Last updated on Feb 17, 2026

Get the free Direct Deposit for Employer template

Show details

Direct deposit is a process where someone who is going to be paid on a recurring basis, such as an employee, or a recipient of a government entitlement or benefit program such as social security,

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is direct deposit form for

A direct deposit form is a document that authorizes an employer or agency to deposit funds directly into a designated bank account.

pdfFiller scores top ratings on review platforms

Good with some periodic slowdowns where it takes too long to connect

overall I like pdffiller, but there are some things I wish I could do, like circle items in word docs. The only circle function I see does not seem to work very well. I would like to be able to draw circles around items more easily. As for signature authentication, is it necessary to include date? It would be easier if the authentication did not include the date. This isn't a big deal, since I can see why the date is necessary... but sometimes I sign a contract on for example, Sept 1st at midnight, but I don't want my clients to know I signed at midnight Sept 1st, particularly if I should have signed the document sooner. Anyway, these are just little issues that I've come across and changes would make my business a bit easier.

I liked the ease of using it but like I said it was the end of a business & just needed 3 w-2's

Makes my job much easier. Love PDFfiller.

Excellent user interface and great functionality! Very useful application.

Very Good, I think someone other than a programmer had set it up.

Who needs direct deposit for employer?

Explore how professionals across industries use pdfFiller.

How to effectively complete a direct deposit form for form

Filling out a direct deposit form is essential for employees who want their salary deposited directly into their bank account. Knowing how to navigate the process can save time and ensure compliance with banking regulations. This guide will walk you through the various aspects of completing a direct deposit agreement.

