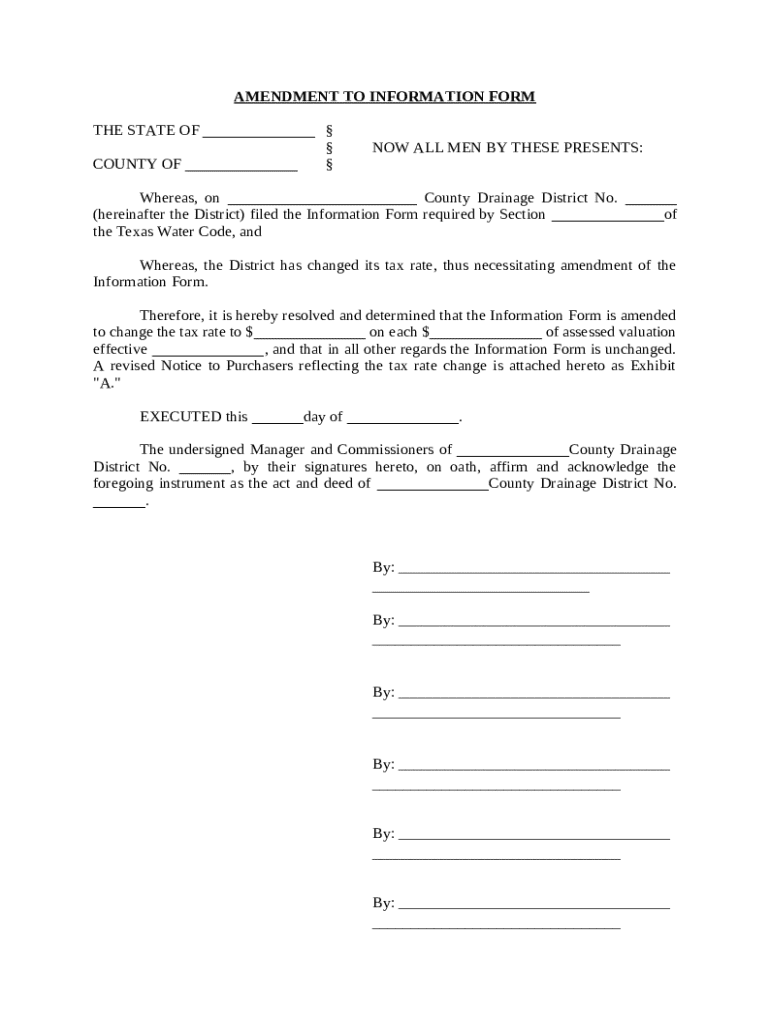

This Amendment form to change District tax rates.

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is amendment to information form

An amendment to information form is a document used to update or correct information in an existing form or application.

pdfFiller scores top ratings on review platforms

Needs a rotating feature in the signature capture field to help center the signature. Otherwise, very smooth experience.

love it! makes my work so much easier!!!

Nice application with short learning curve

You guys have great customer service and I really appreciate that.

As Advertised. Great for forms without having to print and scan. Saves time.

I definitely wish to purchase this software.

Who needs amendment to ination template?

Explore how professionals across industries use pdfFiller.

Amendment to Information Form Guide

How to fill out an amendment to information form

Filling out an amendment to information form involves a few essential steps. Start by understanding the specific changes you need to report, particularly regarding tax rate changes. Ensure that all details are accurate and comply with the legal stipulations outlined in documents such as the Texas Water Code.

Understanding the amendment to information form

The amendment to information form serves to align tax rate information with current legal requirements. This amendment procedure is especially critical in situations where tax rates undergo changes, enabling districts to maintain compliance. The Texas Water Code provides the legal context necessary for these modifications.

-

To officially document tax rate changes for local authorities, ensuring transparency and compliance.

-

The process is governed by the rules outlined in the Texas Water Code.

-

Certain entities, such as municipal districts, are obligated to file the amendment to ensure legal conformity.

What are the key components of the amendment?

Every amendment to information form must include specific components to represent the district accurately and fulfill legal obligations. Identifying all required details is essential to avoid compliance issues.

-

Clearly state the district's name and legal authority.

-

Detail what’s being amended, ensuring provisions of the existing document are satisfied.

-

Outline the procedures to record the amendment and notify relevant local government authorities.

How do you fill out the amendment to information form?

Filling out the amendment to information form correctly is crucial. Each field must be filled out with precision to avoid delays or rejections. Mistakes can often lead to additional complications, especially concerning tax implications.

-

Follow a detailed approach to fill each mandatory field; ensure clarity and correctness.

-

Be aware of frequent errors, such as incorrect data entry or omitting required fields.

-

Correct entries help maintain compliance with legal tax changes and minimize future inquiries.

Why use pdfFiller for your document management?

pdfFiller streamlines your document editing processes. With an intuitive platform for managing and editing forms, it ensures that users can complete documents accurately and efficiently.

-

Simplifies document management through easy editing tools and cloud storage.

-

The platform allows users to fill out forms electronically with ease.

-

Encourage teamwork through options for electronic signatures and shared document management.

What are the tax rate change implications?

Changes to tax rates can have significant implications for districts and property owners. Such alterations require jurisdictions to communicate effectively with stakeholders to manage expectations regarding financial aspects.

-

Tax rate changes can affect funding and operational budgets.

-

Amended forms may create new compliance requirements for districts.

-

Property owners should engage financial advisors for guidance after submitting amendments.

How to submit and follow up on the amendment?

Timely submission is critical for compliance. Knowing when and where to submit your form can prevent potential legal ramifications.

-

Ensure awareness of deadlines to submit in a timely manner.

-

Identify contact points for inquiries on the amendment's progress.

-

Keep copies of all documents for future compliance checks.

What to expect after submission?

After submitting your amendment to information form, there are several key processes you can anticipate. Understanding what's next will help you prepare for any subsequent requirements or assessments.

-

Agencies will usually review the amendment before confirming acceptance.

-

Be prepared for possible reactivations of tax assessments based on the changes made.

-

It’s vital to understand your rights to ensure all debts and obligations are correctly managed.

How to fill out the amendment to ination template

-

1.Open the pdfFiller website and log in to your account.

-

2.Locate the amendment to information form in your documents or upload it if not available.

-

3.Click on the form to open it in the editor.

-

4.Identify the sections that require amendment and use the editing tools to input new information.

-

5.Make sure to double-check the correctness of the updated data entered.

-

6.Utilize the save function to ensure all changes are properly saved before finalizing.

-

7.If required, complete any necessary signatures or declarations as indicated in the form.

-

8.Finally, download the amended form or submit it directly through pdfFiller to the relevant authority.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.