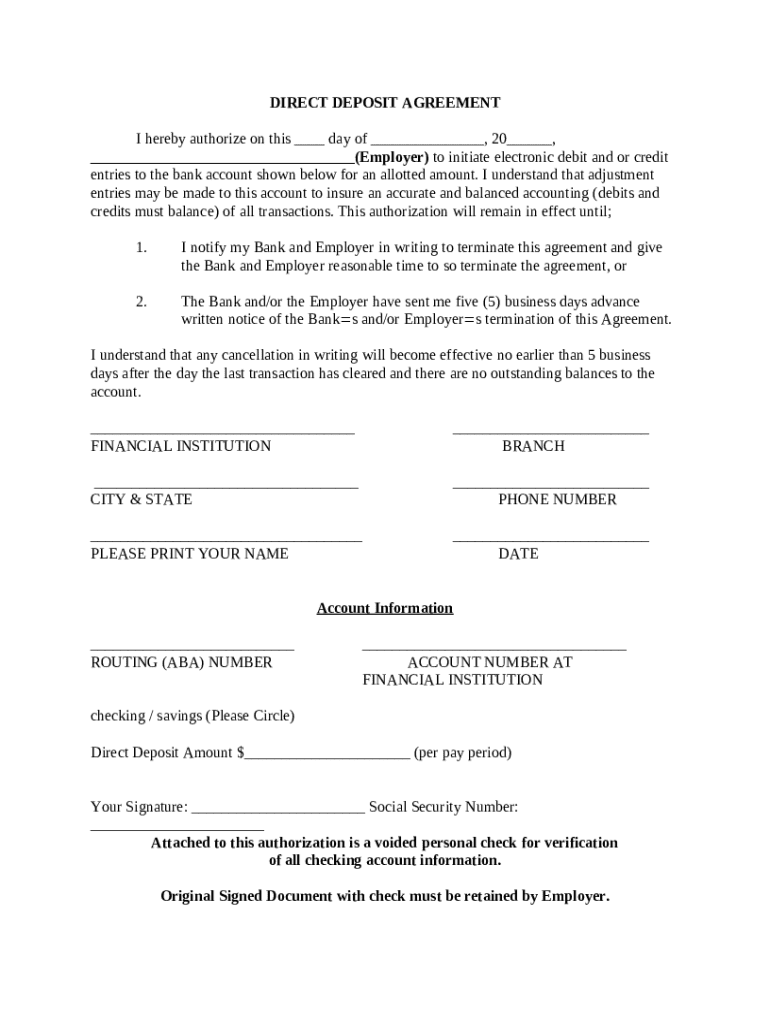

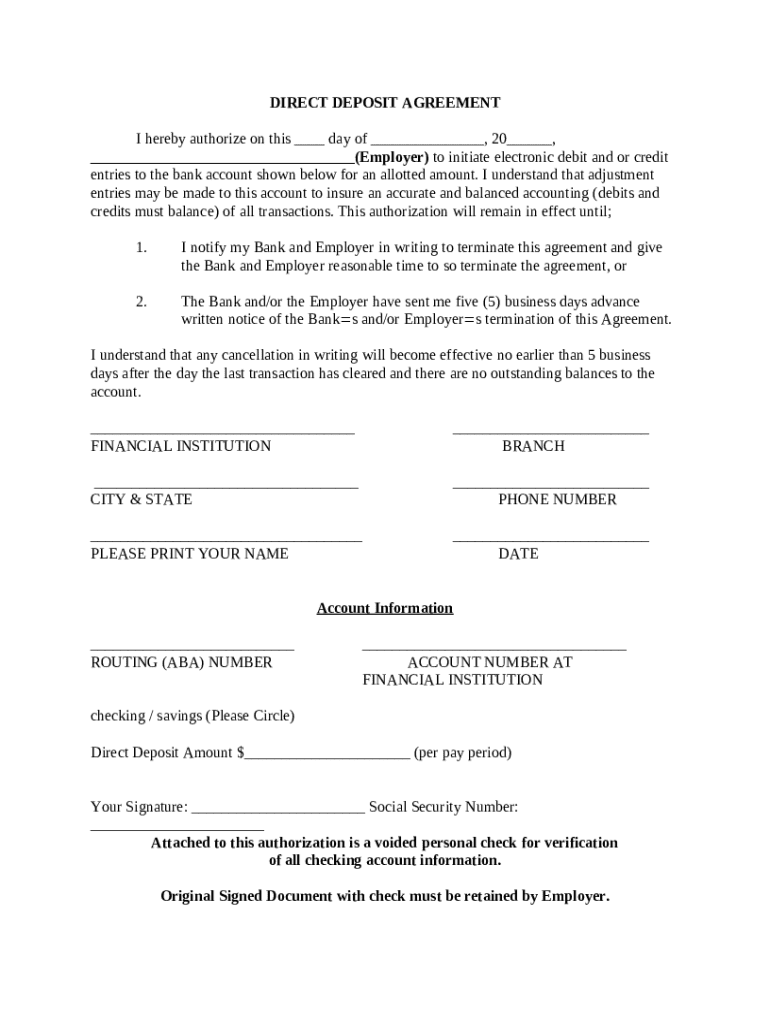

What is a Direct Deposit Agreement?

A direct deposit agreement is a financial arrangement between an employer and employee allowing the automated transfer of funds into an employee’s bank account. This agreement simplifies payroll processing and ensures timely payments, benefiting both employers and employees. Common uses include salary payments, tax refunds, and Social Security benefits.

What are the key components of the direct deposit form?

-

This section confirms the agreement between the employer and employee, detailing the specific days or payroll cycles during which funds will be transferred.

-

It outlines how transactions will occur, typically facilitated by the bank using electronic funds transfer (EFT) methods.

-

It's essential for both parties to understand how to terminate this agreement should the need arise, ensuring clarity and avoiding misunderstandings.

How do fill out the direct deposit agreement?

-

Follow each step carefully, noting down the essential details as prompted on the form.

-

This crucial information ensures the accurate transfer of funds and must be double-checked to avoid errors.

-

Clearly indicate either a fixed amount or a percentage of your paycheck to be deposited directly into your account.

How can edit and manage my direct deposit agreement with pdfFiller?

Using pdfFiller allows you to edit your Direct Deposit Agreement effortlessly. You can access various features that streamline the signing process, including e-signing capabilities, which enhance the user experience. Additionally, cloud-based functionalities enable easy collaboration with employers, ensuring everyone involved remains on the same page.

What common mistakes should avoid on direct deposit forms?

-

Failing to complete all required sections could delay the processing of your direct deposits.

-

Ensure accuracy in inputting account and routing numbers to prevent failed transactions or wrong deposits.

-

A direct deposit agreement typically requires both parties’ signatures and dates for legality and validity.

What compliance and legal considerations should know?

-

Familiarizing yourself with federal laws assists in understanding your rights and obligations.

-

Employers must retain copies of direct deposit agreements for auditing and compliance purposes.

-

It is vital to protect sensitive information shared in the agreement to prevent unauthorized access.

How can secure my financial data?

-

This adds an extra layer of security by verifying that the routing and account numbers provided match those associated with the account.

-

Always use secure connections and store completed forms in safe, encrypted systems to prevent data breaches.

-

Be aware of your rights to access and correct financial information as stipulated by federal regulations.

What are the final steps after completing your direct deposit form?

-

Submit the signed form to your employer for processing to initiate direct deposits.

-

Both parties must retain a copy of the agreement for their records, adhering to company policies and regulatory requirements.

-

With pdfFiller, you can store your document in the cloud, ensuring easy access and enhanced security for all your forms.

How to fill out the direct deposit for employer

-

1.Obtain the direct deposit form from your employer or download it from pdfFiller.

-

2.Open the form in pdfFiller to view it on your device.

-

3.Enter your personal information including your name, address, and Social Security number.

-

4.Provide your bank information by entering your account number and routing number accurately.

-

5.Select the type of account (checking or savings) to indicate where the funds will be deposited.

-

6.Review all entered information for accuracy to prevent delays in processing.

-

7.Sign and date the form to authorize direct deposits.

-

8.Submit the completed form via email or upload it back to your employer's HR department through pdfFiller.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.